FifthPerson: Success of Starbucks and Its Business Merits

Am I the only one crazy about getting stars on my Starbucks Rewards™ account for free drinks? Not to mention the one-for-one days where customers can get a free cup for every cup they purchase and the crowds would be massive.

Those are just some reasons why Starbucks Corp has been such a great company among many others. Of course not forgetting its core business and the management team behind Starbucks.

It is amazing how Starbucks grew from a simple chain of coffee brewers in just the US to an international household brand that most people would think of when someone mentions “awesome coffee”. Of course, taste in coffee differs among individuals but there must be some (really good) reasons why most Starbucks cafes are packed to the brim almost all day round.

What exactly did the Starbucks management do so well that helped them grow so substantially (as shown in the chart above) over the past five to ten years? There must be some competitive moats that Starbucks has that allowed them to be almost ten times larger in sales than their nearest competitor, Costa Coffee, right?

We will look at some key reasons to the Starbucks success story and how they manage to continue growing – despite being a 77-billion-dollar (US) company with 24,000 stores across 68 countries around the world – and some investment merits, courtesy of our friends at Fifth Person.

The Starbucks Success Story – Business

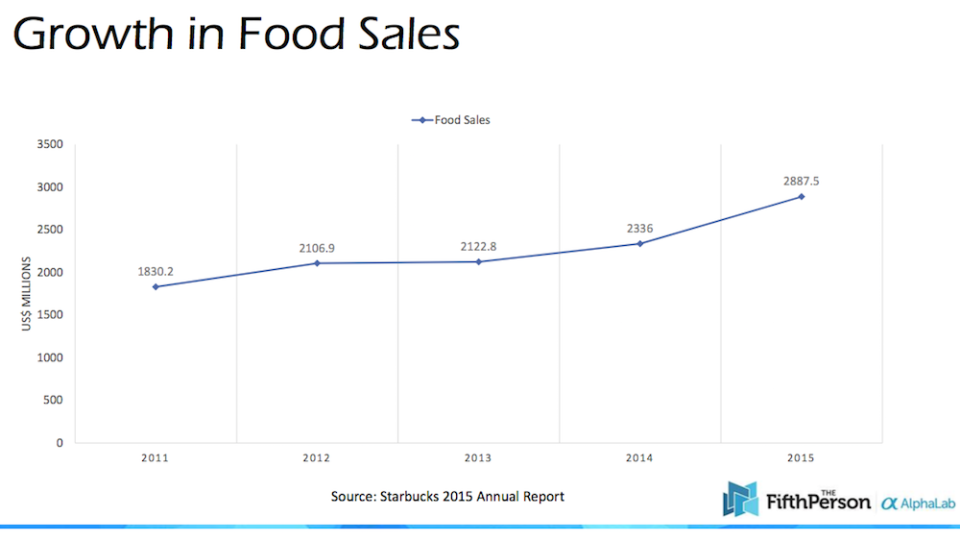

Did Starbucks sell only coffee to get where they are right now? Truth is, they acquired Teavana and La Boulange among a few to diversify their quick-serving reach into the tea and food industries.

The chart above shows more than a 50-percent growth in food sales over a five-year period, or more than US$1 billion. While coffee still accounts for almost 75 percent of their total sales, the contribution from food sales has been growing steadily over the years.

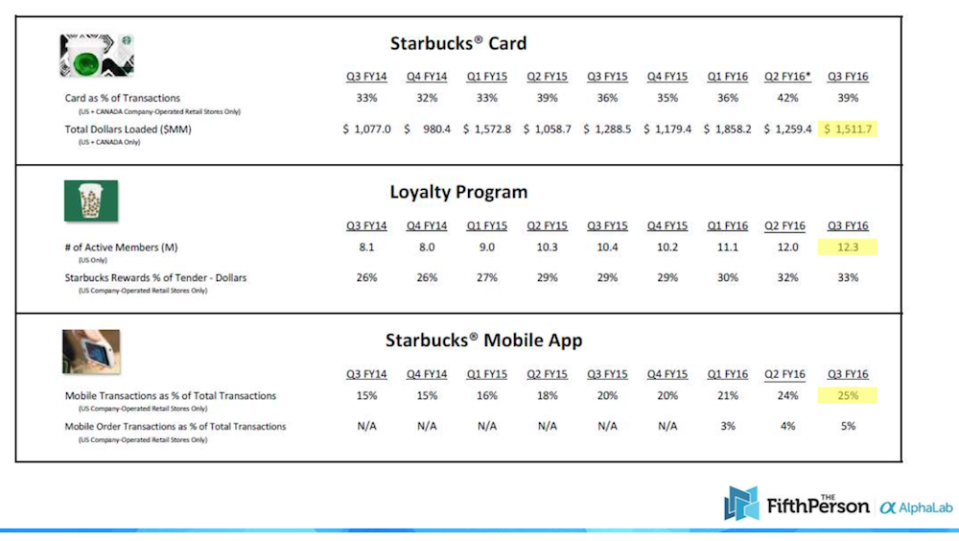

And remember Starbucks Rewards™? It’s a loyalty programme that really took off in 2009. Aside from expansion into the food and tea industry, its loyalty programme is another tool that helped Starbucks grow over the past few years.

Also, the introduction of mobile orders and payments helped Starbucks solve peak-hour long queues at cafes, which boosted sales too, of course.

This is a great illustration of how a company adapted to technological changes and managed to make it work to their advantage. Who would have thought that a coffee chain could do so well with the help of smartphone technology and mobile apps?

The Starbucks Success Story – Management

Howard Schultz in The Roastery (Photo credit: Jamel Toppin for Forbes)

Behind every successful business over the long-term is a great management team, and this is especially so for Starbucks. Although CEO Howard Schultz seems to be always under the spotlight, he would always mention how great a management team he hired to challenge him. That sounds kind of weird for any CEO, right? Who would hire a team to challenge oneself?

A large part of the coffee chain’s success has always been attributed to Schultz and no one doubts that. But Schultz deeply understands that a business should not be micromanaged by one single person. So he hired a strong team whom he trusts and splits the important decision making with. After all, more heads are better than one.

Investment Merits of Starbucks

Now, for the most important question in everyone’s mind: is the stock of this company worth considering? As usual, neither our friends from Fifth Person nor we can give any stock recommendations but here are some key facts about the company’s financials.

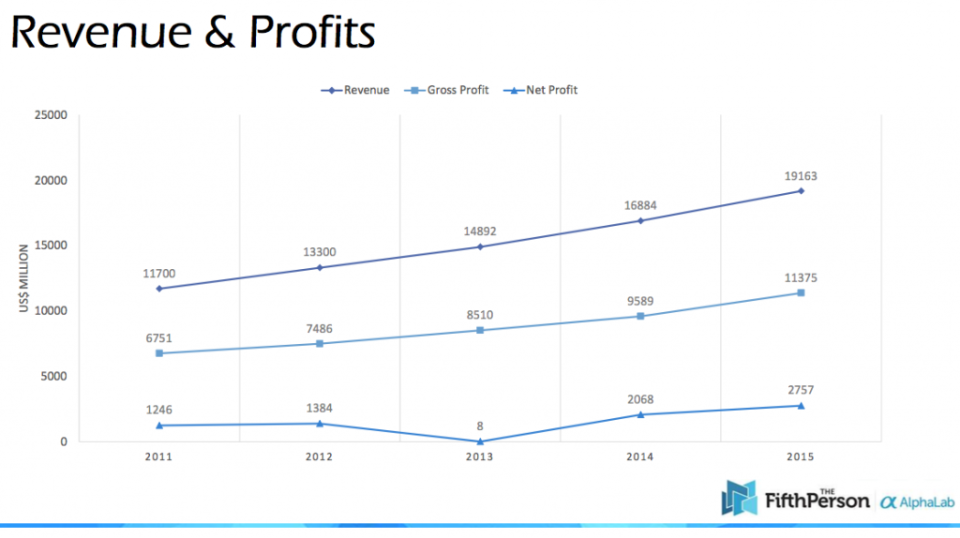

As we can see, revenue has almost doubled while net profit more than doubled over the past five years. There is a huge dip in net profit and profit margins in 2013, though, and it is because Starbucks decided to terminate their grocery deal with Kraft three years earlier.

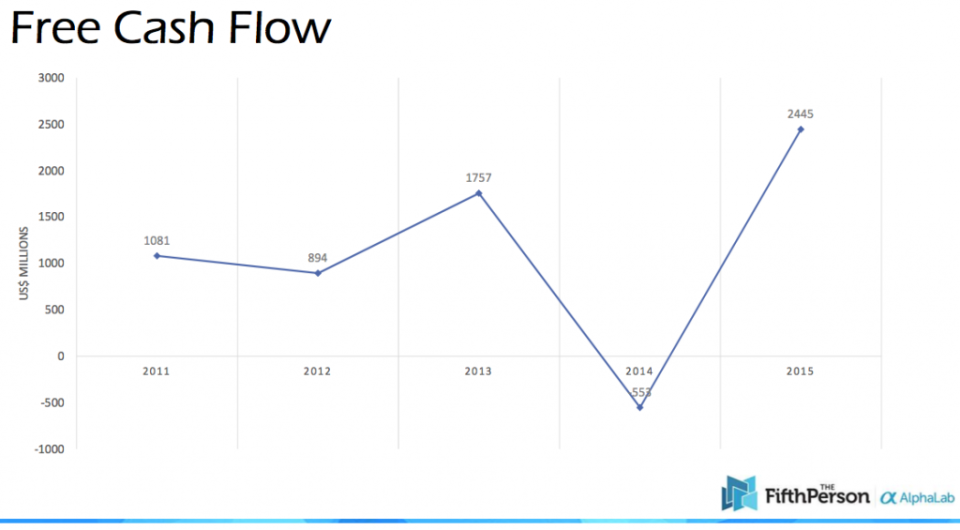

The same goes for its operating cash flow and free cash flow – both dipped in 2014 because that was the actual time the cash left the company’s balance sheet to pay for terminating the Kraft grocery deal. But it proceeded to recover and even register a gain from the previous year. Having positive cash flow is key for any company, as pointed out by Fifth Person.

Looking at their Capital Expenditure (CAPEX), they’ve been spending over US$1 billion every year since 2013, particularly to expand by building and renovation stores (according to its annual report).

As such, it is clear that Starbucks is committed to making its coffee more easily available to its customers, of course, to boost its own sales too. With that, we can know Starbucks is committing their profits and capital to even more growth, which brings us to the next point of valuation analysis.

Starbucks Valuation Analysis

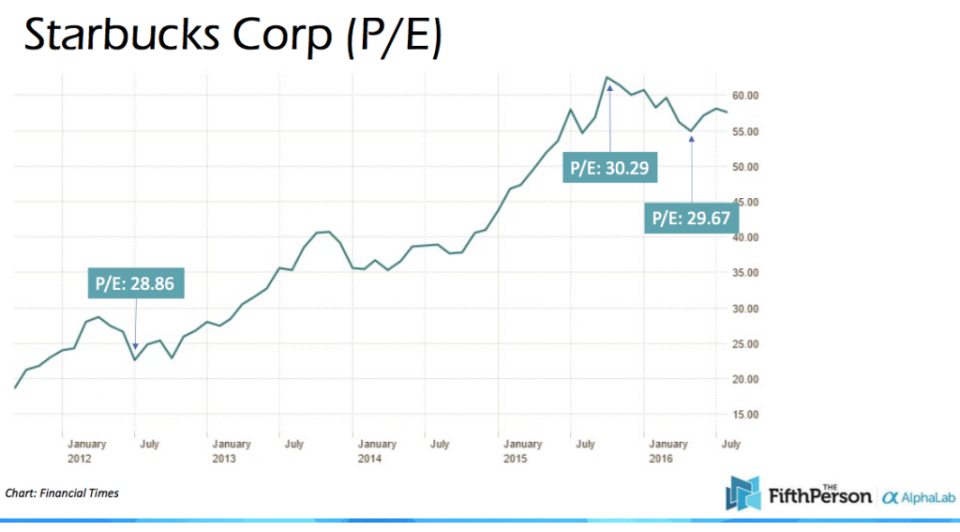

We might lament at the Price-Earnings (P/E) ratio of Starbucks stocks, maybe because most of us would recall value investing principles about buying cheap stocks. There is almost no doubt about Starbucks being a great business backed by a great management team but its stock price seems a turn-off.

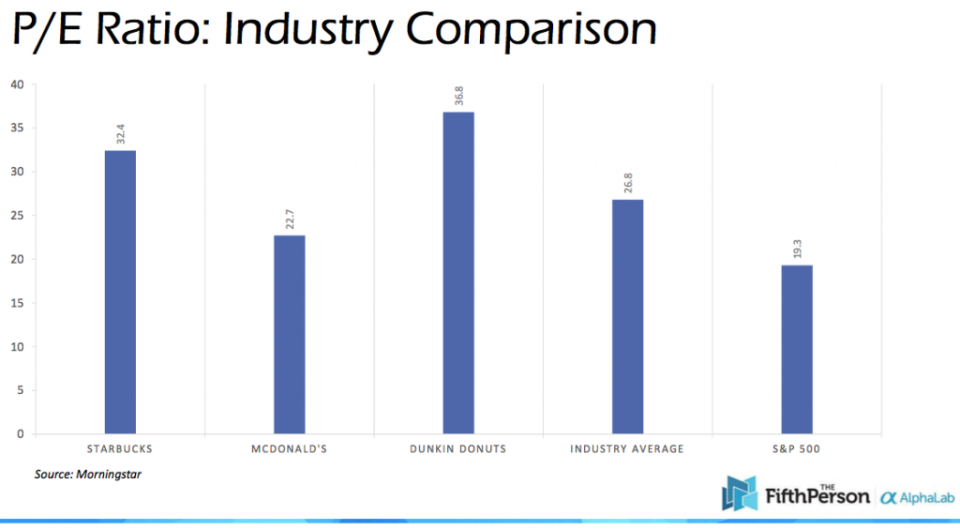

But before that, just looking at its stock price without the P/E ratios, you might think that it was a great value buy five years ago – its stock price more than doubled! Our friends at Fifth Person explains that P/E ratios differ a lot across different industries. As such, looking at the average P/E ratio across the industry might make a lot more sense, before labelling Starbucks as an extremely expensive company not worth considering at all.

From the chart above, the industry P/E ratio average according to Morningstar is 26.8. Starbucks Corp’s P/E ratio (trailing twelve months) according to Bloomberg as at 20 Sep 2016, is sitting at 29.92. Starbucks stocks are indeed selling at a premium, but that’s only because it’s a great company that is poised for more growth.

If you’re interested in learning more…

The video above is a short two-minute video-cut (1.2x speed) of a longer, in-depth video analysis of Starbucks Corp by our friends at Fifth Person. This article is written with the help from their video analysis of Starbucks and other in-depth video analyses of other listed companies are available on Fifth Person’s Alpha Lab.

Alpha Lab is a subscription service that presents easy-to-understand in-depth analyses of listed companies designed to help investors make more informed investment decisions. It takes a lot of time and effort to do proper research on value-growth, deep value companies, and retail investors with day jobs simply don’t have the time to do so. With that, Fifth Person is offering Alpha Lab at US$497(~$680)/year, which gives you access to two video case studies per month (24 video case studies per year).

Click on the button below if you’re interested in learning more about Alpha Lab.

Yahoo Finance

Yahoo Finance