The Fifth Person: 4 Things About SPH You Need To Know Before Investing

Singapore Press Holdings (SPH) is Singapore’s oldest newspaper and media organization that holds a monopoly in the country.

In our current era, technological disruption is inevitable: SPH’s most recent nine-month financial results further prove the challenges the company is facing when they reported an 8.4% decrease in revenue and a 31.9% decrease in profit.

Investors can expect SPH to continue to face disruption in its industry moving forward. The good news is that SPH noticed the trend years ago and made the move to diversify its business early.

However, I personally think the speed of disruption was faster than expected and has caught SPH off guard.

In this article, I want to talk about Singapore Press Holdings’ challenges in the years ahead and its implications on the company:

1. SPH’s media revenue is decreasing

Media business segment revenue decreased from a high of S$1,036.4 million in 2012 to S$839 million in 2016. SPH’s latest nine-month financial results show that media revenue has again decreased by 12.3%.

In recent years, the rise of digital advertising has negatively impacted SPH’s newspaper advertising business. I expect this trend to grow and affect its business moving forward.

I am not trying to be pessimistic here but allow me to share my point of view. If you want to advertise in the newspapers, a small black and white advertisement in the corner of one page can cost you about S$2,000-S$3,000. Needless to say, a half or full-page advertisement will set you back a substantial five-figure sum.

Next, people who read the newspaper can come from all walks of life who may not necessarily be your ideal target market. This means you’re probably wasting a large amount of money on showing your advertisement to consumers who have no interest in what you have to offer.

Compare this to digital advertising giants like Facebook. Since its founding in 2004, Facebook is now the world’s largest social network with over two billion monthly active users globally.

The huge numbers alone don’t mean much; what’s more important is that Facebook allows advertisers to specifically target consumers based on their age, demographic, location, interests, likes, and behaviour.

This means companies can spend less money by only targeting their advertisements to the consumers they want. Based on this alone, it makes business sense for companies to shift their advertising budget away from traditional media like newspapers to digital media like Facebook.

2. SPH is diversifying its business

SPH is aware of the disruption it faces and has diversified into property, nursing homes, investments, and e-commerce. Out of all this, I believe its property segment has been its most successful venture so far.

SPH has been receiving good rental income (through its stake in SPH REIT) from properties like Paragon, Clementi Mall and Seletar Mall.

In 2016, SPH’s total profit before tax comprised 46.2% from its property segment and 45.2% from its media segment, even though the revenue contribution from the property and media segments were 21.5% and 74.0% respectively. Based on the direction SPH is moving, I will not be surprised if it becomes a pure property and investment player one day.

3. Dividend per share is decreasing

(in S$ millions) | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|---|---|

Recurring earnings | 427.1 | 501.7 | 497.0 | 539.1 | 409.0 | 410.2 | 369.3 | 349.0 | 353.5 | 305.2 |

Dividends | 418.6 | 434.2 | 403.1 | 435.8 | 388.3 | 388.7 | 649.1 | 341.0 | 324.6 | 291.9 |

Dividend payout ratio (%) | 98.0 | 86.5 | 81.1 | 80.8 | 94.9 | 94.8 | 175.8 | 97.7 | 91.8 | 95.6 |

SPH dividend payout ratio based on recurring earnings.

Dividend payouts have decreased from S$418.6 million in 2007 to S$291.9 million in 2016. From my past visits to Singapore Press Holdings’ AGMs, I understand that SPH will pay a dividend based on its recurring earnings. If you look at the table above, SPH’s recurring earnings have decreased from S$427.1 million in 2007 to S$305.2 million in 2016.

SPH’s latest nine-month results report that profit decreased by 31.9%. Therefore, there is a high probability that the dividend will decrease again.

Based on this trend, SPH may no longer be a good dividend stock as downward pressure on its recurring earnings is expected to continue since 45.2% of its PBT still comes from the ailing media segment. If I were to invest in SPH as a dividend play, I would wait until its property segment contributes a larger percentage of total profit to buffer any downside.

4. Looking for a sustainable dividend

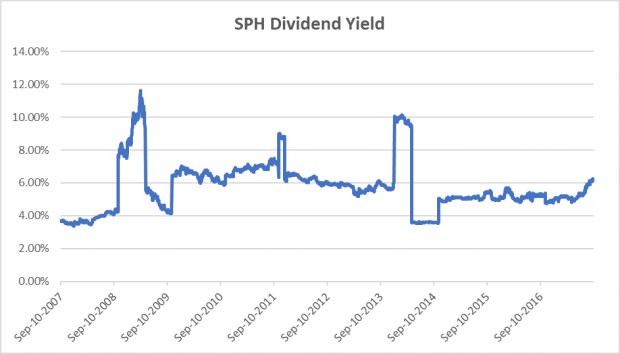

The chart above shows the 10-year dividend yield of SPH. With SPH’s share price at S$2.57 (as at 12 September 2017) and its FY2016 dividend per share at 18 cents, this reflects a dividend yield of 7.0%.

New investors will probably note the attractive yield as it much higher than our bank interest rates. However, we know that SPH’s earnings are expected to fall further which means its dividend will probably fall as well. Hence, this 7.0% yield may be an illusion.

Every investment is a good one — as long as you pay for it at the right price.

We all know that SPH’s media segment is facing disruption, so now we need to paint the worst-case scenario where we exclude any profit from the media segment entirely.

SPH’s property segment, however, is growing nicely and its FY2016 profit before tax is S$179.4 million. If we take this amount and multiply it by SPH’s lowest dividend payout ratio of 80%, we get a dividend per share of 8.9 cents. Based on this conservative figure, you will get a dividend yield of 3.5% (based on SPH’s share price as at 12 September 2017).

At that yield, I would think twice about investing in SPH since its media segment will most probably continue to face headwinds and continue to pull SPH’s earnings and share price. Therefore, you should demand a higher yield based on the worst-case scenario to buffer against any potential price drops. Remember, investing is about protecting your downside as much as growth.

Upcoming Event

We managed to invite a few popular names in the finance and investment education world to speak at our upcoming Shares Investment Convention on 16 September 2017 (Saturday)!

They’ll be covering topics on personal finance, macroeconomics and investment strategies to help retail investors make more shrewd decisions especially in the current uncertain and volatile economy. Click on the button above to learn more and grab your tickets. See you there!

P.S. Don’t forget to enter promo code “SHARES10” for a $10 discount!

Yahoo Finance

Yahoo Finance