Fiat Chrysler Reveals 5-Year Plan of EV & Brand Development

Fiat Chrysler Automobiles N.V. FCAU has outlined a five-year strategy to develop more electric vehicles (EVs) by investing in future technologies while boosting sales of SUVs (sports utility vehicles) and trucks, per Associated Press. This strategy will help the company design a product portfolio which is better-suited to meet consumer demand across all markets.

Under Fiat’s plan through 2022, it will invest €9 billion ($10.5 billion) to develop electric engines and expand offerings of EVs. Also, roughly 15% of the company’s planned €45 billion spending will be used for its combustion engine technology. Fiat’s core brands that use combustion engines are Jeep SUVs, Ram pickups, and Alfa Romeo and Maserati luxury cars. The company anticipates these brands to contribute roughly 80% of total revenues in 2022 compared with the current contribution of 65%. The company aims to double its operating profit to €16 billion ($18.71 billion) at the end of its five-year strategy.

Further, all the new models under Jeep, Maserati and Alfa Romeo brands to be launched in the next five years will also have some version of electrified powertrains while the truck brand, Ram will have alternative powertrain for high-end premium trucks only.

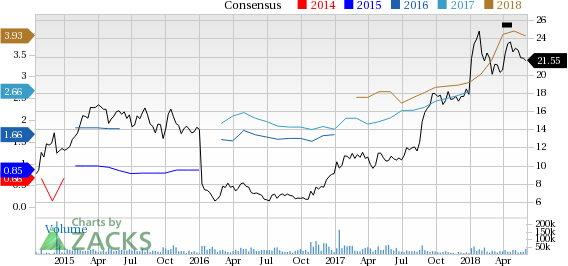

Fiat Chrysler Automobiles N.V. Price and Consensus

Fiat Chrysler Automobiles N.V. Price and Consensus | Fiat Chrysler Automobiles N.V. Quote

Also, Fiat’s management provided sales target for a few of its major brands, which it aims to achieve by 2022 end. Alfa Romeo aspires to achieve annual sales of 400,000 units while the luxury line Maserati targets to double its annual sales to 100,000 units compared with 2017.

Additionally, the company targets a dividend payout ratio of roughly 20%, which is anticipated to be a total payout of €6 billion in five years, per Reuters. At present, the automaker is on its way to achieving all the targets of its previous five-year plan through 2018. Remarkably, the company is set to eliminate its total net debt by the end of this month.

Price Performance

Year to date, Fiat Chrysler’s stock has moved up 20.8%, outperforming 3.6% decline of the industry it belongs to.

Zacks Rank & Stocks to Consider

Fiat Chrysler currently carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the auto space are BMW AG BAMXF, Fox Factory Holding Corporation FOXF and Oshkosh Corporation OSK. Presently, BMW and Fox Factory carry a Zacks Rank #2 (Buy) while Oshkosh sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BMW has an expected long-term growth rate of 4.5%. Shares of the company have risen 4.1% over the past year.

Fox Factory has an expected long-term growth rate of 11.5%. Shares of the company have risen 23.8% over the past year.

Oshkosh has an expected long-term growth rate of 18.3%. In a year’s time, shares of the company have gained 13.9%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fox Factory Holding Corp. (FOXF) : Free Stock Analysis Report

Fiat Chrysler Automobiles N.V. (FCAU) : Free Stock Analysis Report

Bayerische Motoren Werke AG (BAMXF) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance