Fee Income to Aid Northern Trust (NTRS) in Q2 Earnings?

Northern Trust Corporation’s NTRS second-quarter 2024 results are scheduled to release on Jul 17, before market open. The company’s revenues are expected to have improved from the year-ago reported level, while earnings are expected to have declined.

In the last reported quarter, NTRS’ earnings surpassed the Zacks Consensus Estimate. Results have been aided by a rise in fee income. However, a fall in net interest income (NII) and elevated expenses were the major headwinds.

Northern Trust has a decent earnings surprise history. Its earnings beat estimates in three of the trailing four quarters and missed once, the positive surprise being 8.64%, on average.

NTRS’ activities in the to-be-reported quarter were adequate to win analysts’ optimism. The Zacks Consensus Estimate for second-quarter earnings of $1.75 per share has moved 1.2% upward in the past 60 days. The figure indicates a decline of 2.2% from the year-ago quarter’s reported number.

The Zacks Consensus Estimate for revenues is pegged at $1.84 billion, suggesting a rise of 5% from the prior-year quarter’s reported figure.

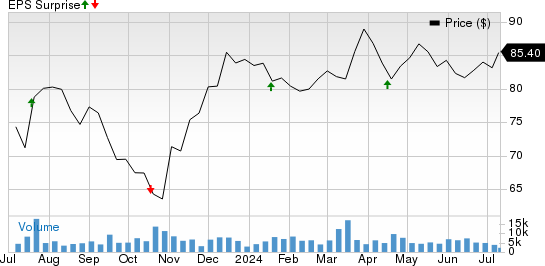

Northern Trust Corporation Price and EPS Surprise

Northern Trust Corporation price-eps-surprise | Northern Trust Corporation Quote

Key Factors & Estimates for Q2

Loans & NII: Banks’ lending activities have improved in the second quarter of 2024 as the economy starts recovering from persistent inflationary pressures boosting consumer spending. Further, the expectations of the Federal Reserve easing interest rates later this year will likely support the lending scenario. The demand for overall loans, especially commercial and industrial loans, improved from the first quarter of 2024 end, per the Fed’s latest data.

Hence, a favorable lending environment is likely to have supported average interest-earning assets. The Zacks Consensus Estimate for average earning assets is pegged at $132.9 billion. This indicates a marginal decrease from the prior quarter’s reported figure.

As the Federal Reserve kept the interest rates steady during the quarter at a 23-year high of 5.25-5.5%, NTRS is less likely to have recorded significant improvement in NII. Also, the inverted yield curve in the June-ended quarter and high funding costs are expected to have weighed on NII growth.

The Zacks Consensus Estimate for NII is pegged at $512 million, suggesting a sequential decline of 3%.

Fee Income: Northern Trust uses a lag effect to calculate its asset servicing fees and wealth management servicing fees, as the company depends on computations of the prior-quarter end valuations.

Asset servicing fees comprise custody and fund administration, investment management, securities lending, and other fees.

In the second quarter of 2024, the equity market sustained a steady performance with lower volatility. This favorable environment is expected to have benefited NTRS by bolstering its custody and fund administration, as well as investment management fees.

The Zacks Consensus Estimate for custody and fund administration fees is pegged at $452.4 million, suggesting a sequential increase of 3.6%.

The Zacks Consensus Estimate for investment management fees is pegged at $144.4 million, indicating an increase of 3.1% sequentially.

The consensus mark for wealth management servicing fees is pegged at $515.7 million, suggesting a sequential rise of 2.4%.

The consensus estimate for total fee income is pegged at $1.17 billion, indicating a 2.8% increase from the prior quarter’s reported figure.

Expenses: Northern Trust’s expenses are expected to have been high in the to-be-reported quarter, given its rise in compensation and increased investment in equipment and software development. This is likely to have hindered bottom-line growth.

Asset Quality: Northern Trust is likely to have set aside a substantial amount of money for potential bad loans, given the expectations of an economic slowdown.

The Zacks Consensus Estimate for non-accrual loans is pegged at $101.9 million, indicating a surge of 60.2% from the prior quarter's reported figure.

What Does the Zacks Model Say?

Our proven Zacks model predicts an earnings beat for Northern Trust this time around. The combination of a positive Earnings ESP and Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat. That's the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Northern Trust has an Earnings ESP of +1.58%.

Zacks Rank: The company currently carries a Zacks Rank of 2.

Other Stocks to Consider

Here are some other bank stocks that you may want to consider, as our model shows that these, too, have the right combination of elements to post earnings beat this time around.

The Earnings ESP for JPMorgan Chase & Co. JPM is +0.57% and it carries a Zacks Rank #3 at present. The company is slated to report second-quarter 2024 results on Jul 12. You can see the complete list of today’s Zacks #1 Rank stocks here.

Over the past seven days, the Zacks Consensus Estimate for JPM’s quarterly earnings has moved marginally upward.

M&T Bank Corporation MTB has an Earnings ESP of +0.31% and carries a Zacks Rank #3 at present. It is scheduled to release second-quarter 2014 earnings on Jul 18.

MTB’s quarterly earnings estimates have moved marginally downward over the past seven days.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

M&T Bank Corporation (MTB) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report