FedEx's High ROE, Financial Leverage Give It Decent Upside Potential

FedEx Corp. (NYSE:FDX) shares recorded a 12% decline, decreasing from approximately $281 to $250 per share after its second-quarter earnings result, which fell short of analysts' expectation. Despite this recent dip, FedExs share price has recorded a substantial rise of about 47% since the beginning of the year, with its shares advancing from $171.

This analysis aims to delve deeper into FedEx's performance, financial health and market position to ascertain its current attractiveness as an investment option.

Business snapshot

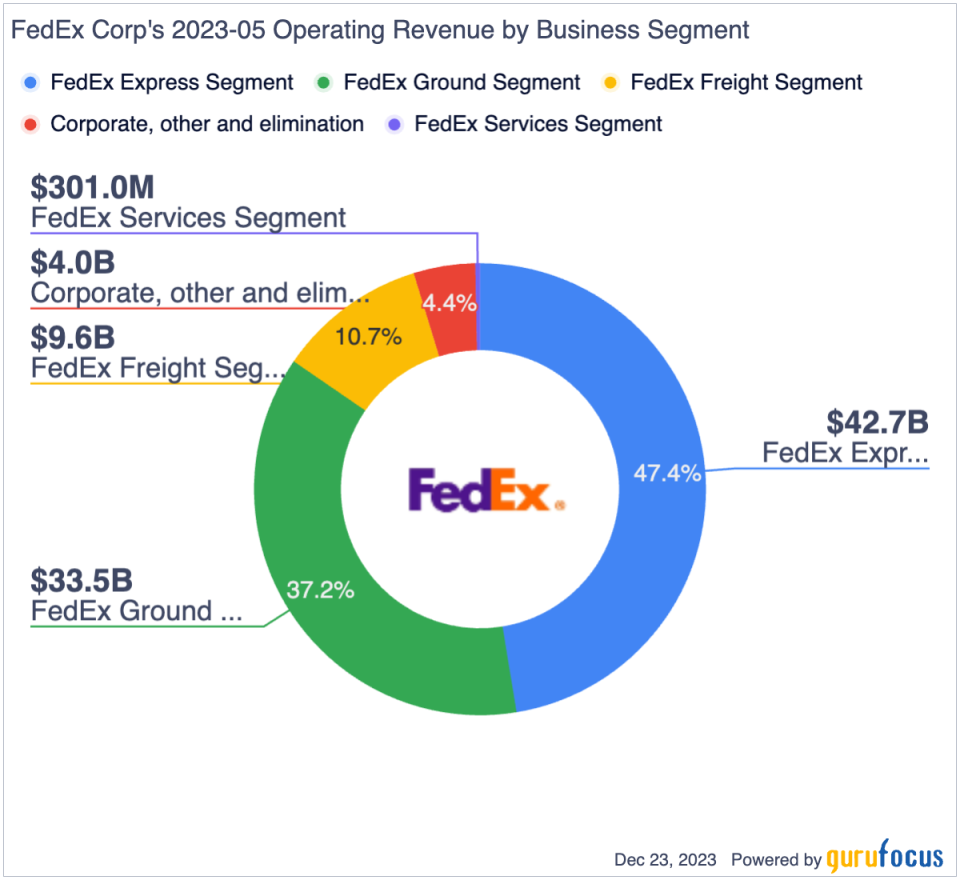

FedEx is a global leader in transportation and delivery services, operating across four business segments, including FedEx Express, offering delivery services to over 220 countries and territories; FedEx Ground, specializing in small-package ground delivery; FedEx Freight, providing less-than-truckload freight transportation services; and FedEx Services, which supports all other FedEx segments with sales, marketing, information technology and various customer services.

The FedEx Express segment is the company's largest revenue contributor, generating $42.7 billion in 2023, accounting for 47.4% of total revenue. The FedEx Ground segment ranks second with sales amounting to $33.5 billion, representing 37.2% of the company's total sales. The FedEx Freight and FedEx Services segments are comparatively smaller, contributing $9.6 billion (10.7% of sales) and $301 million (0.3% of total revenue).

In 2023, FedEx's financial performance showcased varying results across its different segments. Among them, FedEx Freight stood out with the highest operating margin of 20%, marking an increase from 17.4% in the previous year. This improvement was primarily driven by a favorable environment for fuel surcharges on its services. In contrast, FedEx Express recorded the lowest operating margin among all business segments at just 2.5%. Meanwhile, the FedEx Ground segment maintained a steady performance with an operating margin of approximately 9.4%. The relatively lower margins of the two largest segments, FedEx Express and FedEx Ground, have had a negative impact on the company's overall business margin.

Consistently high return on equity

Looking at FedEx's financial health and efficiency over a broader time frame, the company has demonstrated a consistently robust return on equity over the past decade. In eight of the last 10 years, FedEx's ROE remained in double digits, underscoring its financial resilience. The company experienced its lowest ROE in 2019 at just 2.9%, primarily due to non-cash mark-to-market retirement plan losses totaling $3.9 billion. However, FedEx has made a significant rebound, with its ROE climbing to 24.6% in 2021 and settled at 15.6% in 2023.

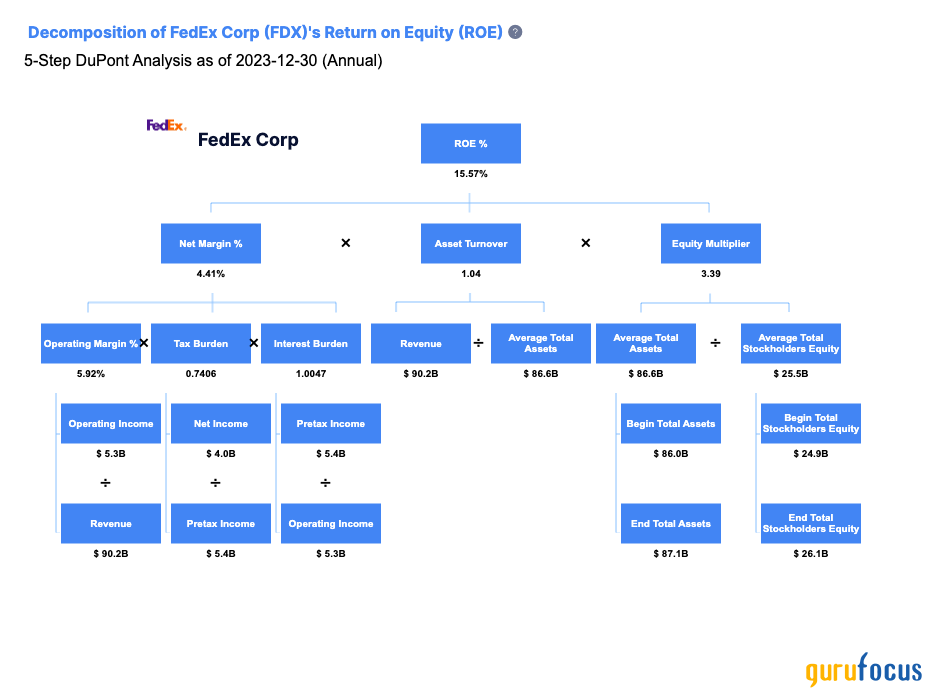

To gain deeper insights into the underlying factors contributing to FedEx's high ROE, let's perform the Dupont analysis. This method breaks down ROE into three critical components: operating efficiency (net profit margin), asset use efficiency (asset turnover ratio) and financial leverage (asset-to-equity ratio).

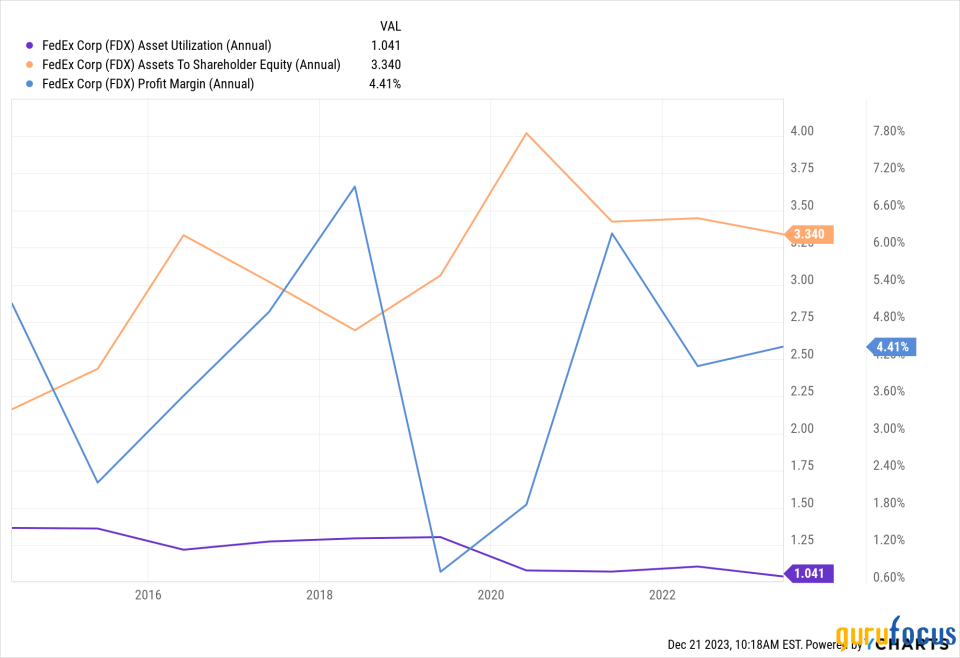

In examining FedEx's financial performance over the last decade, a pattern of fluctuating profit margins and declining asset turnover becomes evident. The company's profit margin varied significantly, ranging from a low of 0.19% to a high of 6.99%. Concurrently, there was a noticeable downward trend in the asset turnover ratio, which decreased from 1.37 in 2014 to 1.04 in 2023.

Particularly in 2023, FedEx's financial metrics reflected modest figures. The profit margin was recorded at 4.41%, while the asset turnover ratio just exceeded 1, aligning with the observed downward trend.

Moreover, a consistent increase in financial leverage was observed throughout this period. The asset-to-equity ratio, one of the key indicators of financial leverage, rose from 2.17 in 2014 to 3.34 in 2023. This significant leverage has been a primary factor driving FedEx's high return on equity over the years.

This Dupont analysis reveals that high financial leverage has been a significant factor in boosting FedEx's ROE. Even with a lower profit margin and average asset turnover, the increased leverage ratioindicative of using a substantial amount of debt relative to equity to finance assets and operationshas amplified the ROE. However, it is essential to consider the potential risks associated with high leverage, especially in volatile economic conditions.

High but managable leverage

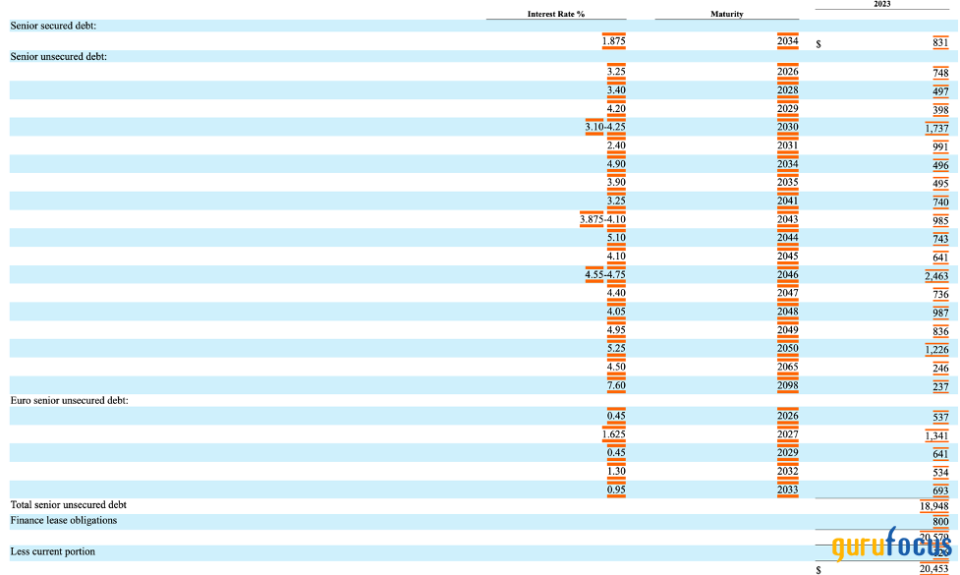

As of November, FedEx's shareholders' equity was approximately $26.77 billion, which included around $6.73 billion in cash. The company's interest-bearing debt was reported to be about $20.35 billion. Despite the substantial long-term debt, which may concern some investors, this debt is spread over many years, with the longest maturities extending up to 2098. The most imminent long-term debt obligations include $748 million due at an interest rate of 3.25% and another $537 million at a rate of 0.45%, with both maturing in 2026. The largest principal payment, nearly $2.5 billion, is not due until 2046.

In 2023, the company's operating cash flow was $8.85 billion. Over the past decade, FedEx's average operational cash flow has been around $6.5 billion, indicating the company is well-positioned to manage its interest and principal debt payments.

Source: FedEx's 10-K

Decent potential upside

By 2025, FedEx's revenue is projected to be between $90 billion and $94.2 billion. If we take the midpoint of these estimates, which is $92.5 billion, and consider the average Ebitda margin from the past decade, which is 12.3%, FedEx's Ebitda in 2025 could reach approximately $11.4 billion. Using the five-year average Ebitda multiple of 10.91 times, we can estimate FedEx's enterprise value to be around $124 billion. This valuation is 33% higher than the current market valuation.

The bottom line

FedEx presents a solid financial profile characterized by a robust return on equity and effective management of financial leverage, offering reassurance to investors. Over the past decade, the company has consistently demonstrated a high return on equity, underlining its financial resilience even amid varying market conditions. This performance is bolstered by its strategic use of financial leverage, which, despite the substantial long-term debt, is spread over many years, reducing immediate financial pressure. With projected revenue growth and an anticipated increase in Ebitda by 2025, FedEx's enterprise value is estimated to be 33% higher than its current market price, suggesting a sound investment in the transportation and delivery sector.

This article first appeared on GuruFocus.