The Fed just raised interest rates again — here's how it happens and why it matters

Mark Wilson/Getty; Samantha Lee/Business Insider

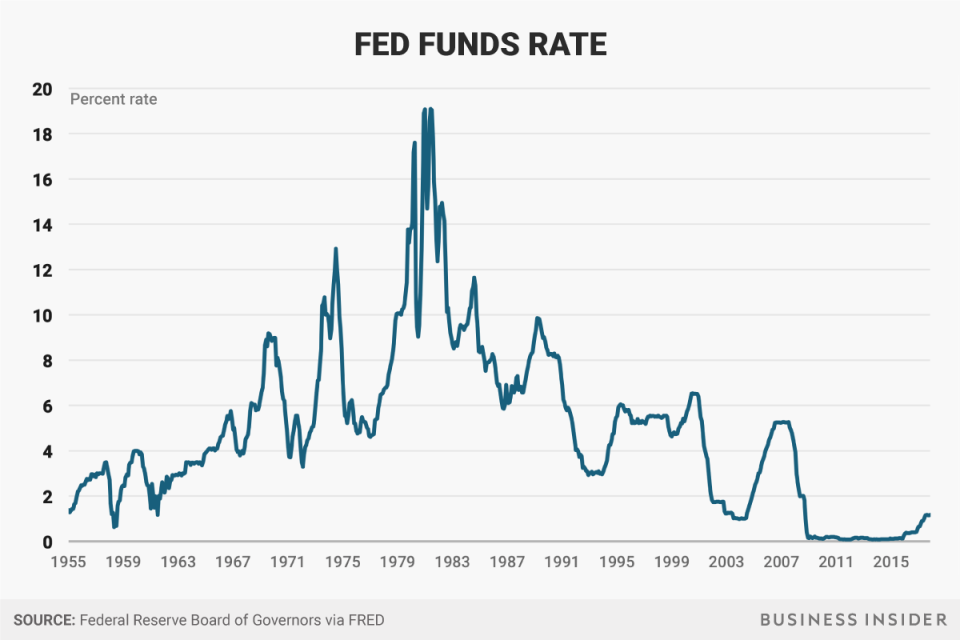

The Federal Reserve on Wednesday raised its benchmark interest rate for the third time in 2018.

America's central bank adjusts the interest rates that banks charge to borrow from one another, a cost that is eventually passed on to consumers.

The Fed raises rates in a strong economy to contain excesses, and cuts borrowing costs when the economy needs support.

Banks give out money all the time — for a fee.

When we borrow and then pay back with interest, it's how banks make money.

The cost of borrowing, known as the interest rate, can make a big difference in which credit card you choose or whether you get one at all.

But if your bank wants to make it more expensive to borrow, it's not as simple as just slapping on a new rate, as a grocer would with milk prices. It's something controlled higher up by the Federal Reserve, America's central bank.

Why does the Fed care about interest rates?

In 1977, Congress gave the Fed two main tasks: Keep the prices of things Americans buy stable, and create labor-market conditions that provide jobs for all the people who want them.

The Fed has developed a toolkit to achieve these dual goals of inflation and maximum employment. But interest-rate changes make the most headlines, perhaps because they have a swift effect on how much we pay for credit cards and other loans.

From Washington, the Fed adjusts interest rates with the hope of spurring all sorts of other changes in the economy. If it wants to encourage consumers to borrow so spending can increase, which should boost economic growth, it cuts rates and makes borrowing cheap. After the Great Recession, it kept rates near zero to achieve just that.

To accomplish the opposite and cool the economy, it raises rates so an extra credit card seems less desirable.

The Fed often adjusts rates in response to inflation — the increase in prices that happens when people have more to spend than what's available to buy.

For most of this economic recovery, inflation hasn't really picked up, though it is now well within the Fed's target. But that's expected to change, since the federal government has provided a jolt in the form of tax cuts and the unemployment rate is at the lowest level since 2000.

For now, the Fed is not exactly raising rates to fight inflation, though it expects prices to rise. That's why the most closely watched issues on Wednesday include the Fed's forecasts for economic growth and future rate hikes.

So how do rates go up or down?

Banks don't lend only to consumers; they lend to one another as well.

That's because at the end of every day they need to have a certain amount of capital in their reserves. As we spend money, that balance fluctuates, so a bank may need to borrow overnight to meet the minimum capital requirement.

And just as they charge you for a loan, they charge one another.

The Fed tries to influence that charge — called the federal funds rate — and it's what the Fed is targeting when it raises or cuts rates.

When the fed funds rate rises, banks also hike the rates they charge consumers, so borrowing costs increase across the economy.

Floor and ceiling

After the Great Recession, the Fed bought an unprecedented amount in government bonds, or Treasurys, to inject cash into banks' accounts. Nearly $2 trillion in excess reserves is now parked at the Fed. (There was less than $500 billion in 2008.)

It figured that one way to pare down these Treasurys was to lend some to money-market mutual funds and other dealers. It does this in transactions known as reverse repurchase operations, which involve selling the Treasurys and agreeing to buy them back the next day.

The Fed sets a lower "floor" rate on these so-called repos.

Then it sets a higher rate that controls how much it pays banks to hold their cash, known as interest on excess reserves. This acts as a ceiling, since banks won't want to lend to one another at a rate lower than what the Fed is paying them — at least in theory.

In September, when the Fed most recently raised rates, it set the repo rate at 2% and the interest on excess reserves at 2.25%, the highest range in more than a decade.

The effective fed funds rate, which is what banks use to lend to one another, would now float between a target range of 2% and 2.25%.

Andy Kiersz/Business Insider

When the Fed raises rates, banks are less incentivized to lend, since they are earning more to park their cash in reserves.

But I'm not a bank

After the Fed lifts the fed funds rate, the baton is passed to banks.

Banks first raise the rate they charge their most creditworthy clients — such as large corporations — known as the prime rate. Usually, banks announce this hike within days of the Fed's announcement.

Things like mortgages and credit-card rates are then benchmarked against the prime rate.

"The effect of a rate hike is going to be felt most immediately on credit cards and home-equity lines of credit, where the quarter-point rate hike will show up typically within 60 days," said Greg McBride, the chief financial analyst at Bankrate.com.

Higher rates are already being felt in the housing market. Mortgage rates, though still low by historical standards, are on the rise at a time when the inventory of affordable houses is low. The average fixed 30-year mortgage rate on Wednesday was 4.64%, up from 3.85% at the beginning of the year, according to Bankrate.com.

But higher rates bring good news for savers as banks raise their interest payments on deposits.

Now read:

NOW WATCH: 3 surprising ways humans are still evolving

See Also:

Yahoo Finance

Yahoo Finance