FDA Accepts Iovance's (IOVA) BLA Filing for Melanoma Drug

Shares of Iovance Biotherapeutics IOVA were up 18.0% in after-market trading on May 26 after management announced that the FDA had accepted its biologics license application (BLA) for lifileucel, its lead pipeline candidate, in melanoma indication. A final decision is expected by Nov 25, 2023.

The BLA seeks accelerated approval for lifileucel to treat patients with advanced unresectable or metastatic melanoma, which progressed on or after prior anti-PD-1/L1 therapy.

Per management, the FDA currently has no plan to hold an advisory committee meeting. The BLA has also been granted priority review by the FDA.

If the BLA is approved, lifileucel will be the first FDA-approved individualized, one-time cell therapy for melanoma patients. The approval to lifileucel will cater to the needs of melanoma patients who have already been treated with standard-of-care medications and have limited treatment options.

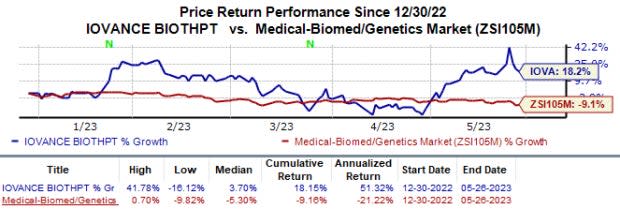

In the year so far, shares of Iovance have increased 18.2% against the industry’s 9.2% fall.

Image Source: Zacks Investment Research

The BLA filing, which was completed earlier this March, is based on data from cohorts 2 and 4 of the phase II C-144-01 study, which evaluated lifileucel in patients with post-anti-PD1 melanoma. Overall data from these cohorts shows that treatment with lifileucel achieved an objective response rate (ORR) of 31%, with the median duration of the response still not reached at 36.5 months.

In January, management reached an agreement with the FDA on the scope of the phase III TILVANCE-301 study, which will evaluate the combination of lifileucel and Merck’s MRK PD-L1 inhibitor Keytruda (pembrolizumab) against Merck’s Keytruda in frontline metastatic melanoma. This late-stage study, starting later this year, will serve as a confirmatory study for the above BLA. Iovance already evaluated the combination of lifileucel and Merck’s Keytruda for the given indication in a cohort of the phase II IOV-COM-202 study. Data from the cohort demonstrated an overall response rate (ORR) of 67%.

A multi-center study, IOV-COM-202 is composed of seven cohorts evaluating Iovance’s TIL therapies in multiple settings and for several indications, as a monotherapy and in combination with Merck’s Keytruda or Bristol-Myers’ BMY Opdivo/Yervoy.

Opdivo and Yervoy are two of the many blockbuster drugs marketed by Bristol Myers. The drugs are key top-line drivers for Bristol Myers. During first-quarter 2023, Bristol Myers generated $2.2 billion from Opdivo sales and recorded $508 million as product revenues from Yervoy.

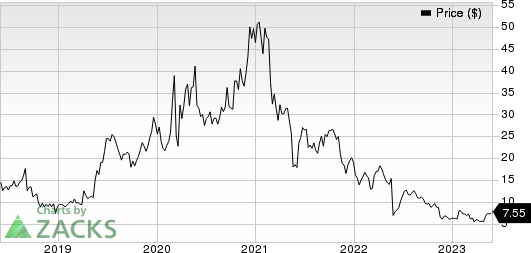

Iovance Biotherapeutics, Inc. Price

Iovance Biotherapeutics, Inc. price | Iovance Biotherapeutics, Inc. Quote

Zacks Rank & Stock to Consider

Iovance currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is Arbutus Biopharma ABUS, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, estimates for Arbutus Biopharma’s 2023 loss per share have improved from 57 cents to 44 cents. During the same period, the loss estimates per share for 2024 have narrowed from 61 cents to 53 cents. Shares of Arbutus Biopharma are up 7.3% in the year-to-date period.

Earnings of Arbutus Biopharma beat estimates in two of the last four quarters while meeting the mark twice. On average, the company’s earnings witnessed a surprise of 12.91%. In the last reported quarter, Arbutus Biopharma’s earnings beat estimates by 28.57%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Arbutus Biopharma Corporation (ABUS) : Free Stock Analysis Report

Iovance Biotherapeutics, Inc. (IOVA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance