Far East Group – An Overlooked Counter

Far East Group, a Singapore-based Heating, Ventilation and Air Conditioning (HVAC) company is listed on the Singapore Exchange (SGX) Catalist Board since August 2011 has one of the highest dividend yields at 20.7 percent, according to SGX Stockfacts. We examined the fundamentals and business model of this overlooked counter.

Brief Business Profile

Far East Group was incorporated in 1964. Not to be confused with the late local tycoon Ng Teng Fong’s Far East Organization, and its public-listed entities Far East Orchard (FEO), and Far East Hospitality Trust (FEHT), Far East Group specialises in the installation, and maintenance of HVAC systems, and trading of refrigeration parts. The company serves both industrial and residential markets. Due to its niche business, few local public listed entities compete in the space. The only and closest peer to Far East Group would be none other than Natural Cool Holdings.

Company Fundamentals

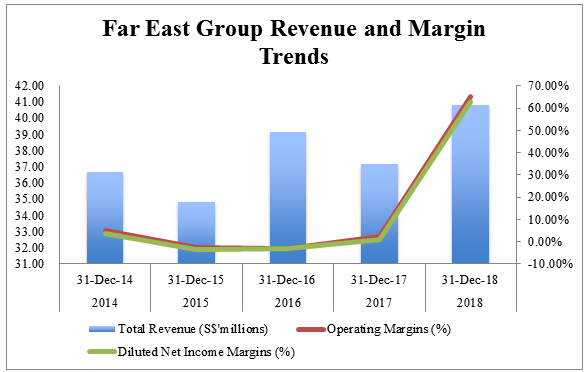

Far East Group’s revenue trended upwards in the range of $35 million to $40 million range per year, but both operating and net income margins have jumped in FY18 due to a huge gain received from the sale of its former headquarters in Lavender Street in Singapore, followed by a building in Kowloon, Hong Kong, industrial properties in Singapore, and Malaysia, as well as the increase in rental and management service income of $1.8 million, and offset by decline in dividend income from an unquoted investment of $0.2 million.

Source: Company’s financials, SGX StockFacts

Stronger Balance Sheet

Source: Company’s financials, SGX StockFacts

Far East Group’s overall debt leverage ratios have fallen from 53.5 percent in FY17 to 26.9 percent in FY18 for total debt-to-asset ratio, while total debt-to-equity ratio has fallen from 155 percent in FY17 to 45.2 percent in FY18. The company’s total cash and short-term investments stood at $21.6 million in FY18 and is about five times higher from the $4.7 million in FY17.

The company’s net cash from operating activities has also risen from $2.6 million in FY17 to S$3.6 million in FY18.

Valuation Comparisons with Natural Cool Holdings

Valuation Ratios | Far East Group | Natural Cool Holdings |

Price/Book Value (P/BV) | 0.28 | 0.84 |

Price/Sales (P/S) | 0.4 | 0.13 |

Dividend Yield (%) | 20.7% | N/A |

Dividend Yield (%) – 5-year average | N/A | N/A |

Enterprise Value (S$’millions) | 20.0 | 28.9 |

Price/Cash Flow (P/CF) | 0.58 | 6.5 |

Price/Earnings (P/E) Ratio | 0.61 | 66.0 |

Net Debt (S$’milllions) | 3.8 | 11.4 |

Total Market Capitalisation (S$’millions) | 16.2 | 17.5 |

Source: Company’s Financials, SGX StockFacts

Based on the valuation comparisons between Far East Group, and it’s closest peer company, Natural Cool Holdings, while both company’s market valuations are close, at $16.2 million for the former and $17.5 million for the latter as of 18 April 2019, Natural Cool Holdings appears to be relatively more expensive than Far East Group in the terms of price multiples. In addition, Natural Cool Holdings also has a higher net debt balance than Far East Group.

Risk Considerations

While Far East Group appear fairly priced, considering its low net debt balances, and relatively high levels of cash and cash equivalents balance as compared to its local peers, the industry is largely fragmented with foreign multinational players who has the clout and reach in many global countries. Companies like Siemens, Honeywell, the Japanese and other European competitors possess the talents, and customer sizes which Far East Group, simply cannot easily match against.

Moreover, the company’s stock is quite illiquid with average three-month trading volume being less than 1 million. The low trading volume presents challenges in trying to reach out to investors’ attention. Despite the illiquid conditions of the stock, along with the lack of coverage, the stock’s basic fundamentals are generally sound.

Related Article:

Yahoo Finance

Yahoo Finance