Factors Setting the Tone for TJX Companies' (TJX) Q3 Earnings

The TJX Companies, Inc. TJX is scheduled to release third-quarter fiscal 2020 results on Nov 19. This renowned off-price retailer’s earnings were in line with the Zacks Consensus Estimate in the last reported quarter.

The Zacks Consensus Estimate for third-quarter 2019 earnings has been stable in the past 30 days at 66 cents per share, which suggests an improvement of 4.8% from the year-ago quarter’s reported figure. The consensus mark for revenues is pegged at $10,309 million, which indicates a rise of 4.9% from the prior-year quarter’s level.

Factors to Note

TJX Companies has been gaining from robust comparable store sales (comps) trend. Comps have been steadily expanding on the back of high customer traffic, across most of the segments. This indicates that the company’s merchandising and brand growth initiatives have been yielding well.

Moreover, the company has been benefitting from solid store-opening strategies. This has enabled it to widen the business rapidly across the United States, Europe and Canada. Additionally, the company’s initiatives to boost e-commerce presence have been lucrative. Such efforts along with a strong inventory position, efficient marketing strategies and robust off-price fundamentals bode well.

In the last earnings call, management highlighted that fiscal third quarter had begun on a solid note. Alongside, it projected consolidated sales for the said quarter in the range of $10.2-$10.3 billion. This indicates growth from sales of $9.8 billion reported in the prior-year quarter.

However, elevated supply-chain expenses and adverse currency rate fluctuations are expected to have affected the company’s performance in fiscal third quarter.

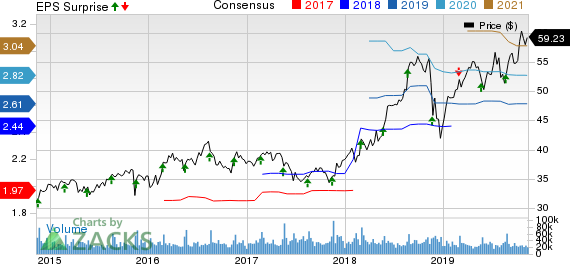

The TJX Companies, Inc. Price, Consensus and EPS Surprise

The TJX Companies, Inc. price-consensus-eps-surprise-chart | The TJX Companies, Inc. Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for TJX Companies this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

TJX Companies carries a Zacks Rank #4 (Sell) and Earnings ESP of 0.00%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks Poised to Beat Earnings Estimates

Here are some companies that you may want to consider, as our model shows that these have the right combination to post an earnings beat:

Ross Stores ROST has an Earnings ESP of +4.03% and a Zacks Rank #2.

Dollar General DG has an Earnings ESP of +2.34% and a Zacks Rank #2.

Foot Locker FL has an Earnings ESP of +0.64% and a Zacks Rank #3.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Foot Locker, Inc. (FL) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance