Factors Likely to Influence Office Depot's (ODP) Q4 Earnings

Office Depot, Inc. ODP, which is slated to release fourth-quarter 2017 results on Feb 28, has seen shares plunge 26.8% in the past six months. The stock has not only underperformed the industry that grew 4.8% but also the broader Retail-Wholesale sector that advanced 21.6%.

For quite some time now, Office Depot has been grappling with dwindling top-line performance. Analysts pointed out that demand for office products (paper-based) has been decreasing due to technological advancements. Smartphones, tablets and laptops are fast emerging as viable substitutes for paper-based office supplies. Further, stiff competition from online retailers, loss of customers in Business Solutions Division and soft store traffic have been playing spoilsport.

Nevertheless, management is not sitting idle, and instead trying all means to bring the stock back on growth trajectory. The company is closing underperforming stores, reducing exposure to higher dollar-value inventory items, shuttering non-critical distribution facilities, concentrating on e-commerce platforms as well as focusing on offering innovative products and services.

Which Way are the Estimates Treading?

The question lingering in investors’ minds is whether this supplier of a range of office products and services will be able to post positive earnings surprise in the quarter to be reported. In the preceding quarter, it had reported in-line earnings.

Let’s look at earnings estimate revisions in order to get a clear picture of what analysts are thinking about the company prior to the release. The current Zacks Consensus Estimate for the quarter under review has decreased by a penny in the last 30 days, and is currently pegged at 7 cents. The consensus estimate shows a sharp decline from 11 cents reported in the year-ago quarter.

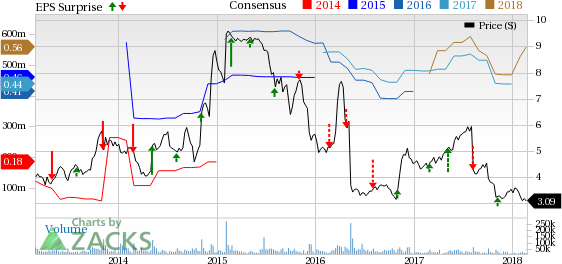

Office Depot, Inc. Price, Consensus and EPS Surprise

Office Depot, Inc. Price, Consensus and EPS Surprise | Office Depot, Inc. Quote

Factors Influencing the Quarterly Results

Top-Line Likely to Decline Again

Office Depot continues to battle a dismal top-line. Total sales had declined 7%, 9% and 8% in the first, second and third quarter of 2017, respectively. Management expects total sales to be lower in 2017 in comparison with 2016, owing to the store closures, tough market conditions, hurricane impacts and losses of contract customers. We also noted that comparable-store sales have tumbled 5%, 6% and 5% in the respective quarters.

However, management anticipates the rate of sales decline to decelerate in the final quarter after taking into consideration higher customer retention and strategic endeavors, along with the implementation of new customer wins. Analysts polled by Zacks expect fourth-quarter revenue to be $2,541 million, reflecting a year-over-year decline of 6.8%.

Are Remedies Undertaken Sufficient?

Office Depot has undertaken a strategic review of business operating model, growth prospects and cost structure with primary focus on core North American market. The company by increasing penetration into adjacent categories and enhancing share of wallet with existing customers intends to boost sales in the contract channel.

With respect to the cost containment effort, Office Depot is employing a more efficient customer coverage model, focusing on lowering indirect procurement costs as well as general and administrative expenditures, and also gaining from its U.S. retail store optimization plan.

To widen its domain of offerings, Office Depot acquired CompuCom Systems to acclimatize to the rapidly changing retail landscape along with providing enterprise-level tech services and products to customers. The company also launched a new subscription-based business services platform, BizBox, to assist start-ups and small businesses on host of things such as website designing, financing and accounting service, HR/payroll support and others.

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that Office Depot is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Office Depot carries a Zacks Rank #3 but has an Earnings ESP of 0.00%, consequently making the surprise prediction difficult.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Dillard's DDS has an Earnings ESP of +15.83% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Best Buy BBY has an Earnings ESP of +4.59% and a Zacks Rank #2.

L Brands LB has an Earnings ESP of +0.41% and a Zacks Rank #3.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

L Brands, Inc. (LB) : Free Stock Analysis Report

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report

Office Depot, Inc. (ODP) : Free Stock Analysis Report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance