Factors Likely to Influence Deckers' (DECK) Q4 Earnings

Deckers Outdoor Corporation DECK is likely to register a decline in the top line when it reports fourth-quarter fiscal 2023 earnings results on May 25. The Zacks Consensus Estimate for revenues is pegged at $703.6 million, indicating a decline of 4.4% from the prior-year reported figure.

However, the bottom line of this designer, marketer and distributor of footwear, apparel and accessories is expected to increase year over year. The Zacks Consensus Estimate for fourth-quarter earnings per share has increased 2.4% to $2.60 over the past 30 days, suggesting an improvement from the $2.51 per share reported in the year-ago period.

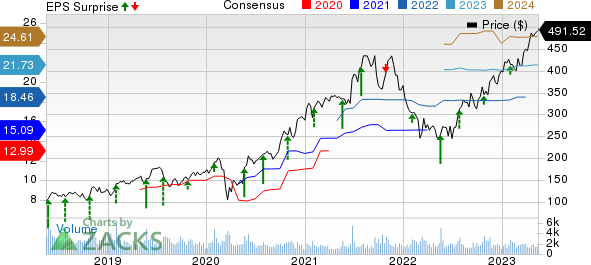

Deckers has a trailing four-quarter earnings surprise of 31%, on average. In the last reported quarter, this Goleta, CA-based company’s bottom line outperformed the Zacks Consensus Estimate by a margin of 9.5%.

Deckers Outdoor Corporation Price, Consensus and EPS Surprise

Deckers Outdoor Corporation price-consensus-eps-surprise-chart | Deckers Outdoor Corporation Quote

Key Factors to Note

Deckers’ fourth-quarter performance is likely to have benefited from management’s focus on ramping up inventory, optimizing channel mix to fulfil consumer demand, scaling production to support the growth of brands and implementing targeted price increases. The company’s focus on expanding brand assortments, introducing an innovative line of products and enhancing the direct-to-consumer business might have acted as tailwinds.

Keeping pace with changing trends, Deckers has constantly been developing its e-commerce portal to capture incremental sales. The company has been making substantial investments to strengthen its online presence and enhance the shopping experience.

We note that the Zacks Consensus Estimate for fourth-quarter sales at the HOKA ONE ONE brand is pegged at $359 million, suggesting an increase of 26.4% year over year. The consensus estimate for the Teva brand is currently pegged at $55 million, flat year over year.

The consensus estimate for sales at the UGG brand is $276 million, down from $375 million reported in the year-ago period. The consensus mark for sales at the Sanuk brand is $11.9 million, which is in line with the figure from the prior-year quarter.

While the aforementioned factors raise optimism, higher freight costs, labor shortages, strengthening of the U.S. dollar and geopolitical tensions are some of the headwinds Deckers might have encountered. On its last earnings call, management hinted that foreign currency headwinds would impact fourth-quarter revenues by $20 million and fiscal 2023 revenues by approximately $100 million.

What the Zacks Model Unveils

Our proven model shows that Deckers is likely to beat earnings estimates this quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here.

Deckers currently has a Zacks Rank #3 and an Earnings ESP of +7.36%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks Poised to Beat Earnings Estimates

Here are three other companies worth considering, as our model shows that these have the right combination of elements to beat earnings this season:

BJ's Wholesale Club BJ currently has an Earnings ESP of +4.19% and a Zacks Rank of 2. The company is likely to register top-line growth when it reports first-quarter fiscal 2023 results on May 23. The consensus mark for BJ’s quarterly revenues is pegged at $4.81 billion, which suggests growth of 7% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BJ’s earnings has remained constant at 84 cents per share in the past 30 days. However, the consensus estimate indicates 3.5% decline from the figures reported in the year-ago quarter.

Target Corporation TGT currently has an Earnings ESP of +0.40% and a Zacks Rank of 3. The company is likely to register top-line growth when it reports first-quarter fiscal 2023 results on May 17. The consensus mark for TGT’s quarterly revenues is pegged at $25.37 billion, which suggests 0.8% growth from the figure reported in the prior-year quarter.

The consensus mark for TGT’s quarterly earnings has declined by 2 pennies in the past 30 days to $1.75 per share. The consensus estimate suggests a decline of 20.1% from the year-ago quarter.

DICK'S Sporting Goods DKS currently has an Earnings ESP of +3.39% and a Zacks Rank of 3. The company is likely to register growth in the top and bottom lines when it reports first-quarter fiscal 2023 numbers on May 23. The consensus mark for DKS’ quarterly earnings has remained unchanged in the past 30 days at $3.18 per share. Also, the consensus estimate suggests growth of 11.6% from the year-ago quarter’s reported number.

The Zacks Consensus Estimate for DKS’ quarterly revenues is pegged at $2.8 billion, which suggests an increase of 4.7% from the figure reported in the prior-year quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance