Factors to Know Ahead of Grocery Outlet's (GO) Q1 Earnings

Grocery Outlet Holding Corp. GO is scheduled to report first-quarter 2020 financial numbers on May 11, after the market closes. In the last reported quarter, the company delivered a positive earnings surprise of 23.5%. This owner and operator of grocery store chains has a trailing three-quarter positive earnings surprise of 31.1%, on average.

We note that the Zacks Consensus Estimate for earnings for the quarter under review has increased by a cent over the past 30 days to 24 cents. The Zacks Consensus Estimate for revenues is pegged at $758.2 million.

Factors Holding Key

In the last month, Grocery Outlet came out with preliminary financial results for the first quarter. For 13-week period ended on Mar 28, 2020, the company projected net sales increase of 25.4% to $760.3 million due to coronavirus-led demand. With people dining at home and maintaining social distancing, they have been stocking essential items.

Management highlighted that the company registered “the wave of customer pantry-loading” in the month of March. Notably, the company guided comparable-store sales growth of 17.4% during the aforementioned period on account of increases in both the number of customer transactions and average transaction size. We note that the company’s comparable-store sales during 13-week period ended Mar 30, 2019 had risen by only 4.2%.

This Emeryville, CA-based company projected income from operations between $14.3 million and $15.3 million compared with $21.7 million reported in the year-ago period. Management envisioned adjusted net income in the range of $30.3-$31.4 million, up significantly from $9.9 million generated in the prior-year quarter.

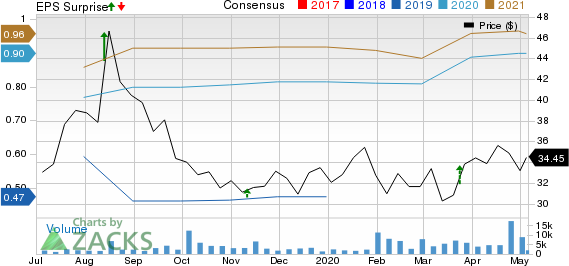

Grocery Outlet Holding Corp. Price, Consensus and EPS Surprise

Grocery Outlet Holding Corp. price-consensus-eps-surprise-chart | Grocery Outlet Holding Corp. Quote

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Grocery Outlet this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Grocery Outlet sports a Zacks Rank #1 and an Earnings ESP of +33.33%.

Other Stocks With a Favorable Combination

Here are some other companies that you may want to consider, as our model shows that these too have the right combination of elements to post an earnings beat this time around:

Campbell Soup CPB has an Earnings ESP of +12.88% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Flowers Foods, Inc. FLO has an Earnings ESP of +7.77% and a Zacks Rank #3.

Nomad Foods NOMD has an Earnings ESP of +5.32% and a Zacks Rank #2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance