Facebook, Amazon, Google earnings — What you need to know for the week ahead

Earnings season is kicking into high gear.

This past week, investors faced a fairly busy earnings schedule while events on the political front seemed calm relative to the chaos of the prior week with Mark Zuckerberg’s testimony, Donald Trump’s tweets on trade, and a raid at Trump’s lawyer’s office.

Stocks, additionally, ended up roughly unchanged for the week with poor results from the semiconductor industry, and a resulting slide in shares of Apple (AAPL) serving as the week’s biggest stock story.

In the week ahead, both the economic and earnings calendar will bring investors and almost overwhelming amount of possible catalysts.

On the earnings side, results from Google parent company Alphabet (GOOGL), Facebook (FB), and Amazon (AMZN) will be the main highlights, with results out of Microsoft (MSFT), which has been a market leader alongside other tech giants in the last 18 months, serving as the most closely-tracked earnings releases.

All in, over 170 companies in the S&P 500 are slated to report results this week, according to data from Bloomberg, and other notable results should include United Technologies (UTX), Coca-Cola (KO), Verizon (VZ), Caterpillar (CAT), Lockheed Martin (LMT), 3M (MMM), Boeing (BA), Twitter (TWTR), General Dynamics (GD), Comcast (CMCSA), Visa (V), AT&T (T), PayPal (PYPL), Chipotle (CMG), eBay (EBAY), Ford (F), Time Warner (TWX), PepsiCo (PEP), UPS (UPS), Domino’s Pizza (DPZ), General Motors (GM), Expedia (EXPE), Starbucks (SBUX), and Intel (INTC), among others.

The economic calendar is also busy, with Friday bringing investors the first read on economic growth in the first quarter of the year. Economists expect that GDP grew at an annualized rate of 2% in the first quarter, down from the 2.9% pace of growth seen in the fourth quarter. Additionally, personal consumption, which accounts for about 70% of GDP growth, is expected to rise just 1.2% in the first quarter.

Other notable economic data expected this week include a run of numbers on home prices and building activity, as well as a check on consumer sentiment on Friday.

Economic calendar

Monday: Markit flash US manufacturing PMI, April (55.1 expected; 55.6 previously); Markit flash US services PMI, April (54.1 expected; 54 previously); Existing home sales, March (+0.2% expected; +3% previously)

Tuesday: FHFA home price index, February (+0.6% expected; +0.8% previously); S&P Case-Shiller home price index, February (+0.63% expected; +0.75% previously); New home sales, March (+1.9% expected; -0.6% previously); Richmond Fed manufacturing, April (16 expected; 15 previously); Conference Board consumer confidence, April (126 expected; 127.7 previously)

Wednesday: No major economic data expected.

Thursday: Initial jobless claims (231,000 expected; 232,000 previously); Durable goods orders, March (+1.2% expected; +3% previously)

Friday: First quarter GDP growth, first estimate (+2% expected; +2.9% previously); Employment cost index, first quarter (+0.7% expected; 0.6% previously); Personal consumption, first quarter (+1.2% expected; +4% previously); University of Michigan consumer sentiment, April (98 expected; 97.8 previously)

Are tax cuts a bust?

This coming week, the Bureau of Economic Analysis will report its first look at economic growth for the first quarter of 2018.

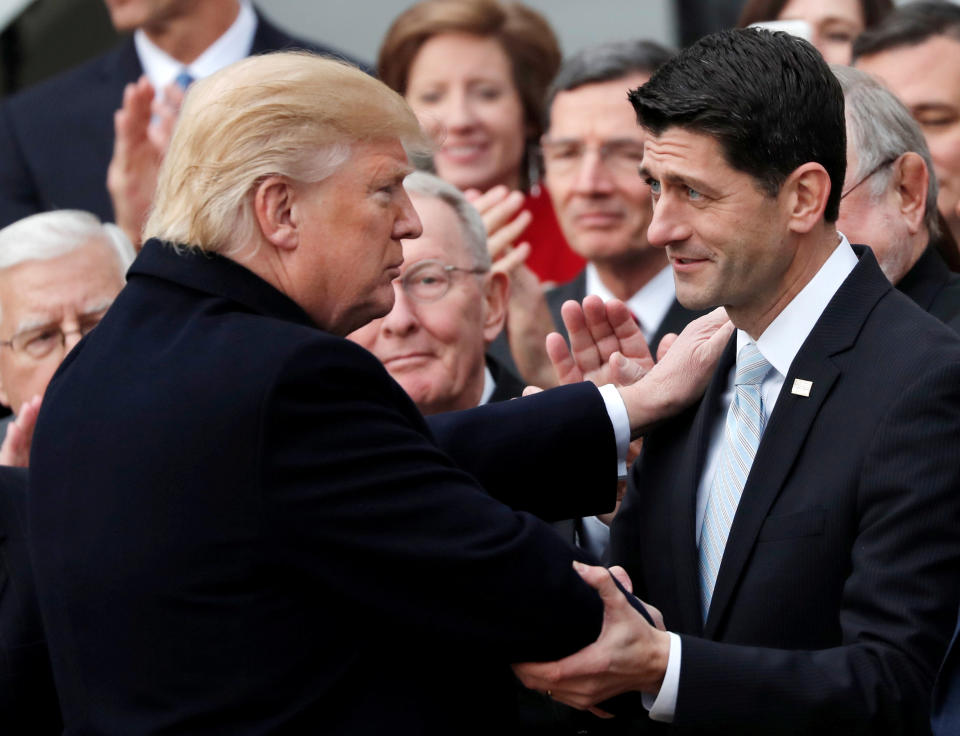

And while this numbers are expected to be about on-par with the growth we’ve experienced since the financial crisis — 2%, give or take — this report comes after a major economic policy change has been enacted: the Trump tax cuts.

On this background then, the 2% growth that is forecasted isn’t great, considering Trump himself campaigned on a pledge to achieve 4% economic growth under a tax cut plan that wasn’t all that different from what was voted into law.

More troubling, however, are the expectations for personal consumption growth in the first quarter, which is set to grow just 1.2% annualized after a 4% increase in the fourth quarter.

Economists at Capital Economics noted Friday that real disposable incomes — that is, how much money Americans had to spend, adjusting for inflation — rose 0.6% in January, the most in two years as the tax burden for many declined following the tax cut’s enactment. Real consumption, or how much people spent adjusted for inflation, declined 0.2% this same month.

“The tax cuts were never likely to result in an instant surge in household spending,” the firm writes. “But the apparent lack of any boost whatsoever is still hard to explain, particularly with employment growth picking up and consumer confidence near a decade high.”

The tax cuts, however, were never a hugely popular political gambit. An NBC News/Wall Street Journal poll published last week showed that 27% of Americans think the tax cut is a good idea. This was down from 30% calling it a good idea in January. Meanwhile, 36%, a plurality of respondents, called it a bad idea.

At Yahoo Finance, Rick Newman this week explored why the tax cuts are not resonating with voters the way policymakers and economists might have expected. And it came down to three basic issues — people think tax cuts are just for the rich, that tax cuts are mostly to help businesses, and that the fiscal irresponsibility of the tax cuts is bad for the country’s economic health.

And when corporate executives are found telling employees that tax cuts will mostly help the company’s shareholders, not its workers, it’s not hard to see why the bill hasn’t resonated with the broader public.

Wall Street strategists are also growing skeptical of the enduring benefits of tax reform to corporate performance, which in 2017 was an idea taken as gospel.

“We believe that earnings increases from tax cuts are a much lower quality than what we experienced since early 2016 with the re-synchronization of the global economy and that the market will be less willing to pay for this type of earnings expansion,” said Morgan Stanley strategists Michael Wilson and Adam Virgadamo in a note to clients published Tuesday.

The firm added that it thinks investors “will not apply the same multiple to tax-related earnings growth as it does organic earnings growth.” In other words, markets will be less likely to reward companies for big earnings beats relative to expectations if this growth is driven by a one-time adjustment in the corporate tax rate.

And with the stock market’s rally in 2017 helping to boost consumer confidence and create a “wealth effect” whereby people and businesses spend more money as the value of their investments increases, a broader investor-class skepticism about the impacts tax cuts have on corporate earnings could pose a problem.

Like any big piece of legislation, however, the enduring impacts that tax cuts have on the economy and the country will take far longer than a few quarters to suss out. And with tax cuts, this lag might be even larger than, say, healthcare.

Because as Capital Economics notes, the biggest changes in income due to the tax bill went to the highest earners. This, of course, explains why the bill is not as popular as many politicians would have you believe. But it also explains why the economic impacts won’t be as immediately clear.

A final possibility is that the tax cuts just aren’t that big of a deal for most Americans,” Capital Economics writes. “After all, the benefits of the Republican bill are skewed towards high earners. The Tax Policy Center (TPC) estimates that while middle-income earners will see their post-tax income rise by 1.6% this year following the tax changes, the top 20% of earners will see a gain of almost double that. The boost to incomes for the top 1% of earners is higher still.”

“With wealthier individuals more likely to save rather than spend any additional income, that’s part of the reason why we always expected the fiscal multiplier for the tax bill to be low,” the firm added.

Capital Economics adds that analysis from the Tax Policy Center suggests median earners will see $1,000 added to their paycheck in 2018. Over the course of a year, this is good for about $90 a month in additional take-home pay. And while this increase adds up over time, it isn’t the kind of one-time shock to a household budget that might really see behaviors change meaningfully in a short period.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance