F.N.B. Corp (FNB) Rides on Buyouts & Loan Demand, Costs Rise

F.N.B. Corporation’s FNB strategic acquisitions, rise in demand for loans and digitization of operations will keep supporting financials in the quarters ahead. However, relatively lower interest rates and mounting costs are near-term concerns.

Acquisitions are a major portion of F.N.B. Corp’s business expansion plan. Since 2005, it has successfully integrated 15 buyouts. This January, it acquired Howard Bancorp in an all-stock deal. This, along with prior agreements, will continue to be accretive to the company’s earnings. Given a solid balance sheet and liquidity position, FNB is likely to continue its expansion strategy.

Similar to FNB, several other banks, including Huntington Bancshares HBAN and KeyCorp KEY, are undertaking buyouts to offer digitized solutions to their clients. HBAN’s subsidiary acquired San Francisco-based Digital Payments Torana, Inc., a B2C payment fintech company. The move advances Huntington’s enterprise payments strategy to cater to clients of all sizes. Torana’s digital payments solution will now be launched as Huntington ChoicePay, further enhancing HBAN’s digital capabilities.

KeyCorp announced the acquisition of Philadelphia, PA-based GradFin. This will strengthen the company’s digital offering capabilities. The transaction is in sync with KEY’s efforts to undertake strategic partnerships with Fintech companies and cater to clients’ ever-changing needs.

Opportunistic buyouts and improving loan balance have been supporting F.N.B. Corp’s revenues. Over the last five years (ended 2021), the same witnessed a CAGR of 3%. Net loans saw a CAGR of 4.3% over the same time frame. Decent economic growth, strategic expansion moves like opportunistic de novo expansion and higher loan demand will support the top-line growth.

Management projects net interest income between $1 billion and $1,04 billion for 2022, while non-interest income is expected to be in the range of $315-$330 million.

At present, FNB carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

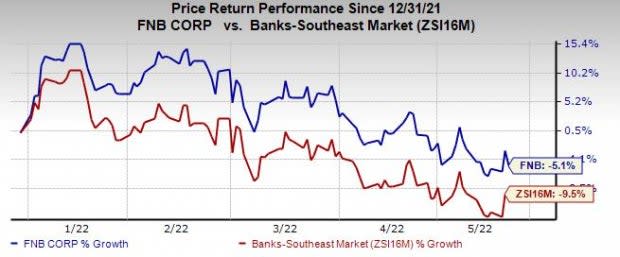

So far this year, shares of F.N.B. Corp have lost 5.1% compared with a 9.5% decline of the industry.

Image Source: Zacks Investment Research

However, pressure on net interest margin (NIM) is a major concern for F.N.B. Corp. Amid the low-interest-rate environment, the company’s NIM has been declining – 2.68% in 2021, 2.91% in 2020, 3.17% in 2019, 3.39% in 2018 and 3.43% in 2017. Despite the recent rate hikes and expectations of more this year, relatively lower rates are likely to keep the company’s NIM under pressure in the near term.

Further, F.N.B. Corp has been witnessing a persistent rise in expenses. Adjusted expenses witnessed a CAGR of 1.2% over the four years ended 2021. The increase was mainly due to higher salaries and benefits costs as well as strategic acquisitions. Overall costs are expected to remain elevated as FNB continues to invest in franchises, digitize operations and grow through acquisitions. The company expects non-interest expenses (operating basis) to be $760-$780 million this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

F.N.B. Corporation (FNB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance