ExxonMobil (XOM) Aims Net-Zero Emissions for Permian Operation

Exxon Mobil Corporation XOM announced plans to achieve net-zero emissions from operated assets in the Permian Basin by 2030.

Energy companies have been under immense pressure due to the growing urgency from investors and environmentalists to curb climate change. ExxonMobil's latest initiative is part of a company-wide effort to reduce upstream greenhouse gas emissions intensity by 40-50% by 2030 from the 2016 levels. The move will expand XOM's emission-reduction plans for unconventional operations in New Mexico and Texas.

ExxonMobil plans to accomplish its net-zero targets by electrifying operations, allocating more investments in methane mitigation and detection technology, eliminating routine gas flaring and upgrading equipment. XOM also plans to use emission offset technology, including nature-based solutions.

ExxonMobil intends to electrify its oil and gas operations with low-carbon power, which might involve wind, solar, hydrogen, natural gas with carbon capture and storage, and other emerging technologies. XOM aims to enhance its methane detection programs, using satellite surveillance and a network of ground-based sensors to monitor continuously.

At the third-quarter end, ExxonMobil produced 500,000 barrels of oil equivalent per day in the Permian Basin, which comprised more than 40% of its total production in the United States. With the rising production, XOM expects to mitigate greenhouse gas emissions accordingly in the basin, aiming to reduce flaring volumes across its Permian operations by more than 75% by 2021 end compared with 2019 levels. ExxonMobil also seeks to eliminate all routine flaring in the Permian basin by the end of 2022.

ExxonMobil's target of achieving net-zero emissions is one of the most ambitious and wide-reaching plans in the Permian Basin. XOM's plan for the basin is well-aligned with the U.S. and European Union-led Global Methane Pledge to reduce methane emissions by 30% by 2030.

Company Profile & Price Performance

Headquartered in Irving, TX, ExxonMobil is one of the leading integrated energy companies in the world.

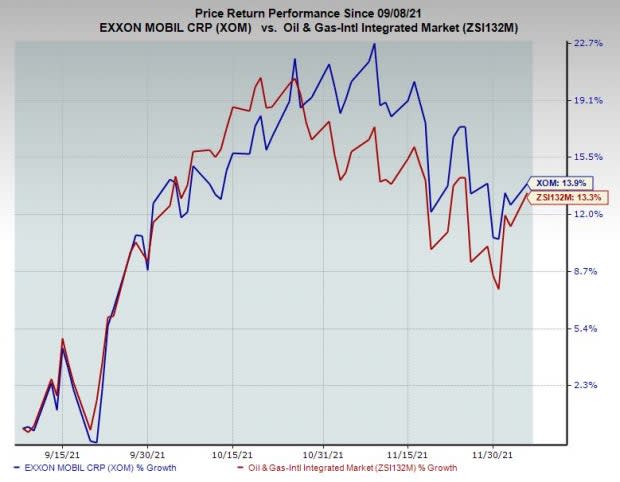

Shares of ExxonMobil have outperformed the industry in the past three months. The XOM stock has gained 13.9% compared with the industry's 13.3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

ExxonMobil currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

SM Energy Company SM is one of the most attractive players in the exploration and production space, which engages in the exploration, exploitation, development, acquisition and production of natural gas and crude oil in North America. SM's operations focus on the Permian Basin, and the South Texas and Gulf Coast region. SM has 443,188 net acres under its possession, of which 33.5% is developed.

In the past year, shares of SM Energy have gained 453.3% compared with the industry's growth of 90.8%. SM's earnings for 2021 are expected to surge 708.7% year over year. SM currently has a Zacks Style Score of A for both Growth and Momentum. The upstream energy player beat the Zacks Consensus Estimate thrice in the last four quarters and missed once. SM Energy has a trailing four-quarter earnings surprise of 126.3%, on average.

Callon Petroleum Company CPE solely focuses on the exploration, and production of oil and gas resources in the Permian Basin. CPE boasts an impressive footprint throughout the core of the Permian Basin, which is the highest-producing shale play in the United States. Callon Petroleum, currently valued at $2.9 billion, entered the basin in 2009 and has been strengthening its foothold in the region since then.

In the past year, shares of Callon Petroleum have soared 234.6% compared with Zacks Exploration and Production Industry's growth of 90.7%. CPE's 2021 earnings are expected to skyrocket 222.7% year over year. CPE currently has a Zacks Style Score of A for both Growth and Momentum. CPE witnessed six upward revisions in the past 60 days.

PDC Energy PDCE is an independent upstream operator that engages in the exploration, development and production of natural gas, crude oil and natural gas liquids. PDCE, which reached its present form following the January 2020 combination with SRC Energy, is currently the second-largest producer in the Denver-Julesburg Basin. As of 2020-end, PDC Energy's total estimated proved reserves were 731,073 thousand barrels of oil equivalent.

In the past year, shares of PDCE Energy have gained 169.4% compared with the industry's growth of 90.8%. Moreover, PDCE's 2021 earnings are expected to surge 285.2% year over year. In the past 60 days, the Zacks Consensus Estimate for PDCE's 2021 earnings has been raised by 31%. PDC Energy beat the Zacks Consensus Estimate in the last four quarters, with an earnings surprise of 51.06%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

PDC Energy, Inc. (PDCE) : Free Stock Analysis Report

Callon Petroleum Company (CPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance