ExxonMobil Signs Deal to Capture Carbon From Nucor's Plant

Exxon Mobil Corporation XOM entered an agreement with steel producer Nucor Corporation NUE to capture, transport and store carbon dioxide (CO2) from the latter’s direct reduce iron (“DRI”) facility in Louisiana.

ExxonMobil will capture up to 800,000 metric tons of CO2 per annum from Nucor’s facility and store it at its Louisiana facility. The project, which is expected to commence in 2026, will help Louisiana achieve net-zero emissions by 2050.

Nucor uses a recycling-based production method to make cleaner steel. This means that Nucor’s steel mills generate about two-thirds less than the CO2 of extractive blast furnace steelmaking plants. The latest deal is crucial to Nucor’s decarbonization strategy and will result in some of the lowest embodied carbon DRI in North America.

Nucor is one of the first steel companies to disclose its Scope 3 emission-reduction goals. The agreement improves Nucor’s position as a sustainability leader, and builds on its plan to produce steel and steel products with low embodied carbon.

Oil and gas companies are getting actively involved in CCS projects, as it offers a transition pathway for the rapid and effective reduction of CO2 emissions beyond what can be achieved by alternative methods like electrification and renewable fuels. Thus, the use of CCS in reducing industrial emissions offers an excellent opportunity.

ExxonMobil is one of the most hydrocarbon-focused companies among Western oil producers. Unlike its peers, the company has stayed away from renewable energy. ExxonMobil’s energy transition plan primarily focuses on reducing emissions within its operations.

The deal shows ExxonMobil’s commitment to reducing emissions from hard-to-abate industries and marks an important step forward in its efforts to benefit from carbon burial. In 2022, the company launched a low-carbon business to address the growing urgency to reduce emissions.

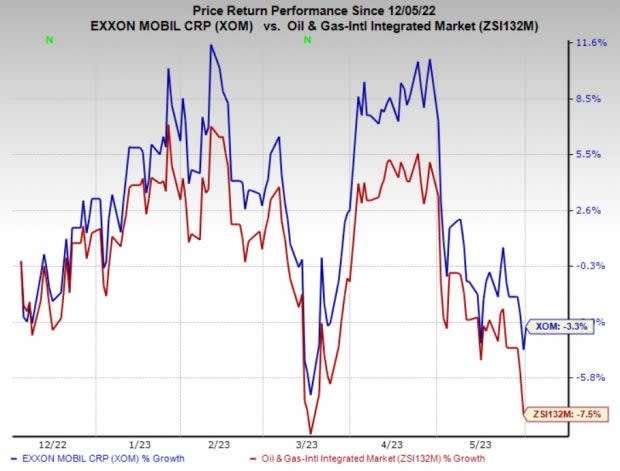

Price Performance

Shares of ExxonMobil have outperformed the industry in the past six months. The stock has lost 3.3% compared with the industry’s 7.5% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

ExxonMobil currently carries a Zack Rank #3 (Hold).

Some better-ranked players in the energy space are Murphy USA Inc. MUSA and Sunoco LP SUN, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Murphy USA announced first-quarter 2023 earnings per share of $4.80, which beat the Zacks Consensus Estimate of $4.06. The outperformance can be attributed to higher volumes and retail fuel contribution.

MUSA is committed to returning excess cash to its shareholders through continued share buyback programs. As part of this initiative, the motor fuel retailer recently approved a repurchase authorization of up to $1.5 billion following the completion of the existing $1-billion mandate. The move underscores MUSA’s sound financial position and commitment to rewarding its shareholders.

Sunoco reported first-quarter 2023 earnings of $1.41 per unit, beating the Zacks Consensus Estimate of $1.21. Better-than-expected quarterly earnings were primarily driven by higher contributions from the Fuel Distribution and Marketing segment.

For 2023, SUN revised its adjusted EBITDA guidance upward to $865-$915 million from the previously mentioned $850-$900 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance