Exploring Undervalued Stocks On Chinese Exchange With Discounts Ranging From 18.6% To 43.6%

As global markets navigate through varying economic signals, China's stock market has shown resilience despite recent underwhelming manufacturing data and ongoing concerns about the economy. In this context, identifying undervalued stocks on Chinese exchanges could present opportunities for investors looking for potential growth at discounted valuations.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥169.00 | CN¥324.24 | 47.9% |

Ningbo Dechang Electrical Machinery Made (SHSE:605555) | CN¥18.88 | CN¥33.79 | 44.1% |

Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥25.42 | CN¥46.17 | 44.9% |

Anhui Anli Material Technology (SZSE:300218) | CN¥14.40 | CN¥26.60 | 45.9% |

Beijing Kingsoft Office Software (SHSE:688111) | CN¥191.38 | CN¥339.76 | 43.7% |

China Film (SHSE:600977) | CN¥10.40 | CN¥20.19 | 48.5% |

INKON Life Technology (SZSE:300143) | CN¥7.70 | CN¥14.64 | 47.4% |

Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.89 | CN¥17.64 | 49.6% |

Quectel Wireless Solutions (SHSE:603236) | CN¥51.00 | CN¥96.71 | 47.3% |

Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥9.59 | CN¥18.84 | 49.1% |

Let's explore several standout options from the results in the screener.

Ningbo Yongxin OpticsLtd

Overview: Ningbo Yongxin Optics Co., Ltd specializes in manufacturing and selling precision optical instruments and components primarily in China, with a market capitalization of approximately CN¥7.03 billion.

Operations: The company's revenue from optical product manufacturing amounts to CN¥881.87 million.

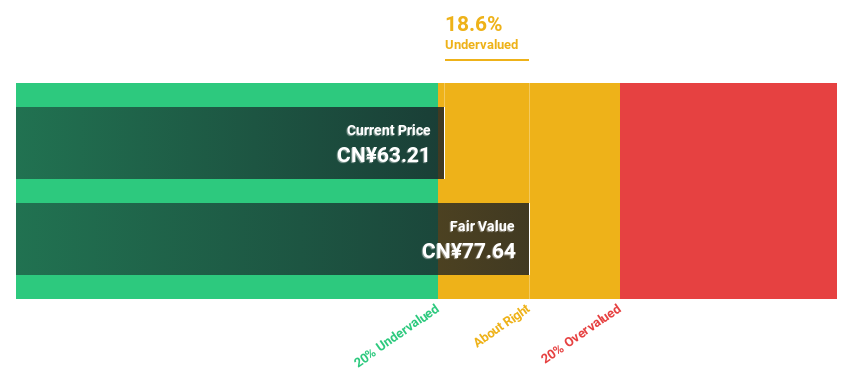

Estimated Discount To Fair Value: 18.6%

Ningbo Yongxin OpticsLtd, with a recent dividend of CN¥0.955, shows potential despite a slight dip in net income from CN¥47.38 million to CN¥45.56 million in Q1 2024. Analysts predict robust revenue growth at 28.4% annually, outpacing the Chinese market's 13.7%. Earnings are also expected to grow significantly by about 28% per year. Currently trading at CN¥63.21, below the estimated fair value of CN¥77.64, the stock appears undervalued based on DCF analysis but only by a modest margin.

SICC

Overview: SICC Co., Ltd. is a global company specializing in the research, development, production, and sales of silicon carbide semiconductor materials, with a market capitalization of CN¥20.47 billion.

Operations: The company's revenue from semiconductor materials reached CN¥1.48 billion.

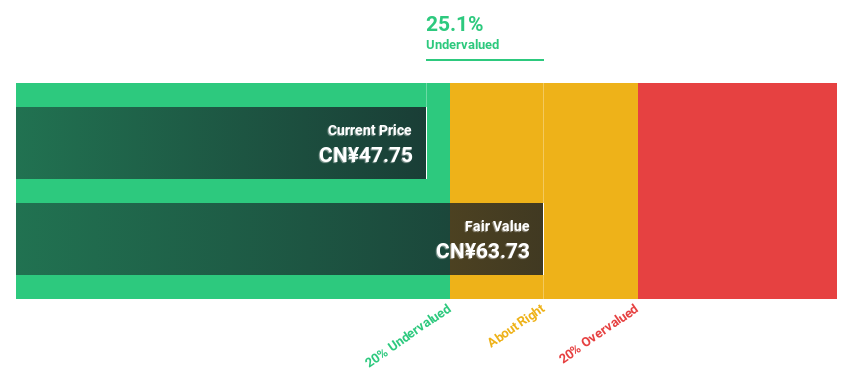

Estimated Discount To Fair Value: 25.1%

SICC Co., Ltd. has shown a remarkable turnaround, reporting a net income of CN¥46.1 million in Q1 2024 against a net loss the previous year, with revenues more than doubling to CN¥426.07 million. The stock is currently trading at CN¥47.75, significantly below the estimated fair value of CN¥63.73, suggesting undervaluation based on DCF analysis. Despite this potential underpricing and high forecasted earnings growth at 37% annually, its projected Return on Equity remains modest at 11.1%. Recent buybacks totaling CN¥100.22 million underline management's confidence in the company's prospects.

Insights from our recent growth report point to a promising forecast for SICC's business outlook.

Click to explore a detailed breakdown of our findings in SICC's balance sheet health report.

Thunder Software TechnologyLtd

Overview: Thunder Software Technology Co., Ltd. specializes in operating-system products across markets in China, Europe, the United States, and Japan, with a market capitalization of approximately CN¥21.88 billion.

Operations: The company generates its revenue from operating-system products across various global markets including China, Europe, the United States, and Japan.

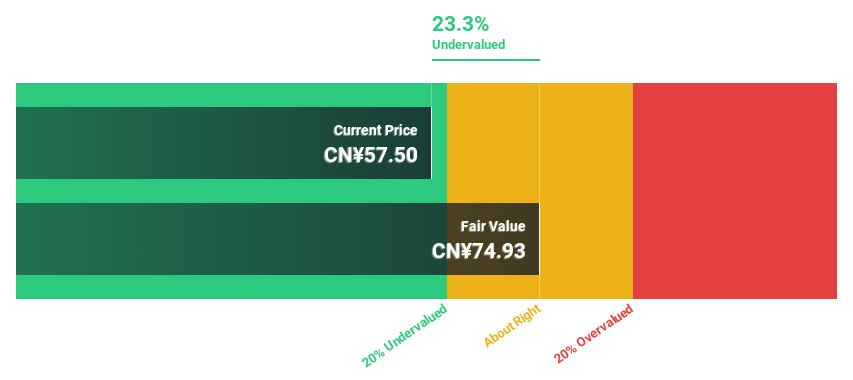

Estimated Discount To Fair Value: 43.6%

Thunder Software Technology Co., Ltd. is trading at CN¥47.65, significantly below the estimated fair value of CN¥84.42, indicating potential undervaluation based on DCF analysis. Despite a decline in net profit margin from 14.3% to 7.4% over the past year and a modest forecasted Return on Equity of 8.7%, the company's earnings are expected to grow by 24.7% annually, outpacing the market's 22.1%. Recent management changes could signal strategic shifts, potentially impacting future performance positively or negatively.

Next Steps

Click this link to deep-dive into the 93 companies within our Undervalued Chinese Stocks Based On Cash Flows screener.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:603297 SHSE:688234 and SZSE:300496.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com