Exploring Top Dividend Stocks In India For June 2024

In recent times, the Indian market has experienced a notable fluctuation, declining by 5.3% over the past week, yet showing a robust annual growth of 34%. Given these conditions and with earnings expected to grow by 16% per annum, investors might consider dividend stocks that promise consistent payouts as potentially stable additions to their portfolios amidst market volatility.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.72% | ★★★★★★ |

Bhansali Engineering Polymers (BSE:500052) | 4.29% | ★★★★★★ |

D. B (NSEI:DBCORP) | 4.78% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.20% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.86% | ★★★★★☆ |

Balmer Lawrie (BSE:523319) | 3.26% | ★★★★★☆ |

D-Link (India) (NSEI:DLINKINDIA) | 3.15% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.79% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.45% | ★★★★★☆ |

PTC India (NSEI:PTC) | 4.13% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

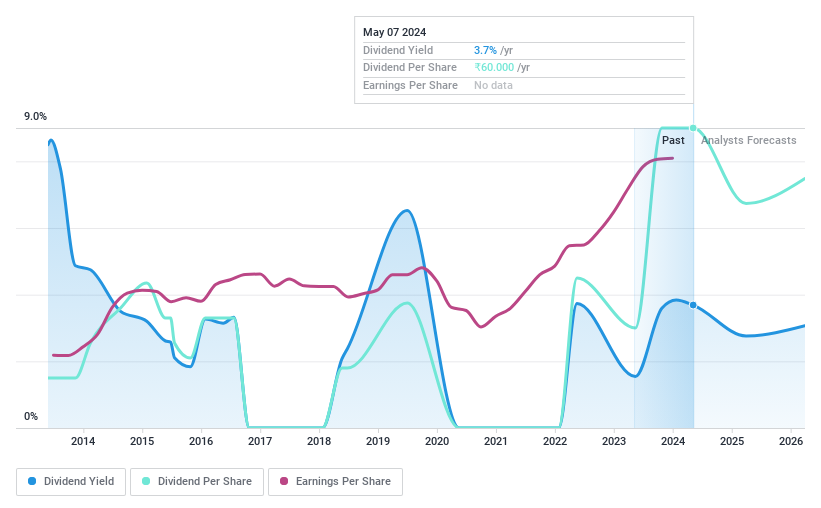

D-Link (India)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D-Link (India) Limited specializes in marketing and distributing D-Link branded networking products across various sectors including consumers, small businesses, and enterprises in India, with a market capitalization of ₹14.63 billion.

Operations: D-Link (India) Limited generates its revenue primarily from the sale of networking products, totaling ₹12.36 billion.

Dividend Yield: 3.2%

D-Link (India) announced a regular dividend of INR 8 and a special dividend of INR 5 per share for FY 2024, subject to shareholder approval at the upcoming AGM. Despite these increases, the company's dividend history has been unstable and unreliable over the past decade. However, both dividends are well-covered by earnings with a payout ratio of 30.7% and cash flows with a cash payout ratio of 38.6%. The share price has shown high volatility recently, which may concern some investors looking for stability in their dividend-paying stocks.

Navigate through the intricacies of D-Link (India) with our comprehensive dividend report here.

Upon reviewing our latest valuation report, D-Link (India)'s share price might be too pessimistic.

MPS

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPS Limited operates in content creation, production, and distribution services targeting publishers, learning companies, and various institutions across India, Europe, the US, and globally with a market capitalization of approximately ₹33.15 billion.

Operations: MPS Limited generates revenue through content creation, production, and distribution services aimed at publishers, learning companies, and various institutions across multiple regions including India, Europe, and the US.

Dividend Yield: 4.6%

MPS Limited has proposed a final dividend of INR 45 per share for FY 2023-24, reflecting a commitment to shareholder returns. However, the sustainability of such payouts is questionable as dividends are not well-covered by cash flows, with a high cash payout ratio of 137.5%. Despite this, MPS's dividends have shown growth over the past decade but lack stability and reliability due to volatility in annual payments. Additionally, while the P/E ratio at 27.9x is slightly below the market average, earnings growth forecasts remain robust at 20.32% annually.

Click to explore a detailed breakdown of our findings in MPS' dividend report.

Our valuation report unveils the possibility MPS' shares may be trading at a premium.

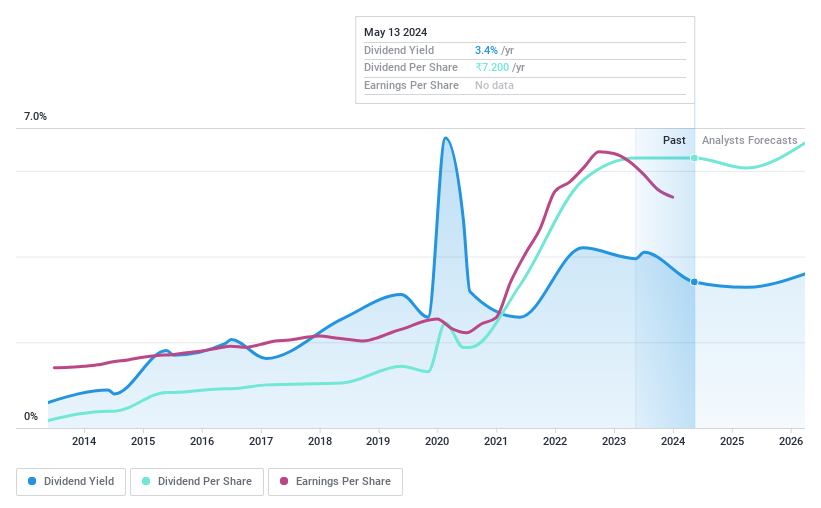

Redington

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Redington Limited operates as a supply chain solutions provider in India and internationally, with a market capitalization of approximately ₹163.39 billion.

Operations: Redington Limited generates revenue through its supply chain solutions operations both in India and globally.

Dividend Yield: 3.4%

Redington's dividend history shows volatility and inconsistency over the past decade, with payments not showing a stable trend. Despite this, the dividends are reasonably covered by earnings and cash flows, with a payout ratio of 40.4% and a cash payout ratio of 58.8%. Recent financial performance indicates growth in revenue and net income for FY 2024, suggesting potential support for future dividends. However, investors should be cautious given the historical unpredictability of payouts.

Take a closer look at Redington's potential here in our dividend report.

Our valuation report here indicates Redington may be undervalued.

Turning Ideas Into Actions

Delve into our full catalog of 23 Top Dividend Stocks here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:DLINKINDIA NSEI:MPSLTD and NSEI:REDINGTON.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com