Exploring Three Undervalued Small Caps In Canada With Insider Buying

As central banks like the Bank of Canada (BoC) initiate rate cuts in response to softening economic indicators, investors might find opportunities in segments less explored by the broader market. In this context, undervalued small-cap stocks in Canada, particularly those with insider buying, could present compelling prospects as they often react differently to macroeconomic changes compared to their larger counterparts.

Top 10 Undervalued Small Caps With Insider Buying In Canada

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Dundee Precious Metals | 9.1x | 3.1x | 41.41% | ★★★★★★ |

Calfrac Well Services | 2.3x | 0.2x | 29.31% | ★★★★★☆ |

Primaris Real Estate Investment Trust | 11.4x | 3.0x | 35.60% | ★★★★★☆ |

Nexus Industrial REIT | 2.5x | 3.1x | 18.12% | ★★★★☆☆ |

Guardian Capital Group | 10.5x | 4.1x | 31.87% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -93.62% | ★★★★☆☆ |

Trican Well Service | 8.3x | 1.0x | -15.67% | ★★★☆☆☆ |

Westshore Terminals Investment | 14.4x | 3.9x | 0.39% | ★★★☆☆☆ |

Russel Metals | 8.8x | 0.5x | -3.18% | ★★★☆☆☆ |

Freehold Royalties | 15.7x | 6.8x | 47.86% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Dundee Precious Metals

Simply Wall St Value Rating: ★★★★★★

Overview: Dundee Precious Metals is a gold mining company with operations at Ada Tepe and Chelopech, boasting a market capitalization of approximately $1.10 billion.

Operations: Ada Tepe and Chelopech generated revenues of $243.33 million and $274.18 million respectively, with a notable gross profit margin peaking at 55.29% in the latest quarter, reflecting significant operational efficiency in cost management relative to revenue generation.

PE: 9.1x

Dundee Precious Metals, a standout among undervalued Canadian entities, recently projected robust 2024 production figures with gold output potentially reaching 285 Koz. This forecast aligns with their Q2 performance showing solid ore processing and metal production. Insider confidence is evident as executives have not engaged in recent share purchases. Adding to its appeal, the newly appointed EVP brings extensive industry experience, enhancing strategic development prospects. With these elements, Dundee's future in the metals sector looks promising amidst a backdrop of operational consistency and executive leadership renewal.

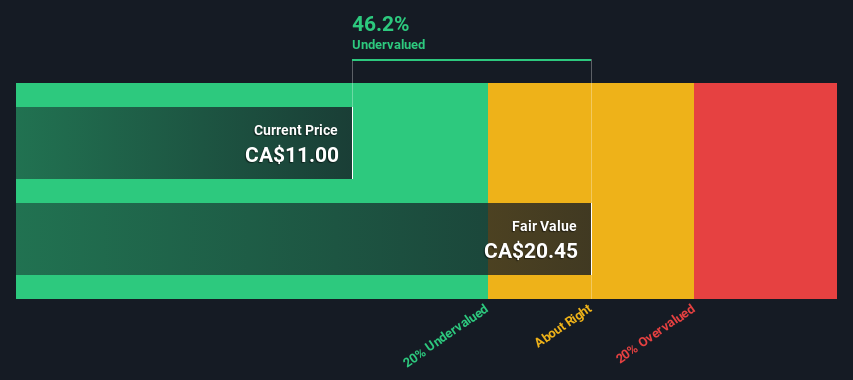

Freehold Royalties

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Freehold Royalties is a company engaged in the exploration and production of oil and gas, with a market capitalization of approximately CA$1.58 billion.

Operations: The company generates a gross profit margin of 96.74% with a net income margin of 43.19%, reflecting efficient cost management relative to its revenue from oil and gas exploration and production, which totals CA$312.28 million.

PE: 15.7x

Freehold Royalties, a lesser-known yet promising player in the Canadian market, has demonstrated financial resilience with a recent uptick in net income from CAD 31.05 million to CAD 34.02 million in Q1 2024. Consistently paying dividends, including a recent declaration for August, signals stable cash flows and shareholder commitment. Insider confidence is evident as they recently purchased shares, underscoring belief in the company’s prospects amid external funding risks. With production levels maintained year-over-year and guidance reaffirmed for 2024, Freehold presents potential for growth within its sector.

Click to explore a detailed breakdown of our findings in Freehold Royalties' valuation report.

Assess Freehold Royalties' past performance with our detailed historical performance reports.

MTY Food Group

Simply Wall St Value Rating: ★★★★☆☆

Overview: MTY Food Group is a diversified company operating in the quick-service food industry, primarily through franchising, with a market presence in Canada and internationally.

Operations: MTY Food Group has demonstrated a notable trend in its financial performance, with gross profit margins ranging from 44.29% to approximately 115.68% over the observed periods, reflecting significant fluctuations in cost of goods sold and operational efficiency. The company's net income margin has also varied considerably, moving between -6.75% during challenging quarters to a high of about 31.91%, indicating varying profitability influenced by both operational management and external factors.

PE: 11.0x

MTY Food Group, a notable player in the Canadian market, recently affirmed its quarterly dividend at $0.28 per share and announced a significant share repurchase program, signaling strong insider confidence with plans to buy back 5% of its shares by July 2025. Despite a slight dip in earnings for the first half of 2024 with net income at CAD 44.58 million from last year's CAD 48.75 million, these strategic financial maneuvers highlight their proactive approach to capital management and shareholder value amidst challenging conditions. This blend of financial prudence and insider buying activity underscores MTY's potential as an undervalued entity poised for recalibration.

Take a closer look at MTY Food Group's potential here in our valuation report.

Gain insights into MTY Food Group's past trends and performance with our Past report.

Taking Advantage

Investigate our full lineup of 34 Undervalued TSX Small Caps With Insider Buying right here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:DPM TSX:FRU and TSX:MTY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com