Exploring Three SGX Stocks With Estimated Intrinsic Discounts Ranging From 39.6% To 43.6%

Recently, the Singapore market has shown resilience amidst global financial fluctuations, maintaining a steady performance that continues to attract investors looking for stability and growth opportunities. In such an environment, identifying stocks that appear undervalued compared to their intrinsic value could provide an appealing avenue for those seeking potentially overlooked investment opportunities.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

Name | Current Price | Fair Value (Est) | Discount (Est) |

Singapore Technologies Engineering (SGX:S63) | SGD4.41 | SGD7.44 | 40.7% |

Winking Studios (Catalist:WKS) | SGD0.295 | SGD0.51 | 41.9% |

Hongkong Land Holdings (SGX:H78) | US$3.42 | US$5.77 | 40.7% |

Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.01 | SGD1.67 | 39.6% |

Seatrium (SGX:5E2) | SGD1.48 | SGD2.62 | 43.6% |

Digital Core REIT (SGX:DCRU) | US$0.64 | US$1.11 | 42.5% |

Nanofilm Technologies International (SGX:MZH) | SGD0.95 | SGD1.48 | 35.6% |

Let's review some notable picks from our screened stocks.

Seatrium

Overview: Seatrium Limited specializes in engineering solutions for the offshore, marine, and energy sectors with a market capitalization of SGD 5.04 billion.

Operations: The company generates revenue primarily through specialized shipbuilding, rigs and floaters, repairs and upgrades, offshore platforms (SGD 7.26 billion), and ship chartering (SGD 31.63 million).

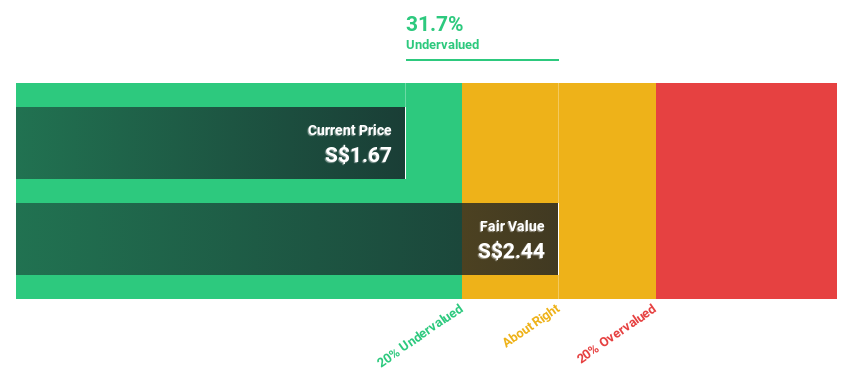

Estimated Discount To Fair Value: 43.6%

Seatrium Limited, currently trading at S$1.48, is perceived as undervalued based on DCF analysis, with an estimated fair value of S$2.62. Despite recent regulatory scrutiny and a highly volatile share price, the company's revenue is expected to grow by 8.7% annually, outpacing the Singapore market's 3.6%. Seatrium's earnings are also projected to increase significantly by 72.23% each year over the next three years, suggesting potential for substantial financial improvement amidst operational challenges like the recent investigations and director changes.

Frasers Logistics & Commercial Trust

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust specializing in industrial and commercial properties, with a portfolio valued at approximately S$6.4 billion across five developed markets and a market capitalization of about S$3.80 billion.

Operations: The trust's revenue is derived from its industrial and commercial properties located in Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

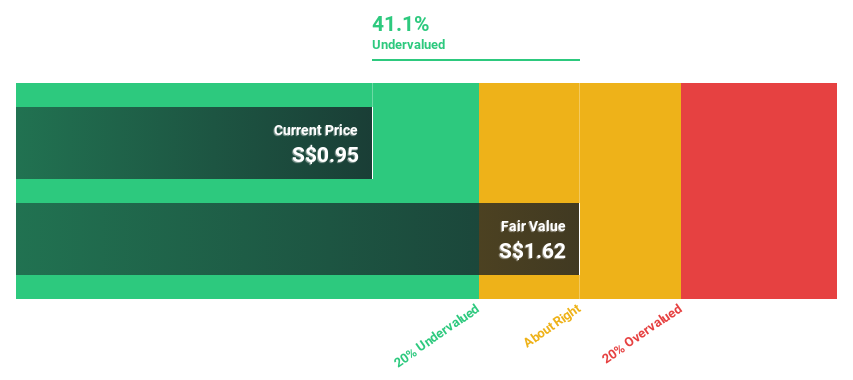

Estimated Discount To Fair Value: 39.6%

Frasers Logistics & Commercial Trust, priced at S$1.01, is significantly undervalued based on DCF with a fair value of S$1.67. Despite a challenging earnings report showing a drop in net income to S$93.59 million from S$118.07 million year-over-year, the trust's revenue growth forecast of 6.1% annually surpasses Singapore's average market growth of 3.6%. However, its dividends show instability and debt coverage by operating cash flow is weak, suggesting financial caution despite the potential for price appreciation and profitability within three years.

Hongkong Land Holdings

Overview: Hongkong Land Holdings Limited operates in the investment, development, and management of properties across Hong Kong, Macau, Mainland China, Southeast Asia, and other international locations with a market cap of approximately $7.55 billion.

Operations: The company generates revenue from two primary segments: Investment Properties, which brought in $1.08 billion, and Development Properties, with revenues of $0.76 billion.

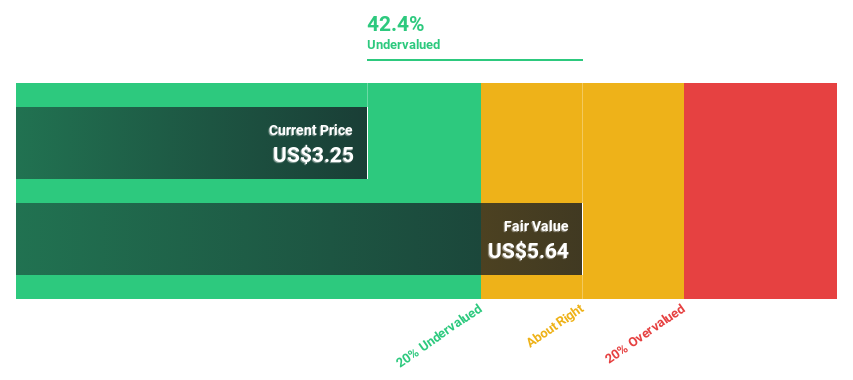

Estimated Discount To Fair Value: 40.7%

Hongkong Land Holdings, valued at S$3.42, is trading significantly below its estimated fair value of S$5.77, suggesting a strong undervaluation based on cash flows. Expected to turn profitable within three years, the company's revenue growth rate of 4.6% annually is set to outpace the Singapore market average of 3.6%. However, its projected low return on equity at 2.4% and dividends not well covered by earnings indicate potential financial risks despite the appealing valuation and growth prospects.

Key Takeaways

Click here to access our complete index of 7 Undervalued SGX Stocks Based On Cash Flows.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:5E2 SGX:BUOU and SGX:H78.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com