Exploring Three Japanese Growth Stocks With Significant Insider Ownership On The Tokyo Stock Exchange

Amid a backdrop of fluctuating global markets, Japanese equities have shown resilience, supported by robust economic data and strong performances in sectors like technology. This environment sets an intriguing stage for exploring growth-oriented companies within the Tokyo Stock Exchange, particularly those with significant insider ownership which can signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.4% | 27.2% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

Hottolink (TSE:3680) | 27% | 57.3% |

Micronics Japan (TSE:6871) | 15.3% | 39.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 35.4% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 80.2% |

Money Forward (TSE:3994) | 21.4% | 63.5% |

Medley (TSE:4480) | 34% | 24.4% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Soracom (TSE:147A) | 17.2% | 59.1% |

Let's dive into some prime choices out of from the screener.

PeptiDream

Simply Wall St Growth Rating: ★★★★★☆

Overview: PeptiDream Inc. is a biopharmaceutical company focused on the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics, with a market capitalization of approximately ¥255.26 billion.

Operations: The company's primary revenue is derived from its biopharmaceutical activities, focusing on novel therapeutics.

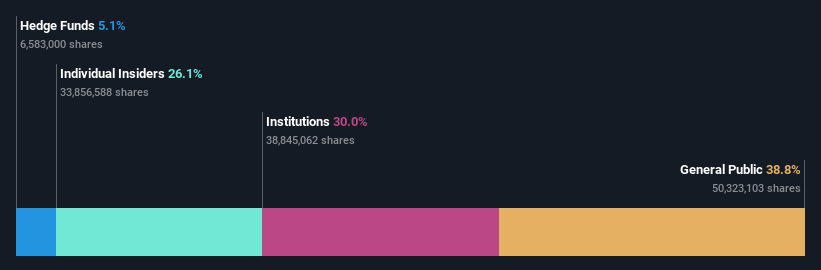

Insider Ownership: 26.1%

PeptiDream, a Japanese biotech firm, is poised for robust growth with earnings forecasted to increase by 22.98% annually. Despite its highly volatile share price in recent months and a significant drop in profit margins from last year, the company's return on equity is expected to be strong at 20.3%. Recent strategic expansions include an enhanced collaboration with Novartis, potentially bringing in up to JPY 422.03 billion based on milestones, plus royalties on sales. This partnership underlines PeptiDream’s ongoing innovation and market potential despite current valuation challenges, trading at 35% below estimated fair value.

Rakuten Group

Simply Wall St Growth Rating: ★★★★☆☆

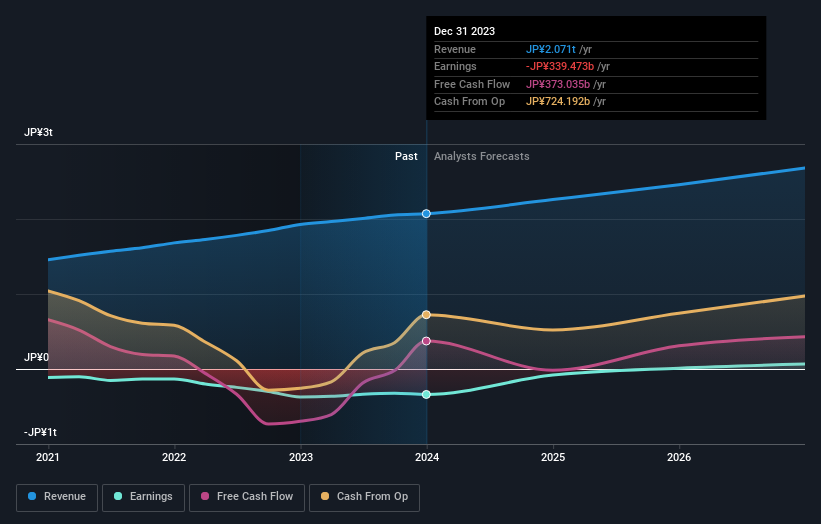

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving customers globally with a market capitalization of approximately ¥1.72 trillion.

Operations: The company generates revenue through its diverse operations in e-commerce, fintech, digital content, and communications sectors.

Insider Ownership: 17.3%

Rakuten Group, a prominent Japanese e-commerce conglomerate, is navigating through a transformative phase with expected revenue growth of 7.4% per year, slightly above the national market average. While insider trading has been quiet recently, the company's earnings are projected to surge by 87.6% annually. However, challenges such as shareholder dilution and modest projected return on equity (8.8%) in three years hint at potential hurdles ahead. Recent activities include a substantial $1.99 billion fixed-income offering and forward-looking corporate guidance anticipating double-digit operational growth excluding its volatile securities segment for 2024.

Capcom

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a Japanese company that specializes in the planning, development, manufacturing, selling, and distribution of home video games, online games, mobile games, and arcade games globally, with a market capitalization of approximately ¥1.14 trillion.

Operations: The company generates revenue through the sale and distribution of home video games, online games, mobile games, and arcade games across various global markets.

Insider Ownership: 11.5%

Capcom, a key player in the Japanese gaming industry, is set to outpace the market with its earnings growth forecast at 8.82% annually and revenue expected to increase by 5.7% per year, surpassing Japan's market average of 3.9%. Despite this promising outlook, revenue growth remains below significant levels and there has been no substantial insider trading recently. The company's return on equity is projected to reach an impressive 20.7% in three years, highlighting strong profitability potential amidst recent strategic developments like a 2:1 stock split announced in March 2024.

Click here to discover the nuances of Capcom with our detailed analytical future growth report.

Our valuation report unveils the possibility Capcom's shares may be trading at a premium.

Seize The Opportunity

Delve into our full catalog of 109 Fast Growing Japanese Companies With High Insider Ownership here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4587 TSE:4755 and TSE:9697.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com