Exploring Three Japanese Dividend Stocks In May 2024

As of May 2024, Japan's market is experiencing subtle shifts, with the Nikkei 225 and TOPIX indices showing marginal weekly losses amid discussions on potential interest rate hikes by the Bank of Japan. This backdrop sets a nuanced stage for investors considering Japanese dividend stocks, which can offer regular income and potential stability in a fluctuating economic environment.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.47% | ★★★★★★ |

Koei Tecmo Holdings (TSE:3635) | 3.50% | ★★★★★★ |

Mitsubishi Shokuhin (TSE:7451) | 3.42% | ★★★★★★ |

Ryoyu Systems (TSE:4685) | 3.41% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.06% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.34% | ★★★★★★ |

Toyo Kanetsu K.K (TSE:6369) | 3.78% | ★★★★★★ |

Mitsubishi Research Institute (TSE:3636) | 3.38% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.29% | ★★★★★★ |

Innotech (TSE:9880) | 4.10% | ★★★★★★ |

Click here to see the full list of 312 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Miyaji Engineering GroupInc

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Miyaji Engineering Group, Inc. operates in Japan, focusing on construction and civil engineering through its subsidiaries, with a market capitalization of approximately ¥59.47 billion.

Operations: Miyaji Engineering Group, Inc. specializes in construction and civil engineering services across Japan.

Dividend Yield: 4.3%

Miyaji Engineering GroupInc. offers a dividend yield of 4.35%, ranking in the top 25% of Japanese dividend payers, supported by a modest payout ratio of 37.7%. Despite this, the dividends are not well covered by cash flows and have shown volatility over the past decade, indicating potential instability in future payouts. Recent board discussions on May 14, 2024, focused on continuing these dividends despite lacking free cash flow coverage, following a year where earnings grew by 21.1%.

USS

Simply Wall St Dividend Rating: ★★★★★☆

Overview: USS Co., Ltd. operates and manages used vehicle auction sites in Japan, with a market capitalization of approximately ¥612.19 billion.

Operations: USS Co., Ltd. generates revenue primarily through its Auto Auction segment, which brought in ¥75.37 billion, followed by the Purchase and Sale of Used Cars, Etc., contributing ¥11.43 billion, and its Recycling operations at ¥10.53 billion.

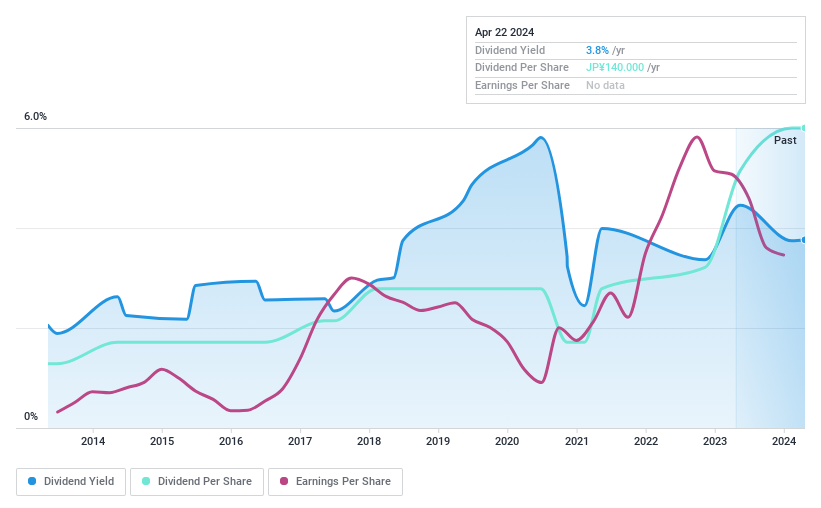

Dividend Yield: 3%

USS Co., Ltd. maintains a steady dividend yield of 3.01%, slightly below the top quartile in Japan's market, with a history of consistent growth over the past decade. The dividends are well-supported by both earnings and cash flows, with payout ratios standing at 50.9% and 41.5% respectively, indicating sustainability. Recent corporate actions include a stock split effective March 28, 2024, and an earnings call on May 09, 2024, following their fiscal year results announcement on May 08, 2024.

Araya Industrial

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Araya Industrial Co., Ltd. is a company based in Japan that specializes in manufacturing and selling steel products both domestically and internationally, with a market capitalization of approximately ¥24.91 billion.

Operations: Araya Industrial Co., Ltd. primarily generates its revenue from the manufacture and sale of steel products across both domestic and international markets.

Dividend Yield: 3.1%

Araya Industrial Co., Ltd. offers a dividend yield of 3.13%, slightly below the top performers in Japan's market, and has shown a capacity to increase dividends over the past decade. Despite this growth, the company's dividend history has been marked by inconsistency and volatility. Financially, dividends are well-covered with a low payout ratio of 12% from earnings and a cash payout ratio of 35.1%, suggesting reasonable coverage by cash flows as well. However, profit margins have declined from last year, and the stock price has been highly volatile recently.

Where To Now?

Get an in-depth perspective on all 312 Top Dividend Stocks by using our screener here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:3431 TSE:4732 and TSE:7305.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com