Exploring Three Dividend Stocks On The KRX

The South Korean stock market has experienced a slight decline of 1.4% over the past week, though it maintains a positive trajectory with an annual growth of 4.2%. In light of these conditions and with earnings expected to grow significantly, dividend stocks could offer investors both stability and potential income in this evolving market landscape.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.67% | ★★★★★★ |

Shinhan Financial Group (KOSE:A055550) | 4.43% | ★★★★★☆ |

KT (KOSE:A030200) | 5.50% | ★★★★★☆ |

LOTTE Fine Chemical (KOSE:A004000) | 4.26% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.98% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.16% | ★★★★★☆ |

Cheil Worldwide (KOSE:A030000) | 5.86% | ★★★★☆☆ |

Snt DynamicsLtd (KOSE:A003570) | 3.93% | ★★★★☆☆ |

Tong Yang Life Insurance (KOSE:A082640) | 7.91% | ★★★★☆☆ |

Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.13% | ★★★★☆☆ |

Click here to see the full list of 66 stocks from our Top KRX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Kia

Simply Wall St Dividend Rating: ★★★★★★

Overview: Kia Corporation, a manufacturer and seller of vehicles in South Korea, North America, and Europe, has a market capitalization of approximately ₩47.54 trillion.

Operations: Kia Corporation generates its revenue from vehicle sales across South Korea, North America, and Europe.

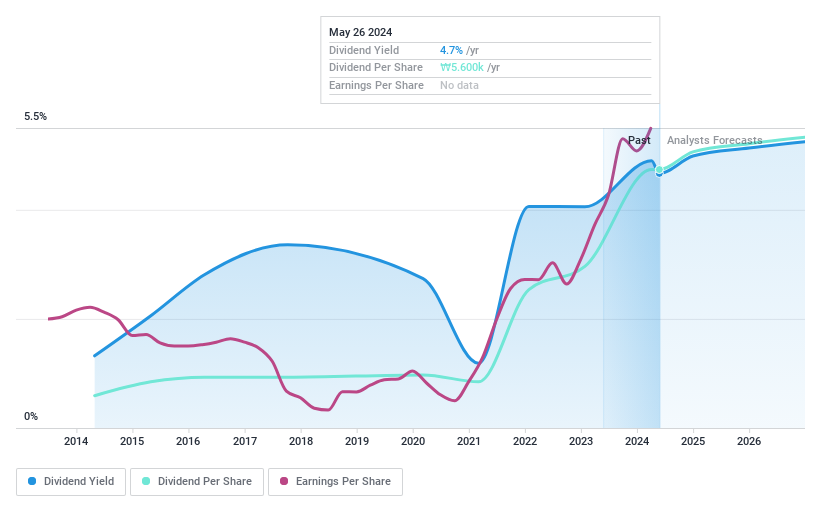

Dividend Yield: 4.7%

Kia Corporation, with a dividend yield of 4.67%, ranks in the top 25% of South Korean dividend payers. Over the past decade, its dividends have demonstrated stability and growth, supported by a low payout ratio of 23.4% and a cash payout ratio of 25.6%, ensuring sustainability from both earnings and cash flow perspectives. Despite recent legal challenges regarding vehicle theft vulnerabilities, Kia's strategic expansion into Li-Metal battery development with SES AI underscores its forward-looking initiatives in evolving industries.

Muhak

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Muhak Co., Ltd. is a South Korean company engaged in the manufacturing and selling of liquors, with a market capitalization of approximately ₩148.59 billion.

Operations: Muhak Co., Ltd. generates its revenue primarily through the production and sales of alcoholic beverages in South Korea.

Dividend Yield: 4.1%

Muhak Co., Ltd. has shown a volatile dividend history with a recent decrease in net income to KRW 16,261.16 million from KWR 38,369.63 million year-over-year as of Q1 2024. Despite this, its dividends are well-covered by earnings and cash flows, with a low payout ratio of 9.3% and a cash payout ratio of 50.1%. Additionally, the company's Price-To-Earnings ratio stands at an attractive 3.4x compared to the Korean market average of 13x, suggesting potential value despite its unstable dividend track record and significant one-off items impacting financial results.

Click to explore a detailed breakdown of our findings in Muhak's dividend report.

Our valuation report here indicates Muhak may be overvalued.

Hyosung ITX

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyosung ITX Co. Ltd is a South Korean company that offers business solutions, with a market capitalization of approximately ₩161.83 billion.

Operations: Hyosung ITX Co. Ltd generates its revenue primarily through business solutions in South Korea.

Dividend Yield: 5.5%

Hyosung ITX Co. Ltd offers a dividend yield of 5.52%, ranking in the top 25% of South Korean dividend payers. Despite a less established history with only five years of dividends, the payouts are supported by earnings and cash flows, with payout ratios at 62.6% and cash payout ratios at 21.8%, respectively. Recent corporate actions include an extension of its buyback plan till March 2025, indicating potential confidence in its financial stability and commitment to shareholder returns.

Seize The Opportunity

Navigate through the entire inventory of 66 Top KRX Dividend Stocks here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A000270KOSE:A033920 and KOSE:A094280.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com