Exploring Three Chinese Exchange Stocks With Estimated Discounts Ranging From 23.3% To 47.3%

Amidst a backdrop of deflationary pressures and subdued consumer confidence in China, investors may find potential opportunities in undervalued stocks that could be poised for recovery as the government continues to implement supportive measures. Identifying stocks with significant discounts could offer attractive entry points against the current economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

YanKer shop FoodLtd (SZSE:002847) | CN¥48.59 | CN¥94.36 | 48.5% |

Xiamen Amoytop Biotech (SHSE:688278) | CN¥58.23 | CN¥110.57 | 47.3% |

Xi'an Manareco New MaterialsLtd (SHSE:688550) | CN¥25.55 | CN¥47.27 | 46% |

Zhongji Innolight (SZSE:300308) | CN¥146.91 | CN¥285.42 | 48.5% |

ShenZhen Click TechnologyLTD (SZSE:002782) | CN¥11.80 | CN¥22.03 | 46.4% |

Zhejiang Taihua New Material Group (SHSE:603055) | CN¥10.94 | CN¥20.22 | 45.9% |

Hainan Drinda New Energy Technology (SZSE:002865) | CN¥47.38 | CN¥91.76 | 48.4% |

Shanghai Milkground Food Tech (SHSE:600882) | CN¥13.54 | CN¥26.97 | 49.8% |

INKON Life Technology (SZSE:300143) | CN¥7.38 | CN¥14.64 | 49.6% |

Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥21.66 | CN¥40.69 | 46.8% |

Here's a peek at a few of the choices from the screener

Xiamen Amoytop Biotech

Overview: Xiamen Amoytop Biotech Co., Ltd. is a Chinese company specializing in the production, marketing, and sale of recombinant protein drugs, with a market capitalization of CN¥23.69 billion.

Operations: The company generates CN¥2.23 billion from its biologics segment.

Estimated Discount To Fair Value: 47.3%

Xiamen Amoytop Biotech has demonstrated robust financial performance with a significant earnings increase of 91.3% over the past year and is projected to grow by 30.82% annually. Despite its unstable dividend record, the company's recent quarterly results showed substantial growth, with net income rising to CNY 128.81 million from CNY 84.17 million year-over-year, supported by strong sales growth from CNY 419.31 million to CNY 545.3 million, indicating potential undervaluation based on cash flows.

iFLYTEKLTD

Overview: iFLYTEK CO., LTD. is a company based in China that specializes in providing services related to artificial intelligence (AI) technologies, with a market capitalization of approximately CN¥98.38 billion.

Operations: The company generates revenue primarily from services related to artificial intelligence technologies in China.

Estimated Discount To Fair Value: 37.6%

iFLYTEK CO., LTD, marked by its trading value at CN¥43.6, significantly below the estimated fair value of CN¥69.89, appears undervalued based on DCF analysis. Despite a challenging financial quarter with a net loss of CN¥300.47 million from sales of CN¥3,646.22 million, the company is poised for substantial growth with earnings expected to increase by 28.33% annually over the next three years and revenue forecasted to outpace the market at 15.2% per year growth rate. However, its Return on Equity is projected to remain low at 7.4%.

Thunder Software TechnologyLtd

Overview: Thunder Software Technology Co., Ltd. specializes in providing operating system products and technologies globally, with a market capitalization of approximately CN¥26.45 billion.

Operations: The firm specializes in operating system products and technologies, achieving a global reach.

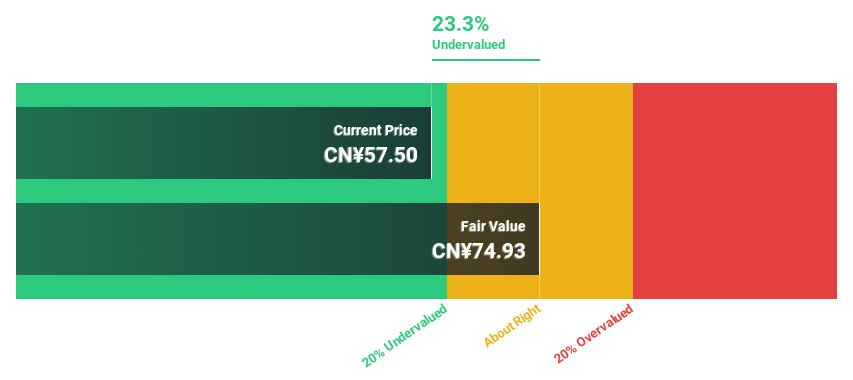

Estimated Discount To Fair Value: 23.3%

Thunder Software Technology Co., Ltd. is grappling with fluctuating financial metrics, as evidenced by a recent decline in net income to CNY 90.76 million from CNY 168.38 million year-over-year and a reduced profit margin of 7.4%, down from the previous year's 14.3%. Despite these challenges, the company is expected to see significant earnings growth at an annual rate of 24.7% over the next three years, outpacing the Chinese market's forecasted growth rate of 22.7%. However, its Return on Equity is anticipated to remain low at 8.9% in three years' time, reflecting potential concerns about long-term profitability and shareholder returns.

Key Takeaways

Unlock more gems! Our Undervalued Chinese Stocks Based On Cash Flows screener has unearthed 94 more companies for you to explore.Click here to unveil our expertly curated list of 97 Undervalued Chinese Stocks Based On Cash Flows.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:688278 SZSE:002230 and SZSE:300496.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com