Exploring Three ASX Growth Companies With Substantial Insider Ownership

Amidst a backdrop of modest economic growth and mixed sector performance in Australia, the ASX has shown resilience with particular sectors like real estate and telecommunications experiencing gains. While the broader market presents its challenges, companies with high insider ownership might offer an intriguing opportunity for investors looking to navigate these conditions. In today's fluctuating market environment, companies where insiders hold a significant stake can be compelling. These insiders often have a vested interest in the company’s success, potentially aligning their goals closely with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Alpha HPA (ASX:A4N) | 26.3% | 95.9% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 85.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Let's explore several standout options from the results in the screener.

Bell Financial Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bell Financial Group Limited, operating in Australia, offers broking, online broking, corporate finance, and financial advisory services with a market capitalization of approximately A$0.42 billion.

Operations: Bell Financial Group's revenue is derived from several key areas: retail broking generating A$103.58 million, institutional broking contributing A$50.36 million, products and services amounting to A$48.10 million, and technology and platforms at A$26.20 million.

Insider Ownership: 10.7%

Earnings Growth Forecast: 26.9% p.a.

Bell Financial Group is trading at a 25.3% discount to its estimated fair value, indicating potential undervaluation relative to intrinsic worth. Despite a modest revenue growth forecast of 5.6% per year, slightly above the Australian market average of 5.3%, its earnings are expected to surge by 26.95% annually over the next three years, significantly outpacing the market projection of 13.9%. However, its dividend sustainability is questionable as it is poorly covered by both earnings and cash flows.

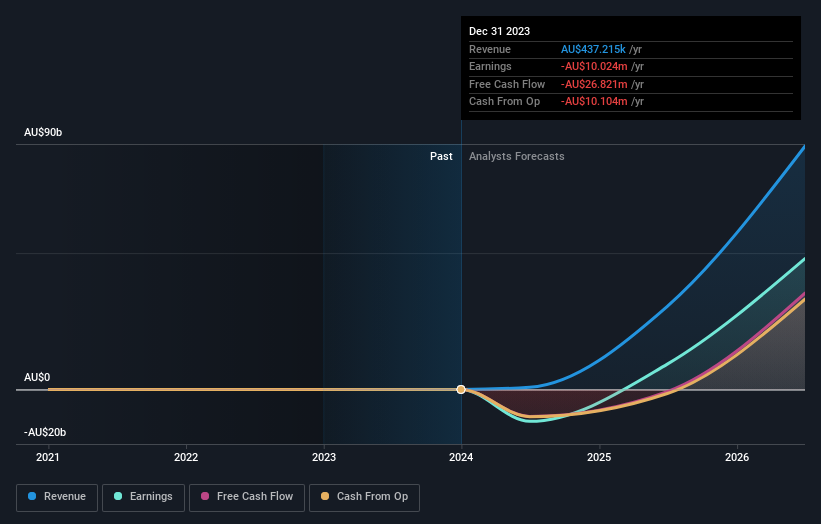

Botanix Pharmaceuticals

Simply Wall St Growth Rating: ★★★★★★

Overview: Botanix Pharmaceuticals Limited is an Australian company focused on the research and development of dermatology and antimicrobial products, with a market capitalization of approximately A$448.91 million.

Operations: The company generates its revenue primarily from the research and development of dermatology and antimicrobial products, totaling A$0.44 million.

Insider Ownership: 11.4%

Earnings Growth Forecast: 120.9% p.a.

Botanix Pharmaceuticals, recently added to the S&P/ASX All Ordinaries Index, is poised for significant growth with expected revenue increases of 120.4% annually. Despite generating less than A$1m in revenue last year and facing shareholder dilution, the company's forecasted return on equity is very high at 43.9%. Challenges include a short cash runway under a year and trading at a substantial discount to its estimated fair value. Upcoming plans include a comprehensive update on commercial launch strategies for SofdraÔ.

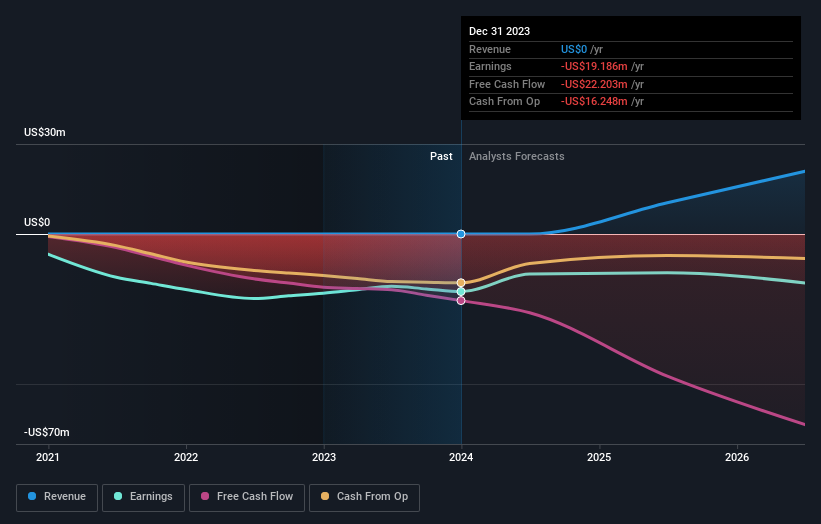

IperionX

Simply Wall St Growth Rating: ★★★★★☆

Overview: IperionX Limited is a company focused on the exploration and development of mineral properties in the United States, with a market capitalization of approximately A$669.58 million.

Operations: The firm is primarily involved in the exploration and development of mineral properties in the United States.

Insider Ownership: 14.0%

Earnings Growth Forecast: 47.4% p.a.

IperionX, despite its modest revenue under US$1m, is set for rapid expansion with a forecasted annual revenue growth of 76.4%. The company recently secured A$50 million through an equity offering and has partnered with Vegas Fastener Manufacturing to develop titanium alloy products for the U.S. Army. Although it's trading significantly below its fair value and shareholders have experienced dilution, IperionX's strategic partnerships and entry into high-performance sectors position it for potential growth in the advanced manufacturing market.

Get an in-depth perspective on IperionX's performance by reading our analyst estimates report here.

Our valuation report here indicates IperionX may be overvalued.

Seize The Opportunity

Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 88 more companies for you to explore.Click here to unveil our expertly curated list of 91 Fast Growing ASX Companies With High Insider Ownership.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:BFG ASX:BOT and ASX:IPX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com