Exploring Dividend Stocks On The KRX For May 2024

In the last week, South Korea's market has remained stable, while showing a modest increase of 4.5% over the past year. With earnings expected to grow by 28% annually in the coming years, dividend stocks could be particularly appealing for those looking for potential income combined with growth opportunities in this evolving market landscape.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.59% | ★★★★★★ |

Shinhan Financial Group (KOSE:A055550) | 4.54% | ★★★★★☆ |

LOTTE Fine Chemical (KOSE:A004000) | 4.36% | ★★★★★☆ |

KT (KOSE:A030200) | 5.56% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.92% | ★★★★★☆ |

Samyang (KOSE:A145990) | 3.50% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.14% | ★★★★★☆ |

Snt DynamicsLtd (KOSE:A003570) | 3.68% | ★★★★☆☆ |

Tong Yang Life Insurance (KOSE:A082640) | 7.92% | ★★★★☆☆ |

Hansae Yes24 Holdings (KOSE:A016450) | 5.33% | ★★★★☆☆ |

Click here to see the full list of 73 stocks from our Top KRX Dividend Stocks screener.

We'll examine a selection from our screener results.

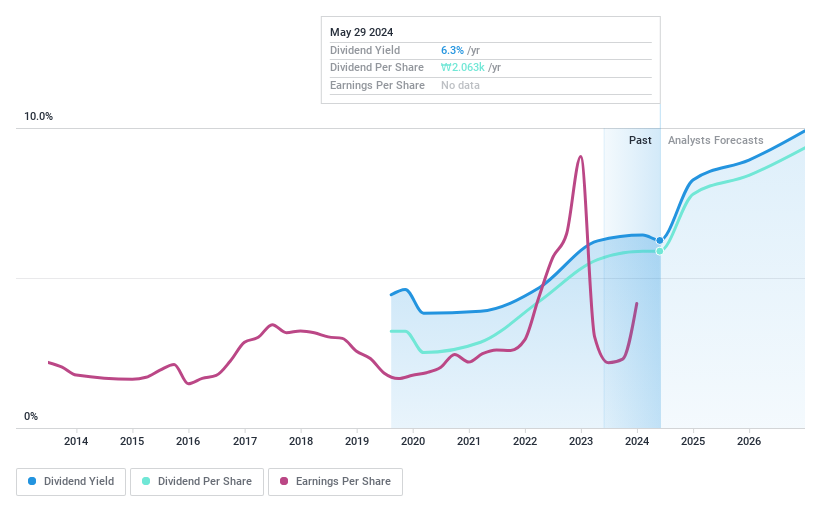

Hyundai Marine & Fire Insurance

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai Marine & Fire Insurance Co., Ltd. is a South Korean company specializing in marine and fire insurance products, with a market capitalization of approximately ₩2.59 trillion.

Operations: Hyundai Marine & Fire Insurance Co., Ltd. generates revenue primarily from the financial industry segment, which accounted for ₩1.13 billion, and a smaller portion from the non-financial industry at approximately ₩16.28 million.

Dividend Yield: 6.3%

Hyundai Marine & Fire Insurance Co., Ltd. is trading at 88% below its estimated fair value, suggesting potential undervaluation. Despite a top-tier dividend yield of 6.25%, higher than the market average of 3.5%, the company's dividend history is marked by instability and unreliability, with significant fluctuations over less than a decade of payments. Earnings are projected to grow by 18.41% annually, and both earnings (27.6%) and cash flows (7.8%) adequately cover dividends, despite recent substantial declines in net income from KRW 1.29 billion in 2022 to KRW 607.83 million in 2023, which also led to a drop in profit margins from last year's figures.

TS

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TS Corporation, a food company based in South Korea, has a market capitalization of approximately ₩287.48 billion.

Operations: TS Corporation generates its revenue primarily from its operations in the food sector within South Korea.

Dividend Yield: 3.6%

TS Corporation, with a dividend yield of 3.59%, ranks in the top 25% of Korean dividend payers. Despite this, its dividend history is short and unstable, having been initiated only five years ago. The company's dividends are well-supported financially, evidenced by a low payout ratio of 36.8% and a cash payout ratio of 44.5%, suggesting sustainability from earnings and cash flows respectively. However, recent financial results show a decline in net income to KRW 8.06 billion from KRW 11.75 billion year-over-year, potentially impacting future payouts.

Unlock comprehensive insights into our analysis of TS stock in this dividend report.

The valuation report we've compiled suggests that TS' current price could be quite moderate.

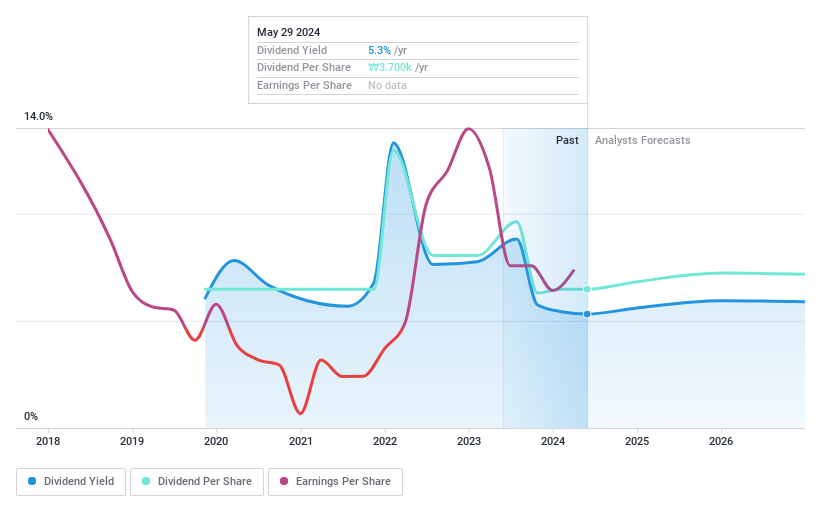

HD Hyundai

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HD Hyundai Co., Ltd. operates globally in the oil refining sector through its subsidiaries and has a market capitalization of approximately ₩4.92 trillion.

Operations: HD Hyundai Co., Ltd. generates its revenue primarily from the oil refining sector on both a domestic and international scale.

Dividend Yield: 5.3%

HD Hyundai has demonstrated significant earnings growth, with a recent quarterly net income increase to KRW 203.15 billion from KRW 62.13 billion year-over-year. Despite this, its dividend history is marked by volatility and lack of growth over the past five years. The company maintains a high payout ratio at 80.2%, yet dividends are well-covered by both earnings and cash flows, with a cash payout ratio of only 13.5%. However, HD Hyundai's profit margins have decreased to 0.6% from last year's 1.7%, suggesting potential challenges in sustaining dividends if profitability does not improve.

Click to explore a detailed breakdown of our findings in HD Hyundai's dividend report.

Upon reviewing our latest valuation report, HD Hyundai's share price might be too pessimistic.

Key Takeaways

Click this link to deep-dive into the 73 companies within our Top KRX Dividend Stocks screener.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A001450 KOSE:A001790 and KOSE:A267250.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com