Exploring Dividend Stocks On The KRX June 2024

The South Korean market has shown promising growth, rising 1.5% over the past week and achieving a 3.1% increase over the last year, with earnings expected to grow by 29% annually. In such a thriving environment, dividend stocks that demonstrate consistent payouts and potential for steady performance are particularly appealing to investors seeking reliable returns.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.60% | ★★★★★★ |

NH Investment & Securities (KOSE:A005940) | 6.73% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 4.47% | ★★★★★☆ |

Hyundai Steel (KOSE:A004020) | 3.49% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 7.39% | ★★★★★☆ |

KT (KOSE:A030200) | 5.50% | ★★★★★☆ |

LOTTE Fine Chemical (KOSE:A004000) | 4.30% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.78% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.95% | ★★★★★☆ |

Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.05% | ★★★★☆☆ |

Click here to see the full list of 72 stocks from our Top KRX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

TS

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TS Corporation, a food company based in South Korea, has a market capitalization of approximately ₩293.31 billion.

Operations: TS Corporation, headquartered in South Korea, engages primarily in the food industry.

Dividend Yield: 3.5%

TS Corporation, with a dividend yield of 3.52%, ranks in the top 25% of dividend payers in South Korea. Despite its relatively short history of dividend payments under 10 years and some volatility in financial results due to one-off items, dividends are well-supported by both earnings and cash flows, with payout ratios at 36.8% and 44.5% respectively. However, recent earnings have shown a decline from KRW 11,751.47 million to KRW 8,064.69 million year-over-year as of Q1 2024.

Hanatour Service

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanatour Service Inc., with a market cap of approximately ₩901.51 billion, operates as a travel service provider in South Korea, Northeast and Southeast Asia, the United States, and Europe.

Operations: Hanatour Service Inc. generates its revenue from travel and related services across regions including South Korea, Northeast and Southeast Asia, the United States, and Europe.

Dividend Yield: 8.6%

Hanatour Service, despite trading 25.1% below its estimated fair value and analysts predicting a price increase of 36.3%, faces challenges with its dividend sustainability. Its high dividend yield of 8.59% is not well supported by earnings, with a payout ratio of 128.6%. Although dividends have increased over the past decade, payments have been inconsistent and volatile. Recent financials show significant improvement in earnings, from a net loss in the previous year to substantial profits (KRW 21,362.52 million) as of Q1 2024.

Delve into the full analysis dividend report here for a deeper understanding of Hanatour Service.

Upon reviewing our latest valuation report, Hanatour Service's share price might be too pessimistic.

HD Hyundai

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HD Hyundai Co., Ltd. operates in the oil refining sector both domestically and internationally, with a market capitalization of approximately ₩4.90 trillion.

Operations: HD Hyundai Co., Ltd. engages primarily in the oil refining sector across both domestic and international markets.

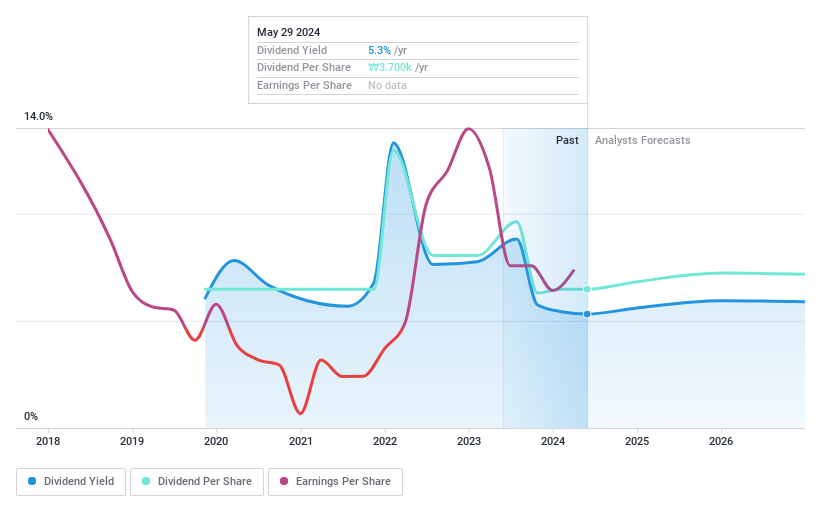

Dividend Yield: 5.3%

HD Hyundai's recent earnings surge to KRW 203.15 billion in Q1 2024 reflects a substantial improvement, supporting a dividend payout ratio of 80.2%. However, the company’s dividends have shown volatility over the past five years and lack consistent growth. Despite this, dividends are well-covered by both earnings and cash flows (Cash Payout Ratio: 13.5%), suggesting sustainability from a cash perspective. The stock is also perceived undervalued with a P/E ratio of 12.1x, below the market average of 13x.

Where To Now?

Get an in-depth perspective on all 72 Top KRX Dividend Stocks by using our screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A001790 KOSE:A039130 and KOSE:A267250.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com