Exploring China's Top Dividend Stocks In May 2024

As of May 2024, China's stock market has shown signs of recovery, buoyed by strong holiday spending and positive trade data. The Shanghai Composite and CSI 300 indices have both posted gains, reflecting renewed investor optimism in the region's economic prospects. In this context, exploring dividend stocks can be particularly interesting as they may offer investors potential income combined with exposure to the recovering Chinese market.

Top 10 Dividend Stocks In China

Name | Dividend Yield | Dividend Rating |

Shandong Wit Dyne HealthLtd (SZSE:000915) | 5.57% | ★★★★★★ |

Wuliangye YibinLtd (SZSE:000858) | 3.09% | ★★★★★★ |

Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.29% | ★★★★★★ |

Midea Group (SZSE:000333) | 4.13% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.55% | ★★★★★★ |

Jiangsu Yanghe Brewery (SZSE:002304) | 4.89% | ★★★★★★ |

Changchun High-Tech Industry (Group) (SZSE:000661) | 3.84% | ★★★★★★ |

Huangshan NovelLtd (SZSE:002014) | 5.41% | ★★★★★★ |

China South Publishing & Media Group (SHSE:601098) | 4.50% | ★★★★★★ |

Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.69% | ★★★★★★ |

Click here to see the full list of 173 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Jinneng Holding Shanxi Coal Industryltd

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jinneng Holding Shanxi Coal Industry Co., Ltd. operates in China, focusing on the production and sales of coal and related chemical products, with a market capitalization of approximately CN¥29.46 billion.

Operations: Jinneng Holding Shanxi Coal Industry Co., Ltd. generates its revenue primarily through the production and sales of coal and related chemical products.

Dividend Yield: 3.6%

Jinneng Holding Shanxi Coal Industry Ltd. reported a slight decrease in Q1 2024 sales to CNY 3.66 billion from CNY 3.71 billion year-over-year, though net income rose to CNY 780.3 million from CNY 710.86 million, indicating improved profitability. The company's dividend sustainability is underpinned by a reasonable earnings payout ratio of 57.8% and a low cash payout ratio of 22.7%. However, its dividend track record has been unstable over the past decade, reflecting some volatility in payments despite recent financial improvements and growth forecasts.

Beijing Haohua Energy Resource

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Haohua Energy Resource Co., Ltd. is a company based in China that specializes in the mining, washing, processing, export, and sale of coal, with a market capitalization of approximately CN¥14.31 billion.

Operations: Beijing Haohua Energy Resource Co., Ltd. primarily generates its revenue through various coal-related activities including mining, washing, processing, and exporting.

Dividend Yield: 3.5%

Beijing Haohua Energy Resource Co., Ltd. experienced a decline in annual sales and net income for 2023, with figures dropping to CNY 8.44 billion and CNY 1.04 billion respectively, from higher levels the previous year. However, first quarter results in 2024 showed improvement with sales rising to CNY 2.41 billion and net income increasing to CNY 451.85 million. Despite this recovery, the company's dividend history has been marked by instability over the past decade, though its dividends are well-covered by both earnings and cash flow with payout ratios of 47.7% and 41.3% respectively, suggesting some level of sustainability if current trends persist.

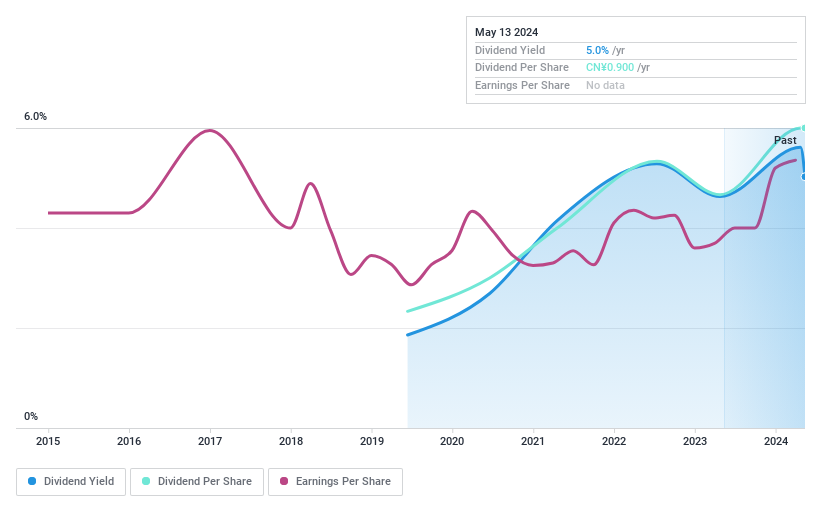

Xinjiang East Universe GasLtd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang East Universe Gas Co., Ltd. operates in natural gas sales, equipment installation, and heating services with a market capitalization of approximately CN¥3.39 billion.

Operations: Xinjiang East Universe Gas Co., Ltd. generates its revenue primarily from the sale of natural gas, the installation of natural gas facilities, and providing natural gas heating services.

Dividend Yield: 5%

Xinjiang East Universe Gas Co. Ltd. has shown consistent financial growth with its Q1 2024 sales increasing to CNY 487.6 million from CNY 433.67 million the previous year, and net income rising to CNY 72.72 million from CNY 66.06 million. Despite a relatively short dividend history of five years, the company's dividend yield is competitive at 5.03%, ranking in the top quartile for Chinese markets, supported by a sustainable payout ratio of 84% and a cash payout ratio of 48.6%. However, its dividend track record remains unstable due to its brief history of payments.

Where To Now?

Embark on your investment journey to our 173 Top Dividend Stocks selection here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:601001SHSE:601101 SHSE:603706

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com