Exclusive: Rogo, an AI startup focused on finance, raised its $18.5 million Series A

Investment banking is having a complex cultural moment.

Consider the rollicking rise of HBO’s Industry, which manages to make i-banking look dark, sexy, and sometimes even swashbuckling. The world of Industry is filled with glass skyscrapers, cluttered desks, and hard-won but devastatingly hollow victories. It’s a whole generation’s introduction to investment banking, and it’s airing just as a real-world reckoning is gaining momentum. In recent months and years, shattering stories have emerged of investment banking associates who die at work amid 100-plus-hour work weeks and reportedly toxic work cultures.

Impossible jobs make for good TV, but impossible demands sooner or later become indefensible in real life. That means there's an opportunity to make these jobs better. And banks, though they’ve lately (and very publicly) been limiting the hours associates can work, are unlikely to do it alone.

Gabe Stengel worked at Lazard in investment banking from 2020 to 2022. Now, he’s the CEO and cofounder of Rogo, a startup building an AI-driven platform especially for finance and its largest institutions. It’s ChatGPT-esque, helping junior analysts streamline workflows, draft memos, and generate models and PowerPoints. Wall Street’s in a moment of change, Stengel told Fortune.

"Wall Street has this rich legacy of people who work really hard, often are overworked, and where people don’t necessarily look out for each other," he said. "I think that’s changing a lot, and that’s true in a lot of industries. People are paying more attention to how they work and to their peers. Stakeholder capitalism, rather than shareholder capitalism, right?... In the way I conceptualize this, [Rogo] is something that could actually prevent people from being overworked, I imagine, because they’re more efficient."

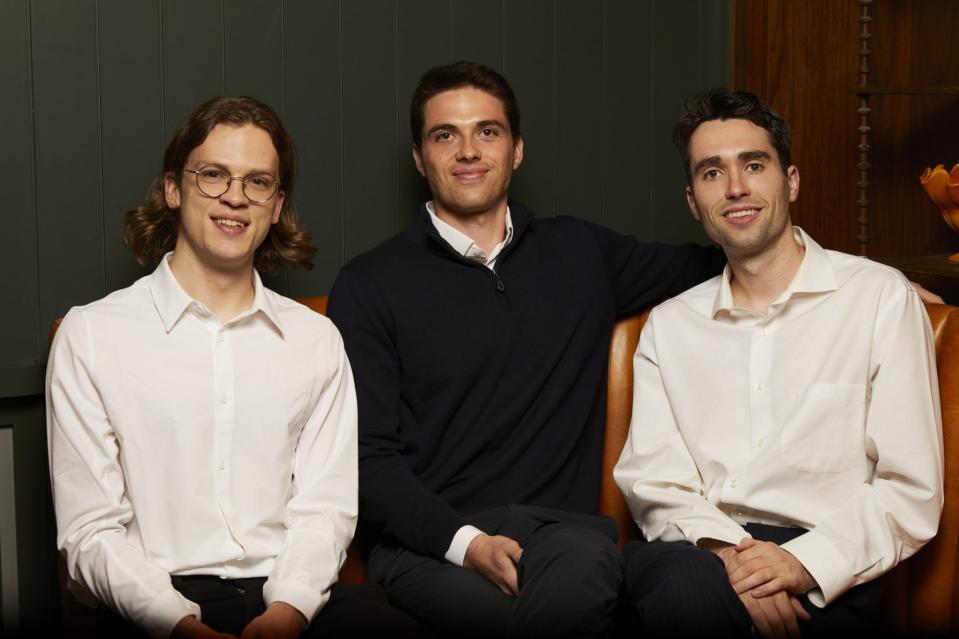

Stengel cofounded Rogo with John Willett and Tumas Rackaitis in 2022 to build a Wall Street-ready AI analyst. And if this all sounds grandiose, consider: Rogo went from zero to a seven-digit ARR in less than five months with one sales rep, and is already fielding tens of thousands of queries daily. (The company declined to disclose more specific numbers.)

Now, Rogo has raised its $18.5 million Series A in a round led by Khosla Ventures, Fortune can exclusively report. Keith Rabois was Khosla’s lead partner on the deal. (Khosla was famously the first investor in OpenAI.) New investors include Jack Altman’s AltCapital, Original Capital, and The Chainsmokers’ Mantis VC. Additionally, existing Rogo investors AlleyCorp, BoxGroup, and ScOp Venture Capital also participated in the round.

There are sideways competitors to Rogo, from the internal tools that banks like JPMorgan Chase are developing to the AI tools being rolled out by Bloomberg and FactSet. But Stengel’s ambitions are substantial—he says Rogo’s end game is to be as ubiquitous as the Bloomberg Terminal. This also begins to situate Rogo at the center of another far-ranging cultural conversation: Will AI take jobs? In finance at least, Stengel ultimately says no, because it remains an "apprenticeship business."

"If you want to be the best private equity investor or the best banker, you’ll need to learn from the best," said Stengel. "So much is contained in the voiceover knowledge, the trade secrets, and the relationships. How can you actually be empowered to focus on that?"

Rogo aims to automate the most rote tasks for junior bankers, allowing them to "spend more time on the things that actually make investment banking and investing interesting" like "getting to form relationships with actual operators and entrepreneurs." One of the things about how Stengel discusses Rogo is that he seems compelled by a seemingly counterintuitive idea—that technology can make finance, well, a little more human. I told him about a friend of mine who started her career in investment banking—and that she quickly ran away screaming, as the promise of a difficult but interesting job receded into an untenable reality.

"What this technology is going to do is make the promise closer to reality," said Stengel. "A lot of smart, ambitious people join these banks because they're interested in the work that the senior managing directors are doing…But then what happens is that there's so much low-hanging fruit to address. But your friend joined for a reason. It’s because a lot of the work is fascinating."

And you know how we know that? There’s a whole TV show about it. Yes, in customary HBO fashion, many of Industry’s most thrilling scenes are moments of twisted interpersonal dynamics. But the scenes in Industry that have most stuck with me are ones where an associate wrests back control in a high-stakes situation—doing what they signed up for in the first place.

Elsewhere…To equity or not to equity, that is the question. Forgive the reference, but there is, in fact, quasi-Shakespearean drama around Sam Altman, OpenAI, and the question of equity. My colleagues Sharon Goldman, Kali Hays, and Verne Kopytoff are here to explain it to you.

Scoop-let…Fintech is so back. I mean, maybe. But either way, fintech-focused Restive Ventures has filed to raise its third fund with a cap of $70 million, according to an SEC filing. The firm’s investments include Atlas, Brico, Flex, and Power, which in 2023 was acquired by Marqeta.

See you tomorrow,

Allie Garfinkle

Twitter: @agarfinks

Email: alexandra.garfinkle@fortune.com

Submit a deal for the Term Sheet newsletter here.

Nina Ajemian curated the deals section of today’s newsletter.

This story was originally featured on Fortune.com