Everything You Need to Know About Investing in REITs Safely & Efficiently

Recently, someone sold their 5-room HDB flat in Henderson Drive for a whopping S$1.4 million, and it is not uncommon in Singapore. In fact, from 2021 alone, sales in luxury apartments and real estate such as Good Class Bungalows (GCB) have doubled. It may seem like a lucrative business to start piling up residential properties as a potential investment. However, the government has stopped the trend with cooling measures such as Additional Buyer Stamp Duty (ABSD) and Seller Stamp Duty (SSD).

In fact, from 9 May 2022, The Ministry of Finance announced that ABSD will now be 35%. This does not count the other cooling measures implemented in 2020, such as the Total Debt Servicing Ratio (TDSR) threshold and the lowering of HDB loan limits.

With residential (and commercial/industrial) properties being a hefty investment requiring huge capital, investing in real estate in Singapore can be challenging.

However, what if you don’t have to obtain colossal capital to invest in Real Estate, to begin with? What if you could earn money from multiple properties with little to no money down? This is where REITs come in.

What Are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts, also known as REITs, are companies that generate income from the real estate that they own and finance. These companies usually have a portfolio of properties for which they collect the payment from rentals.

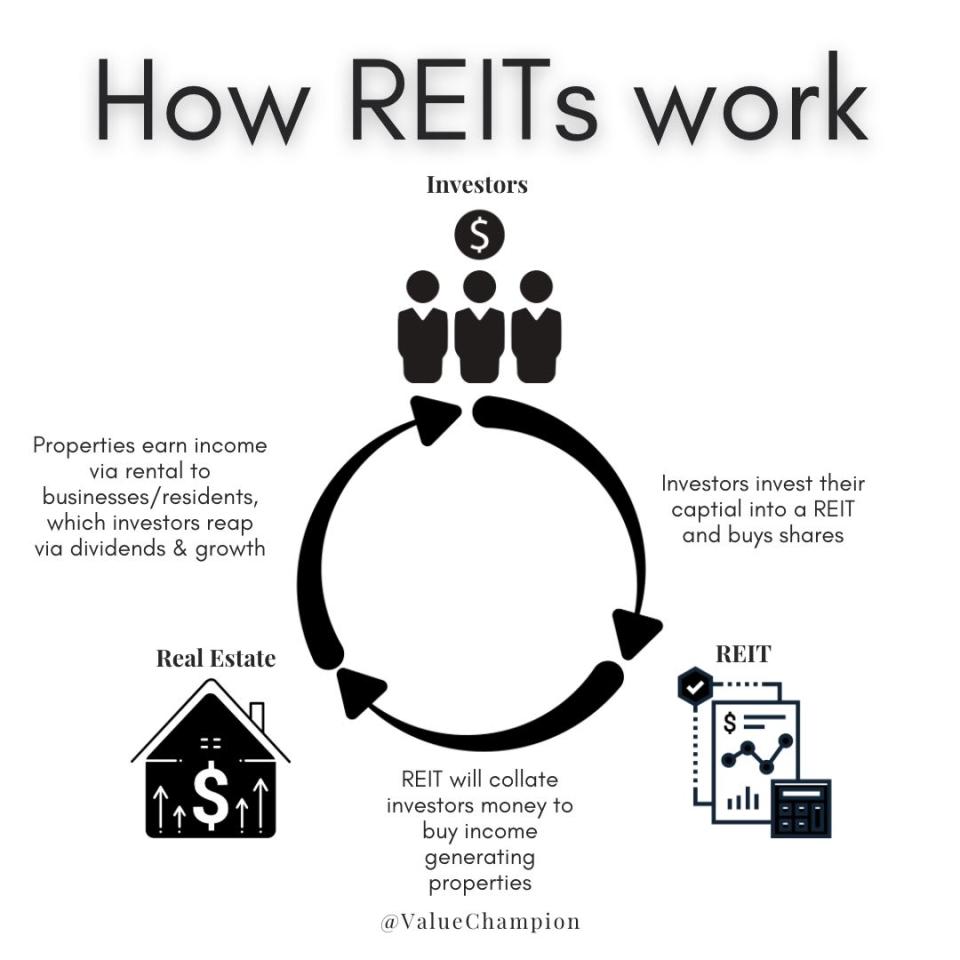

Visualisation Graphics of how a REIT works

Investors of REITs would have their investment capital pooled (similar to how a mutual fund works) for them to invest in a portfolio of Residential (rare in Singapore, but common overseas), Industrial, & Commercial properties. They will collect dividends based on the dividend yield and annualised returns of the investments.

REITs are a good investment vehicle for those new to investing, especially with the simplicity and similarity to ETFs and Mutual Funds, which are equally beginner-friendly investments.

Read Also: Best Online Brokerages for ETF & Unit Trust Trading 2022

The Jargon of REITs

Having a simplified explanation of what a REIT is isn't sufficient. You should know a few technical jargons before investing in REITs to invest safely and efficiently.

Dividend Yield

The dividend yield is the most straightforward metric you have to know about investing in general, but even more important when investing in REITs. It is simply the ratio between the dividend earned per share over the share price of the REIT.

Dividend Yield = Dividend Per Share (or DPU) / Share Price

Usually, we want a higher dividend rate due to higher investment returns. However, during a recession, we must understand the context behind a high dividend yield, such as a fall in share price due to lower capitalisation and earnings. We want yields to be in the 3-7% range consistently to earn a stable income efficiently.

Weighted Lease Average Expiry (WALE)

Weighted Lease Average Expiry is a metric that investors utilise to check the likelihood of a REIT’s portfolio property vacancy. Why do we need to know this? Well, having lesser tenants or a higher vacancy rate means having a lesser rental income, which is not good for our dividend earnings as investors.

You can measure WALE using rentable area/rental income multiplied by the tenants’ remaining lease in years. The higher the WALE, the better the income protection, but you will not capitalise on gains from a booming rental market.

So if Property A has 50% gross rental income with 3 years remaining lease term; Property B has 20% gross rental income with 5 years remaining lease term; Property C has 30% gross rental income with 4 years remaining lease term. Your WALE will be equal to (0.5 * 3) + (0.2 * 5) + (0.3 * 2) = 3.7 years.

A rule of thumb for an acceptable WALE will fall around four years; any WALE below three years can be concerning due to frequent rental renewal as REITs managers failed to renew their lease agreement with the current tenants or find a replacement. The only exception for low WALE would be commercial REITs with Ancillary Tenants, such as SME businesses that pay more rent per square foot for a tinier space as they could not afford long leases.

Distribution Per Unit (DPU)

DPU and Dividends Per Share describe the same thing: how much dividend you can earn from each unit of share you own. They tend to be calculated by the Total Dividends distributed divided by the Number of Shares distributed by the REIT.

Net Asset Value

The Net Asset Value indicates what investors will get if the company liquidates all its assets to pay off its liabilities. NAV is usually used as a valuation tool to determine if the asset is over or undervalued.

There is a variation of NAV being the Revalued NAV (RNAV) that adjusts the values of both assets and liabilities at market value.

NAV Per Share = (Assets Market Value - Liabilities Value) / Number of Shares

Capitalisation Rate

Capitalisation Rate, or cap rate for short, is a measure of the income yielding capability of an asset property of a REIT. Most REITs report the capitalisation rate of each property that they own in their annual reports.

Capitalisation Rate = Net Operating Income / Property Value

A high capitalisation rate would indicate a positive effect, such as the REIT managers’ ability to negotiate for higher income, or an adverse effect, such as a depressed property value. A high capitalisation rate can also yield high returns but have a higher perceived risk.

CAPEX

Capital Expenditures (CAPEX) are what the REIT company spend on acquiring, maintaining, and upgrading its assets. These expenditures include Asset Enhancement Initiatives (AEI), such as property refurbishments and revamps.

AEIs are used to optimise the property value to increase rental income, as having better facilities attracts a higher demand of tenants. AEIs are usually common in Singapore, especially in commercial properties like shopping malls.

Gearing

Despite MAS implementing a 50% Gearing (aggregate leverage) limit on 16 April 2020, we would still need to understand how REITs get involved with financial leveraging to stay safe on our investments.

This is because REITs with relatively high gearing tend to be more vulnerable during recessions as they have to continue paying interest for their debt despite low earnings. A REIT that does not pay its interests or principal on time may fold up, leaving its investors stranded.

Gearing can be measured via Debt-to-Equity ratio (Total Debt / Total Equity) or Debt Ratio (Total Debt / Total Assets).

Example: CapitaLand Integrated Commercial Trust (SGX: C38U)

For example, let’s look at CapitaLand Integrated Commercial Trust. As of Q1 2022, they have a WALE of 3.7 years and a gearing ratio of 39.1%. Their NAV in December 2021is S$2.0624 per share (Looking at the current price of S$2.23, the REIT is slightly overvalued, but it is not a fair assessment to compare past valuation in current circumstances).

Their capitalisation rate for each property ranges between 3-5%, which is relatively modest. Their DPU would be 1.03 cents per share, as they offer a 4.63% dividend yield as of May 2022, a healthy and stable yield for REITs. Therefore, C38U would be a worthwhile investment.

Do note that the metrics covered in this article are not comprehensive, and learning other measures can help you make sound investing decisions. However, we should take not all metrics too seriously as putting too much weight on measurements causes analysis paralysis.

What Kinds of REITs Does Singapore Have?

We have a myriad of REITs ranging from Retail, Hospitality, Healthcare, Commercial, Industrial, etc. Each REIT invests in different sectors like logistic spaces, data centres, offices, shopping malls, hospitals, and hotels. Each industry will have its business cycle, so it is essential to know the business cycle affecting the industry that the REIT specialises in.

We have compiled a table below to show more details; the figures are as of 23 May 2022.

REIT Name | Type of REIT | Countries | Examples | Market Cap | Dividend Yield |

|---|---|---|---|---|---|

Ascendas REIT | Industrial (Offices, Logistics and Distribution Centres, Industrial Properties, Data Centres) |

|

| S$16.4B | 5.04% |

CapitaLand Integrated Commercial Trust | Commercial (Shopping Malls and Centres) |

|

| S$14.8B | 4.63% |

Mapletree Industrial Trust | Industrial (Industrial Plants, Data Centres) |

| - | S$6.53B | 4.84% |

Mapletree Logistics Trust | Industrial (Logistics and Distribution) |

|

| S$7.70B | 5.09% |

Mapletree Commercial Trust | Commercial (Shopping Malls, Office Buildings) | - Singapore |

| S$6.02B | 4.24% |

Keppel DC REIT | Data Centres |

| - | S$3.35B | 1.78% |

Frasers Logistics & Commercial Trust | Commercial & Industrial (Logistics, Offices, Shopping) |

|

| S$4.95B | 5.62% |

Where Do I Start Investing?

Many financial brokers offer REITs in Singapore, such as FUTU MooMoo, Phillip POEMS, Saxo Markets, Tiger Brokers, etc. Robo-advisors such as Syfe and EndowUs also provides REITs in their portfolio.

Want to know which broker is suitable for starting your investment journey? Click here to know the Best Brokers and Robo-Advisors in Singapore!

Read Also:

A Comprehensive Guide to Valuation and Investment Strategies

Best Online Brokerages and Trading Platforms in Singapore 2022

The article Everything You Need To Know About Investing in REITs Safely & Efficiently originally appeared on ValueChampion.

ValueChampion helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValueChampion:

A Basic Guide to Investing: Why It Is Important

A Comprehensive Guide to Valuation and Investment Strategies

Yahoo Finance

Yahoo Finance