Everest Re Group (RE) Estimates Q3 Catastrophe Loss of $635M

Everest Re Group Ltd. RE estimates preliminary pre-tax catastrophe loss of $635 million, primarily due to Hurricane Ida and floods in Europe. The estimated losses are net of reinsurance recoveries and reinstatement premiums.

The Reinsurance segment is estimated to suffer $335 million cat loss from Hurricane Ida and $220 million from European floods. The Insurance segment is estimated to incur $80 million cat loss due to Hurricane Ida. The property and casualty insurer anticipates insured industry losses of about $28-30 billion from Hurricane Ida and about $12 billion from the floods in Europe in July.

The Zacks Consensus Estimate for Everest Re’s third-quarter earnings is currently pegged at $2.52, indicating an increase of 4.1% from the year-ago quarter reported figure. We expect estimates to move south once analysts start incorporating loss estimates into their numbers.

AIR Worldwide, a modeling firm, projects total insured losses from Hurricane Ida in the range of $20-$30 billion as reported in Insurance Journal. The Allstate Corporation ALL estimates net losses of $631 million pretax ($498 million after-tax), reflecting anticipated reinsurance recoveries from Hurricane Ida. The Hanover Insurance Group THG estimates third-quarter catastrophe loss of $150-$165 million pre-tax or $119-$130 million after taxes, primarily stemming from Hurricane Ida. Horace Mann Educators Corporation HMN estimates $35 million to $40 million, pretax, catastrophe loss, most notably driven by the effects of Hurricane Ida.

Being a property and casualty insurer, Everest Re’s exposure to cat losses induce earnings volatility. It incurred $305 million in cat loss in the first half of 2021, surging from $45 million in the year-ago period, primarily attributable to the Texas winter storms as well as Tropical Storm Claudette, Victoria Australia flooding and Europe convective storms. Combined ratio, however, improved 451 basis points in the same time fame.

Everest Re’s active catastrophe management process that deploys modeling and establishes risk limits to control catastrophic exposure on both a probable maximum loss and aggregate basis should provide some respite.

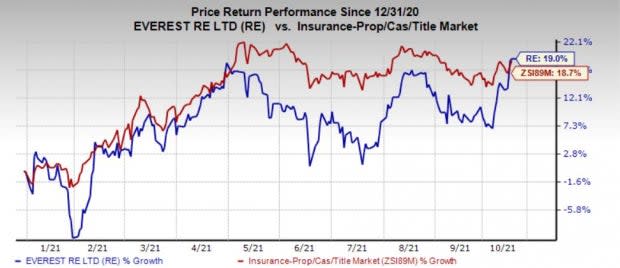

Shares of this Zacks Rank #3 (Hold) property and casualty insurer have rallied 19.9% year to date, outperforming the industry’s increase of 18.7%. Continued solid performance at Reinsurance and Insurance segments, traditional risk management capabilities coupled with well-balanced portfolio mix and capital adequacy should help the stock retain the momentum.

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Allstate Corporation (ALL) : Free Stock Analysis Report

Everest Re Group, Ltd. (RE) : Free Stock Analysis Report

The Hanover Insurance Group, Inc. (THG) : Free Stock Analysis Report

Horace Mann Educators Corporation (HMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance