World stocks power to record high and euro jumps as French vote result sparks relief rally

Euro surges towards six-month high on French election relief

French election ignites risk-on rally in Europe as DAX hits record high

France's CAC 40 surges to highest level in more than nine years

Europe's volatility index wipes out rapid surge as risk appetite returns

Markets wrap: World stocks hit record high and euro jumps on French election relief

World stocks surged to an all-time record high after centrist and market favourite Emmanuel Macron won the first round of the French election, igniting a risk-on rally.

Investors breathed a collective sigh of relief as markets quickly began to price in the prospect of a Macron presidency, who qualified for a May 7 runoff alongside far-right anti-EU candidate Marine Le Pen.

The MSCI All-Country World Index, a gauge of global stocks, jumped 1.5pc, surpassing its previous lifetime high set last month. France’s blue chip index, the CAC 40, surged to its highest level in more than nine years, up 4.1pc on the day to 5,268.85. Meanwhile, the German DAX set a new record high of 12,454.98 and the Euro Stoxx 600 jumped 2.1pc to 386.09, a 20-month peak.

In the UK, the FTSE 100 enjoyed its biggest daily rise since September last year, rallying 150.13 points, or 2.11pc, to 7,264.68, while the mid-cap FTSE 250 index set a lifetime closing high of 19,602.83.

Worries about a potential anti-establishment shock had plagued market sentiment in the build up to the election. However, today polls showed pro-EU Macron is expected to beat Le Pen i the second round, easing fears of a breakup of the eurozone.

Credit Suisse analyst Andrew Garthwaite said Macron is “a good choice” for both the French economy and financial markets.

“Macron's policies are clearly pro-Europe, and as economy minister he implemented reasonable reforms to improve the competitiveness of French companies and liberalise the economy,” he added.

On Wall Street, US stocks joined the relief rally, with the Nasdaq touching a new record high and the Dow Jones posting triple digit gains.

Banking stocks were among the biggest beneficiaries of the Macron first-round victory, which quelled concerns about a Le Pen win and a Frexit.

Neil Wilson, of ETX Capital, said: “Banks are doing well because there is now no major risk of significant outflows from the European banking system as investors no longer worry about the future of the euro.”

The Euro Stoxx Bank index recorded its biggest one day gain in almost five years, rising 2pc. Barclays jumped 5.4pc, Standard Chartered leapt 4.8pc and Royal Bank of Scotland bounced 4pc.

Meanwhile, Europe’s fear gauge, the Euro Stoxx 50 Volatility index fell 8.8 points, wiping out gains made earlier this month as investors fretted about the outcome of the first round vote.

Markets breath sigh of relief on French vote. 1-month euro volatility slides to 8.4% from 12.85% on Friday - the biggest fall on record. pic.twitter.com/ZJOtZIDIW7

— Jamie McGeever (@ReutersJamie) April 24, 2017

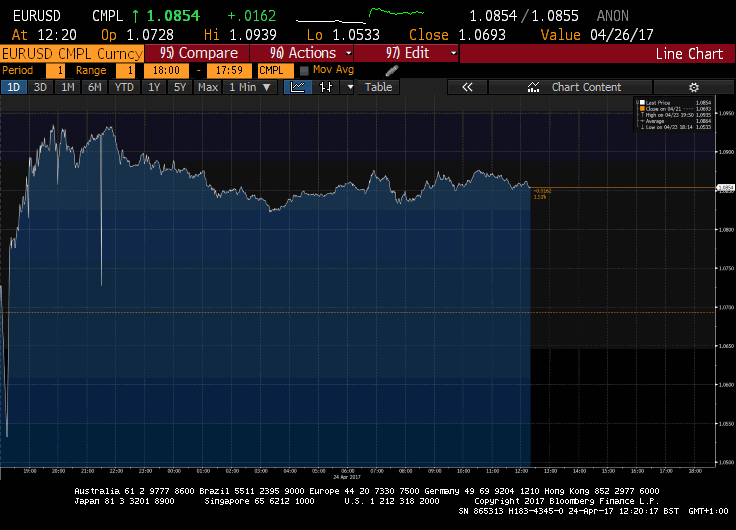

On currency markets, the euro popped by as much as 2.3pc against the US dollar to its highest level in almost six months of $1.0939, before retreating slightly in the afternoon to trade below $1.08. Meanwhile, the pound suffered its worst day against the euro since January, falling around 1.4pc to close just shy of 85p per euro.

Currency analyst Lee Hardman, of MUFG, said: “The market’s focus will begin to shift away from political risk in Europe, and more onto the improving economic fundamentals which should begin to offer the euro more support going forward.”

Election relief also spread to bond markets. French 10-year bond yields fell by over 10 basis points to more than three-month lows at 0.74pc, while the German-French 10-year bond yield, seen as a barometer of French election risks, tightened to around 40 basis points, down from around 62 basis points before the vote.

On that note, it's time to close up. We'll be back again tomorrow from 8.30am.

Market report: Energy suppliers falter on Conservative price cap pledge, as FTSE 100 enjoys best day since September on French relief rally

British energy suppliers suffered sharp losses after the Conservative Party vowed to cap domestic energy prices if it retained power in the forthcoming election on June 8.

The government has previously called for more competition among the ‘big six’ energy providers, which include Centrica, SSE, Scottish Power, Npower, E.ON and EDF, while Work and Pensions Secretary Damian Green said the Conservative’s manifesto would include pledges on controlling energy prices.

In its wake, UBS downgraded Centrica’s rating to “neutral” from “buy, and cut its price target to 215p from 255p. The Swiss bank believes an energy tariff cap would be “a negative development” for the FTSE 100 company, which relies on UK retail for around one-third of its operating profit.

Meanwhile, Morgan Stanley predicted further underperformance for stocks sector-wide as investors await the Conservative manifesto for more detail on a potential price cap.

Analyst Nicholas Ashworth said: “We see little likelihood of an earnings impact in 2017 for now, but sentiment will remain weak until the time that there is more clarity.”

Rattled by uncertainty, Centrica plunged to a five-month low in intraday trade, before closing down 7.3p, or 3.5pc, at 200.4p, while SSE surrendered 28p to £14.17.

Meanwhile, Randgold Resources also found itself among a handful of laggards as investors piled out of safe-haven assets following Emmanuel Macron’s victory in the first round of the French presidential vote, sending gold prices 1pc lower. The FTSE 100 precious metal producer dropped 100p to £69.70.

On the wider market, the FTSE 100 posted its biggest one-day gain since September as markets began to price in a Macron presidency following the first round vote. The blue chip index surged 150.13 points, or 2.11pc, to 7,264.68, while the FTSE 250 set a new record peak of 19,621.69, before closing up 1.26pc at 19,602.83.

Banking stocks were among the main beneficiaries of the French vote results, which eased fears of a breakup of the eurozone. Shares in Barclays rallied 11.3p to 219.2p, Standard Chartered jumped 32.6p to 718.5p, Royal Bank of Scotland leapt 9.5p to 249.3p and Lloyds climbed 1.9p to 66.2p.

Away from the blue chips, real estate investment trust Tritax Big Box became the biggest FTSE 250 faller, down 6.7p to 140.5p, after it announced plans to raise £200m through a placing to fund further investments.

Elsewhere, drugmaker Vectura tumbled 5.7p to 142.6p after broker N+1 Singer downgraded its trading to “sell” from “buy” as it believes the risk of a delayed approval of its generic asthma drug VR315 is “significant”.

On the other side, WS Atkins made gains of 11p to £21.13 after US activist investor Elliott revealed it had taken a 6.8pc stake in the company. It comes a week after Canadian group SNC agreed to buy the FTSE 250 firm for £2.1bn.

An upbeat outlook for the year ahead lifted shares in IT services provider Computacenter 56.5p to 790p.

Property group Kennedy Wilson Europe surged 131.5p, or 13.4pc, to £11.10, after it announced plans to merge with its parent company, Kennedy Wilson Holdings.

Finally, software and big data group WANdisco bounced 20pc higher to 462p on the back of a $4.1m contract win with a major financial institution. It also confirmed that it ended the first quarter with cash of $7.6m, reducing its cash burn in the first three months of the year to zero.

European bourses post stellar gains after French vote relief rally

European bourses posted stellar gains after the outcome of the first round of the French election sparked a relief rally.

The provisional European closes indicated:

Euro Stoxx 600: +2.05pc

FTSE 100: +2.1pc

CAC 40: +4.1pc (best day since August 2015)

DAX: +3.3pc (Closes at record high)

FTSE MIB: +4.77pc

Chris Beauchamp, of IG, said: "The FTSE 100 is ending the day in fine fettle, gaining over 150 points and looking set to finish near the highs of the session. In Europe the picture is even rosier, with stock markets putting in a solid performance. This might seem a bit overdone, given Macron was always supposed to win the first round, and there is still a second round to go. Only in two weeks’ time will be able to put thoughts of a Len Pen presidency behind us. However, investors seem buoyed by the consistent record of French polling, one that was reinforced by the result yesterday, and are prepared to move back into risk assets once more.

"Of course, this hasn’t solved all the other problems, such as North Korea, Syria and the Trump administration’s failure to produce any major reforms, but for now the bears have been forced to get out of the way or risk being trampled in the rush to buy stocks again."

Are markets getting carried away with Macron?

With world stocks at a new record high, Kathleen Brooks, of City Index, assesses whether investors are getting carried away with a Macron presidency:

Oddschecker puts Macron’s chances of winning the second round vote at 89pc, with Le Pen’s chances plummeting after Macron received the majority of endorsements from his rival candidates. With Macron almost certain to win in two weeks’ time, market momentum could be dependent on the margin of victory.

If Le Pen can tweak her campaign and narrow the margin of victory for Macron then we could see some scaling back of the Macron trade as we lead up to the second round run-off and euro and European equity market softening.

It is worth remembering that France also has National Assembly elections in June, and if Macron can’t get enough of his En Marche members elected, and the Front National increases its number of seats, then Marine Le Pen is likely to remain a major force in French politics as she waits for her next chance in 2022. Thus, the collective sigh of relief that the markets’ have taken this morning may be a little premature; even if Le Pen loses the Presidential election she is not a spent political force yet.

The FX market may be scaling back its Macron enthusiasm this afternoon, EUR/USD has fallen below the 1.09 level and has tested key support at 1.0838- the 200-day sma - as traders take profit after the post-election move. If we close below 1.0900 today then this could be a bearish sign, suggesting that the euro may not be able to maintain upside on the back of Macron’s expected victory on May 7.

World stocks hit record high as French vote sparks risk-on rally

MSCI's gauge of global stocks hit an all-time high on Monday as abating political risk after a market-friendly outcome to the first round of the French presidential election stoked a risk-on rally.

The MSCI All-Country World was up 1.5pc, surpassing its prior peak set last month before growing risks of a Brexit-like shock in the French election and doubts about the Trump administration's policies interrupted the so-called reflation trade.

France relief rally overdone, maybe?

CAC's best day in 5 yrs

Euro's best day since June

World stocks record high

Euro 1-mo vol record fall— Jamie McGeever (@ReutersJamie) April 24, 2017

Across major indices, France's CAC 40 rose more than 4pc on the day and was on track for its best session in nearly five years. In the United States, the Nasdaq Composite rose 1.2pc to a record.

Report from Reuters

FTSE 100 extends gains; on track for best day since September

The FTSE 100 has extended its gains in afternoon trade and is on track for its biggest one-day rise since September last year.

The blue chip index has jumped 150.32 points, or 2.12pc, to 7,264.90.

Nasdaq opens at record high as Wall Street joins relief rally

Wall Street joined its European counterparts in a relief rally after Macron came out on top of the first round of the French election.

The Nasdaq stormed to a record high as the opening bell sounded on Wall Street, gaining 1.18pc to 5,980.08.

Meanwhile, the Dow Jones leapt 1pc and the S&P 500 climbed 1.1pc.

Dow rises 200+ points & Nasdaq hits all-time high at the open as French election results spark rally https://t.co/BztlayzS4tpic.twitter.com/289felE2xl

— CNBC Now (@CNBCnow) April 24, 2017

Markets could experience a shift to a more bullish stance over the next few months

Jake Robins, Global Equities Manager at Premier Asset Management, explains why markets are enjoying a relief rally today:

“Despite the result being in line with the polls, the recent failure of the pollsters to predict election outcomes led markets to begin to prepare for the worst case scenario of a run-off between the hard left and right. Either would have resulted in France distancing itself from, if not outright leaving, the EU and the Euro. In fear of this, spreads between French and German bonds had blown out to levels not really seen since 2012. With the business friendly Macron almost certain to become the next President then markets can breathe a huge sigh of relief. French equities are rallying hard, as are those of the wider EU as political risk recedes.

How the French presidential election works

“More importantly, from here markets can focus more on the much improved fundamentals across European and global economies. Last week saw European PMI, a measure of future economic output, rise yet again suggesting accelerating economic growth. This comes at the same time that Chinese growth is surprising positively and even the likes of Japan are seeing a noticeable pick-up in exports. Given that this year has seen some reversal within markets towards safe havens in the face of perceived political risks, as these fade and focus returns to fundamentals then markets could well experience a shift to a more bullish and cyclical stance over the next few months.”

US stocks set to join European bourses in relief rally

US stocks are poised to join European bourses in a relief rally after Macron's weekend victory in the first round of the French presidential election reduced some uncertainty.

The Dow Jones is expected to enjoy a jump of more than 200 points when the opening bell sounds on Wall Street in less than an hour's time.

A couple of hours to go until the US markets open, but the overnight Dow currently suggesting a start of around +220 at 20,767.

— David Jones (@JonesTheMarkets) April 24, 2017

European Parliament president joins parade of leaders to endorse Macron

The president of the European Parliament has joined the parade of EU and German leaders who have endorsed Macron in the French presidential race.

Antonio Tajani said he believes Le Pen will not win in the second round of the presidential election on May 7. He called on French people to get involved and defend the European Union.

Tajani says Le Pen's goal of leaving the EU is a poor choice because "to remain in isolation is a bad solution".

French presidential election 2017 - in pictures

He said there are things to be improved about the EU "but that doesn't mean to destroy it".

Tajani spoke through a translator on Monday at a news conference in the Slovak capital, Bratislava, where he attended a conference of speakers of EU member states' parliaments.

Head over to our live politics blog for the latest: French election: EU leaders back Emmanuel Macron as Marine Le Pen 'seeks destruction' of European values

French vote sparks rush on banking stocks

UK banks are enjoying a bounce today, in line with a broader risk-on rally, as investors began to price in a Macron presidency.

Barclays leapt 5.1pc, Standard Chartered jumped 4.8pc, Royal Bank of Scotland climbed 3.2pc and Lloyds advanced 2.9pc.

Mike van Dulken, Head of Research at Accendo Markets, said: “Bullishness has returned to equities after a favourable first round French election outcome. Clearing another political hurdle is welcome - Macron expected to win the run-off by much bigger margin in a fortnight - but uncertainty lies with June parliamentary elections and who'll work with him as an independent. The resulting stronger euro would normally hinder the French CAC and German DAX, but a surge by banks on reduced concern about a Le Pen win and 'Frexit', coupled with Macron being pro-banks/business, is helping offset this."

Meanwhile, speaking to Reuters, Dafydd Davies, partner at Charles Hanover Investments, said: "It's the pro-growth backdrop that we're now starting to see come through rather than ... ongoing austerity which is providing quite a significant shift with the outlook for the European banks, in particular with the French banks very much leading the way, which of course sees their UK-listed counterparts rally quite significantly today as well."

HSBC expect euro to rise to $1.20 against US dollar by year-end

HSBC: now exp $eurusd to rise to 1.20 by year-end. As the EUR moves to a less political and more cyclical bias, the data remain supportive

— Anthony Cheung (@AWMCheung) April 24, 2017

Manufacturers growing at fastest pace in 20 years - but do not expect it to last

Data from the CBI has shown that British factories are upbeat on exports, but worried about inflation. Tim Wallace reports:

Britain’s factory output increased at the fastest pace since the 1990s as a combination of strong demand in the UK, a global economic recovery and the weak pound helped to boost sales.

The number of manufacturers ramping up production outweighed the number cutting back over the past three months by a margin of almost two to one, according to a survey from the Confederation of British Industry.

Export orders grew at the fastest pace since 2011, when the weak pound was combined with the end of the post-financial crisis recession.

Businesses expect that to continue - forecasts of overseas demand in the coming three months are at the highest level since 1995 - and are hiring more workers to meet that demand.

“Manufacturers reported that orders growth was the highest in over two decades in the three months to April, largely underpinned by a strengthening in exports on the back of sterling’s depreciation,” the CBI said.

Moody's: Fiscal and economic policies likely to be key rating drivers under next French presidency

Responding to the outcome of the first round vote of the French presidential election, ratings agency Moody's has said it will assess any credit implications associated with the election once the outcome is known, following the second round runoff on May 7.

The credit ratings agency added: "Fiscal and economic policies are likely to be key rating drivers under the next French presidency given debt and growth challenges."

How the polls compared to the actual vote share 12:23PM

Can the euro hold on to the post-vote gains?

Although the euro has held on to the bulk of its gains following the outcome of the first round vote, analysts reckon the single currency may face obstacles if uncertainty returns ahead of the second round runoff between Macron and Le Pen.

FXTM Research Analyst Lukman Otunuga said: "Although this risk-on sentiment could support the Euro in the short term, upside gains may face obstacles if uncertainty starts to mount once again ahead of the second round of voting on 7 May. While expectations remain somewhat elevated over Macron becoming the next French President, the live threat of an unexpected Trump-style victory by Marine Le Pen could still expose the Euro to downside shocks."

Mr Otunuga questions the longevity of the current rally, adding: "Bulls need to secure a daily close above 1.0900 to open a path towards 1.1000. In an alternative scenario, weakness below 1.0800 could open a path towards 1.0750 and lower."

The euro is currently trading up 1.5pc on the day against the US dollar at $1.0855, having smashed $1.09 in early trade.

Investors see outcome as 'end of political upheaval'

Joshua Mahony, of IG, explains the reason behind today's surge in the euro and stock markets:

"While this result was widely anticipated, we are seeing a substantial amount of hedges unwound this morning with most seeing this as the end of the political upheaval, hence the sharp gains for European stocks and the euro."

French election pushes EURUSD higher after 76.4% pullback. 1.0906 needed to maintain 2017 uptrend #FX#Tradingpic.twitter.com/YHu97QOLFa

— Joshua Mahony (@JMahony_IG) April 24, 2017

French yields slide on election relief

As investors breathed a huge sigh of relief last night, French yields fell to multi-month lows and the premium investors demand to hold the debt over German peers shrank sharply.

Investors moved quickly to unwind safe-haven bets, such as government debt, and instead started to factor in the chances of an ECB rate hike early next month.

France 10y risk spread over Germany known as 'Le spread' crashes below 50bps as Frexit risk has faded following French presidential election pic.twitter.com/YXmPUd2aBW

— Holger Zschaepitz (@Schuldensuehner) April 24, 2017

French 10-year bond yields slid over 10 basis points to more than three-month lows at 0.74pc, while the yield on Germany's safe-haven 10-year Bund yield jumped over 10 basis points to a one-month high at 0.37pc.

That left the gap between the two, a barometer in recent months of French election risks, at its tightest since December at around 40 bps and down from around 62 bps on Friday.

����2yr French government bond yields fall around 10bp after Macron won the 1st round yesterday pic.twitter.com/mF4gIArNat

— Danske Bank Research (@Danske_Research) April 24, 2017

ECB to show 'steady hand' in Thursday's meeting after French first round vote

With round two now clearly in focus and markets already looking to price in a Macron presidency, UBS have compiled a handy list on what to watch out for:

Opinion polls for round 2

The projected rate of abstentions

Parliamentary elections on June 11 and 18

UBS Economist Felix Huefner thinks the results from round one suggest that the ECB will show "a steady hand" in its meeting on Thursday.

Europe's fear gauge collapses in wake of French vote

Europe's main fear gauge, the Euro Stoxx 50 Volatility Index, has slumped by more than 22pc this morning after Macron came out on top in the first round vote of the French presidential elections.

The slide in the VIX has wiped out the rapid surge it made this month when investors grew increasingly nervous two anti-EU candidates could progress to the second round of the vote.

VOW! Fear index VIX has collapsed by 22% following French elections. pic.twitter.com/lQBAGmMw9i

— Holger Zschaepitz (@Schuldensuehner) April 24, 2017

European bourses surge as French vote sparks relief rally

European bourses have surged this morning as yesterday's first round French vote sparked a relief rally across the region.

Investors cheered the results which saw centrist Eammanuel Macron come out on top, followed by Le Pen. Polls are now putting him comfortably ahead of far-right leader Marine Le Pen in the May 7 run-off.

The green on the scoreboard today is so bright, it almost makes your eyes hurt https://t.co/bDcZONjLckpic.twitter.com/0BFrU7X7OM

— Joe Weisenthal (@TheStalwart) April 24, 2017

Just after 11.30am, here's a snapshot of the current state of play in Europe:

FTSE 100: +1.85pc

Euro Stoxx 600: +1.98pc

Euro Stoxx 50: +3.8pc (on track for best day since August 2015)

DAX: +2.99pc (at new lifetime high)

CAC 40: +4.5pc (highest level in more than nine years)

Ooops: French benchmark index CAC40 has surpassed #Germany's Dax in 2017 following the first round of presidential elections. pic.twitter.com/SogSJsyfhO

— Holger Zschaepitz (@Schuldensuehner) April 24, 2017

France's CAC 40 hits highest level in more than nine years

France's blue chip index, the CAC 40, powered to its highest level in more than nine years this morning as investors cheered the first round results of France's presidential election.

The index is currently trading up 4.43pc at 5,283.22, marking its highest level since late to 2007.

However, Michael Hewson, of CMC Markets, cautioned: "While markets are celebrating what looks like a significant blow to the populist movement it would be a mistake for politicians to think that France’s problems are over.

"Once the euphoria has subsided the next question is likely to centre around as to whether Emmanuel Macron can deliver on his campaign promises of getting unemployment down to 7pc, tweak French labour market rules and reduce taxes at a time when over 40pc of the French electorate voted for an anti EU candidate, and remain disillusioned with the French political elite.

"France has consistently failed to deliver on its reform programs even when Sarkozy was President which means any new President is likely to find it similarly challenging, particularly since he will be expected to abide by the terms of the fiscal compact, unless Germany decides that budget responsibility no longer matters."

How Le Pen did better in areas with lower employment

Chart - Le Pen did best in areas with low levels of economic activity 10:24AM

FTSE 250 surge

The FTSE 250 hit a record high this morning, rising 1pc as stock markets across Europe reacted positively to the news coming out of France.

DAX hits all-time high

Germany's blue-chip share index, the DAX, hit an all-time high Monday, as stock markets across Europe reacted with relief to pro-business French presidential candidate Emmanuel Macron's first-round success, AFP reports.

Dax just hits life-time high after French vote as a collapse of Eurozone seems averted, at least for now. https://t.co/r9nwGepDnX via @weltpic.twitter.com/GBzSChBwuv

— Holger Zschaepitz (@Schuldensuehner) April 24, 2017

The index of 30 leading stocks briefly touched 12,398 points, only slightly above the previous record of 12,391 reached in April 2015.

By 0905 GMT, it had fallen back to 12,390 points, up 2.85 percent since trading opened in Frankfurt.

Burgeoning economic recovery

Arne Hassel, Chief Investment Officer at Barclays Wealth & Investments, says:

With politics doing little to inspire investor confidence, the economy seems to be reaping the benefits of not only a warming international business cycle but also more European factors such as previous structural reforms and supportive monetary and fiscal policies.

The cyclical lead indicators are pointing sharply upwards, while unemployment is falling faster than forecast. The private sector is in better shape to borrow and the banks are becoming more fit to lend.

This burgeoning economic recovery will, in our view, be a more important consideration for investors than the ever fractious political backdrop.

Meanwhile, in Asia

Hong Kong stocks ended higher Monday as Emmanuel Macron won the first round of France's presidential election and looked set to beat his far-right opponent in a run-off next month, easing concerns over the EU's future, AFP reports.

The Hang Seng Index rose 0.41 percent, or 97.46 points, to 24,139.48.

But the benchmark Shanghai Composite Index tumbled 1.37 percent, or 43.62 points, to 3,129.53 while the Shenzhen Composite Index, which tracks stocks on China's second exchange, plunged 2.44 percent, or 46.86 points, to 1,873.37.

Who is Macron?

Profile | Emmanuel Macron 9:30AM

'Banking stocks are flying'

Here's Neil Wilson, senior market analyst at ETX Capital:

“Populism was so last year. The expected relief rally in French banking stocks has spread across the entire European banking sector, helping the main indices post handsome gains.

"Banking stocks are flying after ex-banker Emmanuel Macron won the first round of the French presidential race and is a shoo-in to defeat Marine Le Pen on May 7th. Banks are doing well because there is now no major risk of significant outflows from the European banking system as investors no longer worry about the future of the euro. Until the Italian elections that is.

"The Euro Stoxx Banks Index is more than 5% higher this morning and looks on course for its best daily gain in a year. The index is now trading at its best level since December 2015.

"There’s a huge sigh of relief in the French banking sector - Societe Generale, Credit Agricole and BNP Paribas are up in the region of 7-9% in early trading.

"German bank stocks are also jumping – Commzerbank rising 9% and Deutsche up over 5%. Italian banking stocks also like Macron. Unicredit was last rocketing 9% higher as investors have decided that the result makes a Eurozone breakup highly unlikely.

"On the FTSE there are also strong gains for bank stocks, with Barclays climbing 4% and RBS and Standard Chartered close behind as the index enjoys a 100-point-plus rally."

Gold down, oil up

Gold, the safe haven in times of uncertainty, is down 1pc today (although it is still up 11pc in the year to date).

The price of Brent crude, meanwhile, is up 0.6pc today.

Happy markets

"Markets are happy to buy what they see as the fact - that 39-year-old Emmanuel Macron will be confirmed as the next president of the French republic in two weeks' time," said Ray Attrill, head of FX strategy at National Australia Bank

China stocks post worst day in four months

China stocks tumbled more than 1pc on Monday in their worst day in four months amid signs that Beijing will tolerate further market volatility as regulators clamp down on shadow banking and speculative trading, Reuters reports.

Traders also said market confidence has been hit by an accelerated pace of initial public offerings which are pumping more supply into the weakening market, and by worries that the world's second-largest economy will start to lose momentum in coming months.

Early wrap

Courtesy of Reuters.

The euro surged and the yen sank on Monday after the first round of France's presidential election turned out bang in line with opinion polls, settling currency market worries of another systemic political shock from next month's second round.

Measures of expected volatility of the euro - driven to their highest in a year by nerves ahead of the vote - collapsed back to relatively normal levels around 8.5 percent, pointing to a fall in concern over anti-EU, anti-euro nationalist Marine Le Pen's chances next month.

First round results

French Presidential Election - Exit Poll 8:35AM

Uncertainty will weigh on French-German government bond spreads

More analysis for you. Here's Morgane Delledonne, Fixed Income Strategist at ETF Securities:

"After the second round of the presidential elections, the next decisive step for France will be to elect the Parliament in a month and a half from now. It is still unclear how Macron will win a clear political majority without joining forces with both the Socialist and Republicans groups.

"The uncertainty around the ability of Macron to gain a majority of seats in the Parliament to pass on his reforms will likely continue to weigh on the French-German government bond spreads in the next 6 weeks. We believe in a gradual tightening of the spreads in the weeks to come."

French banks on the up

French banks are flying this morning, with Societe Generale up more than 9pc, BNP Paribas up more than 7pc and Credit Agricole up around 8pc.

Asian and Euro markets 'welcome news of Macron and Le Pen'

Here are analysts Mike van Dulken and Henry Croft at Accendo Markets:

Calls for a positive open come as Asian markets and the Euro welcome news of Macron and Le Pen progressing to the second round run-off of the French presidential election. The assumption is that centrist Macron is victorious in a fortnight's time, picking up supporters of Fillon, Hamon andMélenchon. Pollsters may have been right this time, how things swing in the next two weeks is anyone’s guess.

FTSE 100 up

The London market has opened about 100 points, or 1.4%, higher at 7,213 points.

FTSE +113 (+1.6%) at 8.02am

— David Buik (@truemagic68) April 24, 2017

Tokyo shares rally on French presidential vote

Tokyo stocks rose Monday as investors cheered news that market-friendly Emmanuel Macron came out ahead of far-right candidate Marine Le Pen in the first round of France's presidential election, reports AFP.

The benchmark Nikkei 225 rose 1.37 percent, or 255.13 points, to finish the day at 18,875.88. The broader Topix index of all first-section issues ended up 0.98 percent, or 14.61 points, to 1,503.19.

The euro rose sharply against the yen, a plus for Japanese shares because a cheaper currency inflates the repatriated profits of firms doing business abroad.

Results map

French election 2017 results map 7:36AM

Euro soars as Macron tops first round

The euro briefly hit a five-month peak after Macron's first-round success. Macron is seen as the stable candidate.

At first, the euro rose to its highest level since the US election in mid-November, jumping 2pc against the dollar to $1.09395. It then fell back slightly to $1.0866.

The euro rose 2.4pc to 119.77 yen, while the US dollar gained 1pc to 110.20 yen.

"The rise of the euro and risk appetite rebounding is understandable and this should also see yields in Europe fall, spreads to Bunds tighten and stocks rally," Tim Riddell, an analyst at Westpac, told Reuters.

"However, such gains are likely to be contained when markets reflect upon the marked shift away from the 'establishment' and just how effective the new president may be."

Good morning

Hello and welcome to the Telegraph's live coverage of the world's markets. Of course, much of today's focus will be on France, where Emmanuel Macron topped the first round of voting in the French presidential election.

As ever, we will be with you with all the latest news and views throughout the day.

Yahoo Finance

Yahoo Finance