European shares fall on political worries over Greece and Italy, as JP Morgan says hung parliament could be positive for pound

JP Morgan: Centre-left UK coalition might be positive for pound

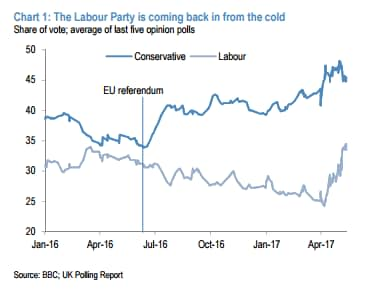

A hung parliament could be positive for the pound, strategists at US investment bank JP Morgan argued, as investors braced for a volatile run in to the general election next week.

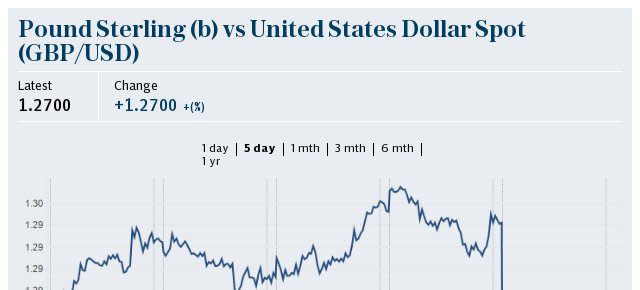

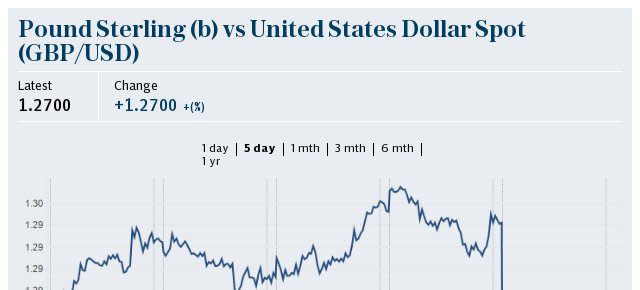

The pound has risen by almost 4pc since Prime Minister Theresa May called a snap election on the assumption a landslide victory for the Conservatives would strengthen the party’s hand in Brexit negotiations.

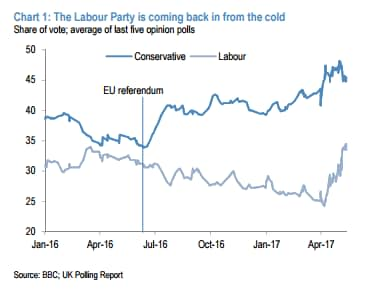

But opinion polls showed that the Conservatives’ lead over the Labour opposition narrowed to just 5 percentage points on Friday, prompting the pound steepest daily fall since January.

However, the US bank, the world's second biggest trader of currencies, thinks these last-minute political jitters are misplaced. Strategists at the bank believe the prospect of a “less disruptive Brexit” under a Labour-led government might see the pound react positively to a defeat for the Conservatives.

FX strategist Paul Meggyesi said: “A hung parliament would in more normal circumstances be viewed as quite negative for sterling – that was very much the experience of the 2015 election when sterling was braced for one of a myriad of potential coalition permutations only for sterling to jump by 3pc once David Cameron secured an improbable narrow majority.

“But in the post-referendum world, all political developments need to be viewed through a Brexit prism and an argument can be made that a hung parliament which delivered or held out the prospect of a softer-Brexit coalition of the left-of-centre parties (Labour/Lib Dems/SNP) might actually be sterling positive.”

But the market doesn’t appear to share the same assessment as JP Morgan, as the pound dropped by more than 1pc last week after opinion polls tightened last week.

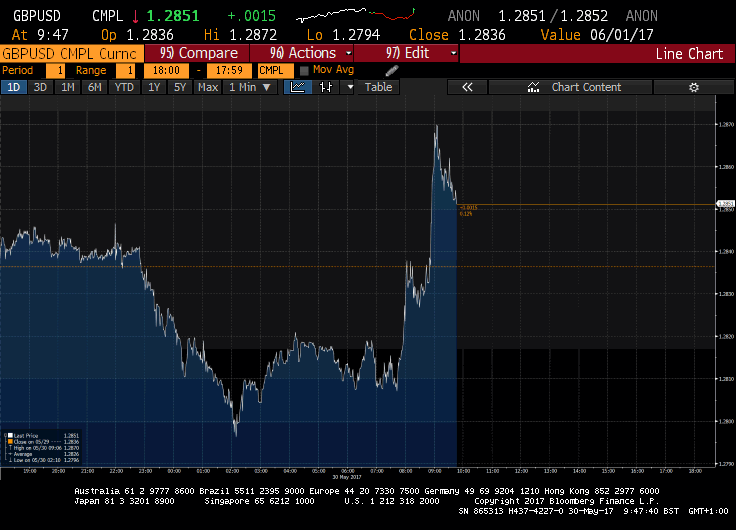

The pound, which slumped to an intraday low of $1.2794 against the US dollar today, regained momentum to touch a day’s high of $1.2880, as investors appeared unnerved by the shrinking in some polls of the Conservatives lead.

European shares fall on Greece and Italy uncertainties

European shares fell for a fourth consecutive day as rising geopolitical risks in the eurozone sapped risk appetite.

A report in the German newspaper, the Bild, suggested that Greece might forego its next bailout payment if creditors cannot strike a relief deal.

Meanwhile, uncertainties about the Italian election have also weighed on sentiment in the region. At the weekend, former Italian prime minister Matteo Renzi suggested that Italy's next election should be held at the same time as Germany's, saying it made sense from "a European perspective".

Other highlights:

FTSE 100 retreats from record highs

EU May economic sentiment falls after near 10-year high in April

Greece denies report it may opt out of receiving more bailout money

Markets wrap: Pound climbs as bets on May victory remain intact, but JP Morgan argues a hung parliament could be positive for the pound

The pound climbed nearly half a percent against the dollar as investors' bets on a Conservative Party victory remained intact, while JP Morgan argued a hung parliament could be positive for the pound.

Investors braced for a volatile run in to the general election next week, with the pound slumping to an intraday low of $1.2794 against the US dollar as political concerns weighed on the local currency.

However, minutes after an ICM poll revealed that the Conservatives Party’s lead over the Labour opposition narrowed to 12 points, down from 14 points in the previous week, the pound jumped to $1.2888.

Although recent polls confirm a narrowing trend, they continue to show the Conservatives with a sizeable lead.

However, JP Morgan, the world's second biggest trader of currencies, thinks these last-minute political jitters are misplaced. Strategists at the bank believe the prospect of a “less disruptive Brexit” under a Labour-led government might see the pound react positively to a defeat for the Conservatives.

FX strategist Paul Meggyesi said: “A hung parliament would in more normal circumstances be viewed as quite negative for sterling – that was very much the experience of the 2015 election when sterling was braced for one of a myriad of potential coalition permutations only for sterling to jump by 3pc once David Cameron secured an improbable narrow majority.

“But in the post-referendum world, all political developments need to be viewed through a Brexit prism and an argument can be made that a hung parliament which delivered or held out the prospect of a softer-Brexit coalition of the left-of-centre parties (Labour/Lib Dems/SNP) might actually be sterling positive.”

Meanwhile, the yield on 10-year UK government debt dropped briefly below 1pc for the first time since October, as investors sought the safety of government bonds ahead of the general election.

The 10-year gilt yield fell to a low of 0.99pc shortly after markets opened, marking its lowest level since October 13, before nudging back above 1.01pc.

With that, it's time to close. I'll be back again tomorrow from 8.30am.

Market Report: South African-exposed stocks slide as Zuma survives another call to step down

South African-exposed stocks became the biggest FTSE 100 laggards after the country’s president Jacob Zuma survived another call from inside the ruling ANC party for him to step down.

The rand extended its losses against the dollar for a second consecutive day, falling by as much as 1.5pc, as domestic political tensions continued to weigh on the currency.

The South African President is facing mounting pressure from both ANC members and opposition parties since he fired respected finance minister Pravin Gordhan two months ago. The move triggered credit rating downgrades from Fitch and S&P.

In its wake, Mediclinic dropped to the bottom of the blue chip index, down 26.5p to 789.5p, Old Mutual surrendered 5.3p to 191.3p and mid-cap Investec lost 12p to 611p.

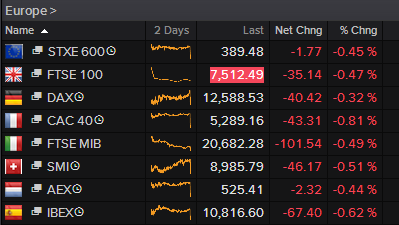

On the wider market, European shares fell for a fourth consecutive day as political jitters in Greece and Italy sapped risk appetite. The Euro Stoxx 600 slipped 0.2pc, the German DAX fell 0.2pc and the CAC in Paris tumbled 0.5pc.

Back in London, the pound strength weighed on the FTSE 100, dragging it 21.12 points, or 0.28pc, lower to 7,526.51. However, US investment bank JP Morgan upgraded its rating on UK equities to “neutral” from “underweight” as it thinks the UK is becoming “interesting in the regional allocation again”.

Cigarette makers were also among the biggest fallers after the World Health Organisation called on firms to compensate for environmental damage caused by growing tobacco. The United Nations agency found tobacco growing causes “massive harm” to the environment through extensive use of chemicals, energy, water and pollution from manufacturing and distribution. Shares in Imperial Brands dropped 73p to £36.08 and British American Tobacco fell 90p to £55.01.

Elsewhere, British Airways owner IAG lost altitude, down 8.5p to 605.5p, on the first day of trading since the group’s massive IT outage. US investment bank Citi estimates the weekend disruption to flights will result in a €100m hit to the airline.

Its low-cost rival Ryanair edged up 0.43c to €18.44 after reporting annual profits in-line with market expectations.

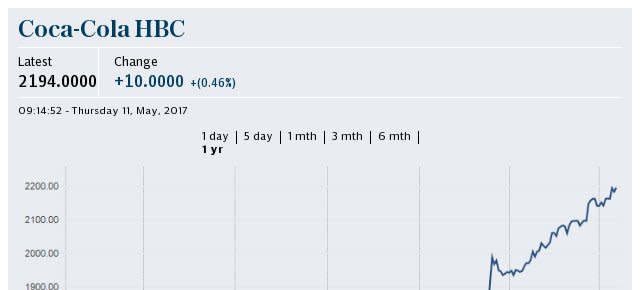

Informa dipped 19p to 669.5p following a price target downgrade from Barclays, while bottler Coca-Cola HBC drifted 22p lower to £22.47 on the back of a bearish broker note. Barclays said the FTSE 100 stock’s current valuation fails to reflect the downside risks in M&A and the increasing competitive threat in its key Nigerian market.

On the other side, London Stock Exchange Group nudged up 51p to £34.42 after it snapped up Citi’s fixed income analytics and index businesses for £535m. In its wake, UBS resumed coverage of the stock with a “neutral” rating.

Drugmaker GlaxoSmithKline eked out gains of 29.5p to £16.73, after its rival Gilead’s new HIV drug bictegravir succeeded in four-late stage studies, but didn’t show any superiority to Glaxo’s established drug.

On the mid-cap index, Ferrexpo climbed 9.9p to 182.6p after HSBC began covering the stock with a “buy” rating, while Sophos added 17.2p to 454p on a rating upgrade by Shore Capital.

Meanwhile, a rating downgrade by Peel Hunt weighed on platinum miner Lonmin, down 6.3p to 80p, and Tullow Oil dipped 8.8p to 192.7p as Morgan Stanley resumed coverage of the mid-cap stock with an “equal weight” rating.

Fusionexplunged 63.2pc to 46.3p as investors piled out of the stock after the big data analytics specialist unveiled plans to delist from Aim after markets closed on Friday. In its wake, the company’s joint broker Peel Hunt and non-executive chairman John Croft resigned from their respective positions.

Finally, Aim-listed Science in Sport was granted a patent for its novel WHEY20 protein gel, propelling shares 2.9pc higher to 88.5p.

European shares post fourth day of consecutive losses as political jitters weigh

European shares recorded their fourth day of successive losses as political jitters in Greece and Italy sapped risk appetite in the region.

Here are the provisional closes:

FTSE 100: -0.28pc

FTSE 250: -0.2pc

DAX: -0.2pc

CAC 40: -0.52pc

Euro Stoxx 600: -0.15pc

Reflecting on the day's trading session, Jasper Lawler, of London Capital Group, said: "It wasn’t the most glorious of returns from a long weekend in markets. Investors bought up the latest Trump dip but haven’t quite shown the desire to take it any further. Continuing weakness in oil markets after last week’s OPEC meeting doesn’t help – but may also be symptomatic of the shunning of riskier assets."

No let-up in tech gains

Chris Beauchamp, of IG, weighs in on Amazon crossing the landmark $1,000 a-share level:

"When in doubt, buy tech stocks. That is a fair summary of this afternoon’s price action. Aside from the Nasdaq 100, almost all the other major markets are trading lower to a greater or lesser degree. Momentum traders clearly still think that the likes of Facebook and Amazon can go higher, however, with the Nasdaq 100 having gained almost a fifth so far this year.

"Amazon has surpassed the $1000 mark this afternoon, an event that would mark the top in the market perfectly, but one that probably won’t. There seems to be no shortage of investors willing to jump on board this bandwagon. Once again, valuation worries are simply old-hat, but will it really be different this time around? "

Pound edges higher after poll shows Conservative Party's lead at 12 points

The pound edged up 0.4pc against the dollar, a full cent above Friday's lows, after the latest opinion poll showed the Conservatives Party's lead stood at 12 points.

It hit $1.2883, having traded at an intraday low of $1.2794 earlier today.

Oil slips on oversupply worries despite OPEC deal

Oil prices fell on Tuesday on concerns that output cuts by the world's big exporters may not be enough to drain a global glut that has depressed the market for almost three years.

Benchmark Brent crude dropped $1.10 a barrel, or more than 2pc, to a low of $51.19 before recovering some ground to trade around $51.30.

"The oil market remains on the back foot," said Stephen Brennock, analyst at London brokerage PVM Oil Associates.

"Last week’s decision by OPEC to extend its output pact (has failed) to alleviate lingering fears of a global oil glut."

The Organization of the Petroleum Exporting Countries and other oil producers, including Russia, agreed last week to keep a tight rein on supply until the end of the first quarter of 2018, nine months longer than originally planned.

Collective output by OPEC and other producers will be held around 1.8m barrels per day (bpd) below its level at the end of last year.

Report from Reuters

Shares in e-commerce heavyweight Amazon hit $1,000

Shares in Amazon touched $1,000 for the first time ever this afternoon, pushing value of online goliath to more than double that of Wal-Mart.

That's a long way from the e-commerce heavyweight's 52-week low of $682.12.

Data from FactSet shows there are just 14 other US stocks trading above $1,000 per share.

Amazon shares hit $1,000 for the first time today. About 4x the price 4 years ago. No US tech company is more interesting right now. pic.twitter.com/PH4tLRTMvS

— Shira Ovide (@ShiraOvide) May 30, 2017

Meanwhile, another tech giant, Alphabet, hit a session high of $997.62, up 0.3pc on the day, as it too races towards the landmark $1,000 level.

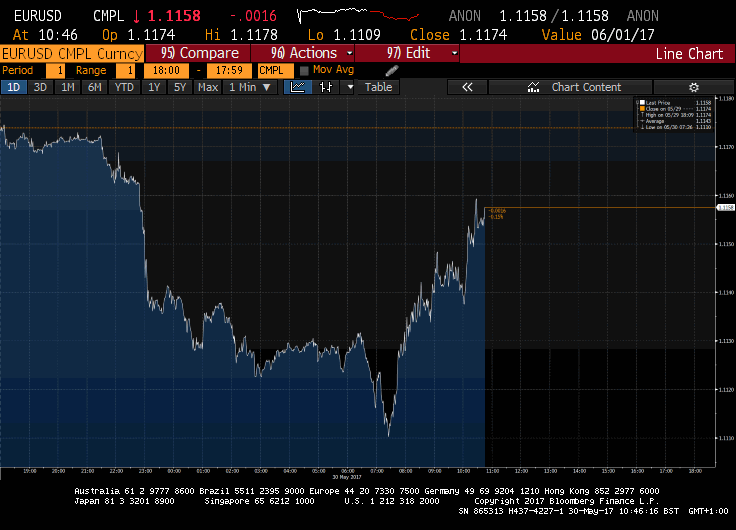

Euro regains momentum despite political worries over Greece and Italy

Despite worries over Greece and Italy, the euro has regained momentum in afternoon trade.

The single currency, which fell by as much as 0.45pc to $1.1114 against the US dollar, regained momentum to trade up 0.14pc on the day at $1.1190.

Meanwhile, the pound continues to rise, up 0.26pc against the US dollar, at $1.2868.

Greek PM held talks with Merkel, Macron and Tusk

Greek Prime Minister Alexis Tsipras held talks over the phone with German Chancellor Angela Merkel and French President Emmanuel Macron, the premier's office announced this afternoon.

It also said he had a telephone conversation with European Council President Donald Tusk today.

In a statement, the premier's office said:

"The prime minister relayed the Greek side's positions regarding the necessity for a clearcut solution on the issue of Greece's debt and all sides agreed to continue working ahead of the June 15 Eurogroup."

US stocks opened lower after raft of economic data

US stocks opened lower this afternoon as investors digested a raft of economic data after the long weekend.

At the opening bell:

Dow Jones: -0.17pc

Nasdaq: -0.11pc

S&P 500: -0.19pc

Pizza Express chief Hodgson exits just weeks after second UK sales dip

Back in London, Pizza Express boss Richard Hodgson has resigned. Bradley Gerrard reports:

The chief executive of Pizza Express has resigned after four years in the job just weeks after the business suffered a second annual drop in UK sales.

Richard Hodgson’s resignation will see him leave the company in the wake of a like-for-like sales fall in the UK and Ireland of 0.9pc in the year to January 1 in spite of a new partnership with delivery giant Deliveroo.

At the time Pizza Express announced the sales fall in XX, Mr Hodgson put this performance - which was marginally better than the 1.3pc like-for-like UK sales fall in the prior year - down to a “softening casual dining market” but the numbers are markedly different to the chain's previous rapid growth.

Pizza Express is owned by Chinese private equity group Hony, which spent £900m in 2014 to take control of the company.

But the chain is now having to fight off a growing number of fast-growing rivals, including London-focused Franco Manca, part of the listed Fulham Shore group headed by former Pizza Express chief executive David Page, as well as an ever growing litany of casual dining chains across a range of food types, from Mexican-focused Wahaca to Asian-focused Wagamama.

US consumer spending jumps; monthly inflation rebounds

US consumer spending enjoyed its biggest monthly increase in four months, data from the Commerce Department showed, while monthly inflation rebounded.

Here's the latest on the economic data release from Reuters:

Consumer spending, which accounts for more than two-thirds of US economic activity, increased 0.4pc last month after an upwardly revised 0.3pc gain in March. Households spent more on both goods and services last month.

#USD uptick after Personal Consumption Expenditure index which #Fed watches closely. +0.2% in Apr vs +0.1% fcast & -0.1% in Mar ^KO

— Ken Odeluga (@Ken_CityIndex) May 30, 2017

April's increase was the biggest since December and could ease concerns about second-quarter economic growth after weak reports on core capital goods orders, the goods trade deficit and inventory investment in April. Consumer spending was previously reported to have been unchanged in March.

The personal consumption expenditures (PCE) price index rebounded 0.2pc in April, reversing March's 0.2pc drop. In the 12 months through April, the PCE price index increased 1.7pc after rising 1.9pc in March.

Solid consumer spending & disposable income April: both +0.4% nominal & +0.2% in real terms. Solid trend: Income +1.9%; Spend +2.6% y/y pic.twitter.com/1RRPaT7sTK

— Gregory Daco (@GregDaco) May 30, 2017

Excluding food and energy, the so-called core PCE price index also bounced back 0.2pc after dipping 0.1pc in March. In the 12 months through April, the core PCE price index increased 1.5pc after rising 1.6pc in March.

The core PCE is the Fed's preferred inflation measure. The central bank has a 2pc target for core PCE.

But rising inflation is cutting into both consumer spending and income growth. When adjusted for inflation, so-called real consumer spending rose 0.2pc last month after advancing 0.5pc in March.

US stocks set to open little changed

US stocks are poised to open little changed after a three-day holiday weekend as investors eye economic data.

On Friday, the S&P 500 and the Nasdaq closed at record highs.

Investors will be keeping an eye on economic data to assess if weak first-quarter economic data was transitory. A second reading of the GDP on Friday showed the economy grew at a faster pace then previously estimated in the first three months of the year.

Hikma and Intu Properties facing FTSE 100 relegation

The latest predictions from the LSE using Friday's closing prices suggest Hikma and Intu Properties are facing relegation from the FTSE 100, while G4S and Segro are set for promotion to the blue chip index.

FTSE 250 constituents that are eligible for potential entry into the FTSE 100 Index are as follows:

G4S

Segro

FTSE 100 constituents that are eligible for potential demotion into the FTSE 250 Index include:

Hikma Pharmaceuticals

Intu Properties

FTSE 250 Index

FTSE 250 constituents that are eligible for potential demotion into the FTSE Small Cap Index are:

PayPoint

Debenhams

Keller

AO World

Allied Minds

BH Macro (GBP)

SVG Capital

FTSE Small Cap companies or new entrants that are eligible for potential entry into the FTSE 250 Index include:

Melrose Industries

Pershing Square Holdings

Sirius Minerals

Coats Group

Stobart Group

TBC Bank Group

FDM Group Holdings

A final decision and approval of changes will be announced after markets close on Wednesday, using the market capitalisation of companies at close of trading on Tuesday 30 May. Changes will be made effective after market close on Friday 16 June.

German EU-harmonised consumer prices fall 0.2pc in May

German consumer prices fell by 0.2pc this month, but were up 1.4pc on the year in May, preliminary data from the Federal Statistics Office showed this afternoon.

Both readings, which are harmonised to compare with other European countries, came in weaker than expected. Forecasts points to a yearly increase of 1.6pc, but expected the monthly reading to be unchanged.

German CPI/HICP slightly weaker than expected. No breakdown available but core probably on the weak side based on state CPI data.

— Frederik Ducrozet (@fwred) May 30, 2017

ECB to discuss closing door to extra stimulus next week - Reuters

The ECB is likely to discuss removing easing bias at their June meeting next week, Reuters has reported citing sources. Here's the full story:

European Central Bank policymakers are set to take a more benign view of the economy when they meet on June 8 and will even discuss dropping some of their pledges to ramp up stimulus if needed, four sources with direct knowledge of the discussions told Reuters.

With economic growth clearly shifting into higher gear, rate setters are ready to acknowledge the improvement by dropping a long-standing reference to downside risks in the bank's post-meeting opening statement, calling risks largely balanced, the sources said. Growth indicators have been outperforming expectations all year.

But they disagree on how quickly the ECB should change its policy stance, including its guidance, with countries on the currency bloc's periphery fearing that a sharp shift in its communication could induce self-defeating market turbulence, they added.

ECB Sources: Likely to discuss removing easing bias at the June meeting but decision far from certain. pic.twitter.com/16PujjZOVu

— Sigma Squawk (@SigmaSquawk) May 30, 2017

"After the French election the political risk is clearly down and economic indicators are by and large positive, so it's time to acknowledge this," said one Governing Council member who declined to be named.

Having fought off the threat of deflation with years of extraordinary stimulus, the debate within the ECB is shifting to the pace of normalisation, pitting doves who want incremental changes against conservatives who fear that the ECB could miss its cue, forcing more abrupt moves later.

"The positive environment has been relatively short compared to the long periods of crises we had," another source said. "It wouldn't be responsible to base a major policy shift on such a short upswing."

A key debate at the June 8 meeting is likely to be whether the bank should axe all or part of its so-called easing bias, a pledge keep rates at their current or lower levels for an extended period and to increase the volume of asset buys if the outlook worsens.

Though many investors expect a decision on this, the sources said that this was far from certain.

"This will be the first time we discuss this so I don't necessarily expect a decision," another source said.

JP Morgan upgrades UK stocks to 'neutral'

US investment bank JP Morgan upgraded its rating on UK equities to "neutral" from "overweight", as it thinks the UK is becoming "interesting in the regional allocation again".

UK equities have gained 9pc in the past six months, lagging behind their eurozone peers, which are up 18pc over the same period.

Here are the reasons cited by JP Morgan strategists Mislav Matejka for the change of heart:

UK is a defensive market with high dividend yield. It should perform better in the backdrop of potential softening in activity indicators, lower inflation prints and continued range-bound bond yields. Market internals have turned defensive since early May, which is a support for the UK.

We think commodity sectors will perform better from here post Q1 weakness, helping UK – consistent with the big picture of a lower USD.

GBP might not move much higher from here, which would be a tailwind for the exporters’ part of the FTSE100. FX is also a hedge on any unexpected political outcome. Labour win would be challenging for many domestic plays – screens in the report – but exporters would benefit from the potentially weaker GBP.

UK appears under-owned and it is back to being record cheap on P/B relative.

Half-time update: European shares fall for fourth consecutive day

European shares fell for a fourth consecutive day as concerns about geopolitical risks in Greece and Italy sapped risk appetite in the region.

Banks were among the biggest laggards following a downgrade by German lender Deutsche Bank.

At midday:

FTSE 100: -0.43pc

CAC 40: -0.59pc

DAX: -0.12pc

IBEX: +0.09pc

Euro Stoxx 600: -0.21pc

Connor Campbell, of SpreadEx, said: "The morning’s losses eased slightly as lunchtime approached, though not by enough to lift the European indices out of the red.

"The FTSE managed to reduce its decline from 0.7pc to half a percent – admittedly not great progress – thanks to an improvement in its mining sector and a recovery from a couple of its banks. Part of the reason the UK index hasn’t been able to gather any real momentum is the gains made by the pound. Sterling rose 0.2pcagainst both the dollar and the euro; while that’s not enough to substantially lift it away from its recent lows, it’s a start."

Potential hurdles to further euro strength in the near-term

With the euro trading in negative territory today amid concerns about Greece and Italy, MUFG's Lee Hardman sets out the potential hurdles facing the euro in the near-term:

President Draghi continues to strike a dovish tone: ECB President Draghi continued to strike a dovish tone when addressing the European parliament yesterday. He emphasized that the euro-zone still needs “an extraordinary amount of monetary support” from the ECB in spite of its strengthening economic recovery. The dovish comments will help to dampen expectations for a more material hawkish shift in policy at the ECB’s upcoming policy meeting on the June 8.

Risk of early elections in Italy has increased: The euro has been undermined by a pick-up in European political risk. Reports over the weekend have indicated that there is a higher likelihood that Italy could hold elections earlier than planned by the autumn of this year. Italy’s largest political parties are reportedly near to a deal on a new electoral law which would then open the door to holding early elections. The leader of the ruling centre-left Democratic party Renzi has stated that he sees sense in holding election in the autumn perhaps even on the same day as the German elections, although he did emphasize as well that the Democratic party is not pushing for early elections.

Downside tail risk from Greece still remains in play: The more immediate downside risk for the euro is the ongoing negotiations to provide further financing for Greece. Market participants could become more concerned by developments if there is a lack of progress. The Bild has reported that Greece may consider waiving the next tranche of financing unless creditors agree on debt relief. We continue to expect that a compromise deal will ultimately be reached next month, but will continue to monitor the ongoing developments closely.

JP Morgan: Centre-left UK coalition might be positive for pound

The pound is set for a volatile ride ahead of next week’s general election, but analysts at JP Morgan think the local currency could react positively to a defeat for Prime Minister Theresa May’s Conservatives Party.

Although FX investors had shown little interest in what opinion polls indicated was a one-horse race, on Friday, the pound suffered its biggest one-day loss since January after recent polls showed the Conservatives’ lead has shrunk.

In a note published on Friday, but distributed to media today, the bank’s FX strategist Paul Meggyesi said: “The wake-up call for markets was a YouGov poll released on Thursday– this shows a halving in the Conservative lead to only 5pts compared to an average of polls at the start of the week.

“In some ways this election campaign is starting to resemble the Scottish independence referendum in 2014. Markets were unperturbed until the very end of that campaign when a solitary poll showing a majority in favour of independence caused a last minute jump in the political risk premium.”

The US investment bank thinks the prospect of a “less disruptive Brexit” under a Labour-led government might see the pound react positively to a defeat for the Conservatives.

Mr Meggyesi said: “A hung parliament would in more normal circumstances be viewed as quite negative for sterling – that was very much the experience of the 2015 election when sterling was braced for one of a myriad of potential coalition permutations only for sterling to jump by 3pc once David Cameron secured an improbable narrow majority.

“But in the post-referendum world, all political developments need to be viewed through a Brexit prism and an argument can be made that a hung parliament which delivered or held out the prospect of a softer-Brexit coalition of the left-of-centre parties (Labour/Lib Dems/SNP) might actually be sterling positive.”

However, JP Morgan pointed out that the market doesn’t appear to share the same assessment, as the pound dropped 1pc after the polls tightened last week.

Mr Meggyesi added: “This suggests that in balancing the two competing risk premia the market is attaching greater weight to Labour’s domestic policies than it does the party’s stance on Brexit. But this is a potentially fine balancing act and the market’s judgement could just as easily swing the other way.”

FTSE 100 retreats from record highs in mid-morning trade

In mid-morning trade, the FTSE 100 dropped 29.15 points, or 0.38pc, to 7,518.80.

On Friday, the blue chip index touched a new record high of 7,554.21.

Chris Beauchamp, of IG, said: "The lifespan of market dips these days appears to shorter than that for a fruit fly. The FTSE 100 opened in the red and briefly dipped below 7500, but already the bargain hunters are back in and preventing further losses.

"Europe also had a wobble on the open, partially due to punchy negotiating tactics from Greece over the next bailout payment, but the sound of Draghi promising more stimulus yesterday has been more than sufficient to tempt buyers back in to the market. Over the past few sessions we have seen a decent recovery in the breadth of the rally, with the number of risers beginning to outnumber the fallers. Perhaps we are coming to the end of the recent weakness in eurozone stocks in particular, with a falling euro likely to aid any rally."

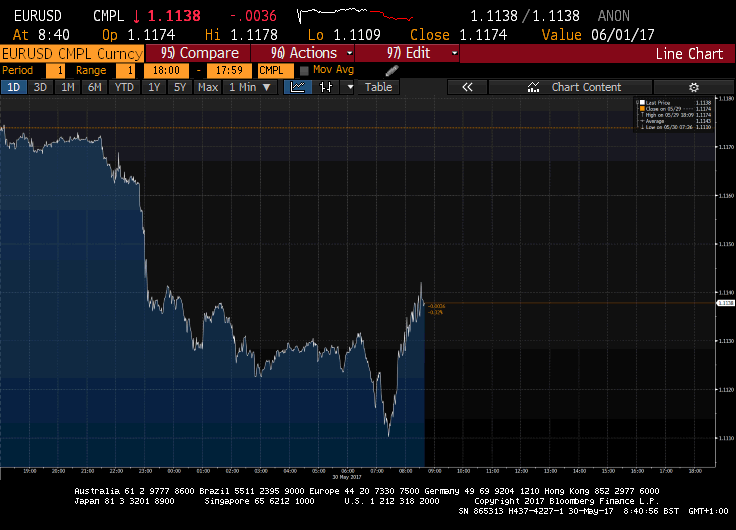

Euro regains momentum; down 0.15pc on the day

The euro has regained some momentum despite concerns about Greece and Italy weighing on the single currency.

After skidding to an intraday low of $1.1109 against the dollar, it's now trading down 0.15pc on the day at $1.1159.

UK 10-year yields dip below 1pc for first time since October

UK 10-year government bond yields dropped briefly below 1pc for the first since October today.

The 10-year gilt yield fell to a 0.99pc shortly after markets opened, marking its lowest level since October 13, before nudging back above 1.01pc.

While sterling has fallen sharply since opinion polls started to raise doubts about Prime Minister Theresa May's ability to deliver a large majority in next week's election, there has been little impact on gilts, Societe Generale fixed income strategist Jason Simpson said.

"Bunds were trading on Monday, the 10-year (Bund yield) fell 4 basis points. Gilts are benefiting from that a bit," Simpson said, adding there was little economic news out of Britain on Tuesday.

Simpson said the 1pc mark had significance because the last time gilts were trading at that level regularly, the Bank of England had recently cut interest rates and was talking of more stimulus.

But he doubted gilt yields had much further to fall now.

"Unless we feel that we are in that sort of environment again, to my mind (yields) will struggle to sustain any break lower," he said.

Quotes from Reuters

Eurozone economic sentiment: A downside surprise

Eurozone economic sentiment fell in May from a near 10-year-high in April against expectations of a rise, as confidence mostly dropped in services, data from the EU showed this morning.

The headline economic confidence index fell to 109.2 in May from a revised 109.7 in April, below the consensus, 110.0.

Weighing in on the slide in economic sentiment, Claus Vistesen, of Pantheon Macroeconomics, said the "surprising dip" was mainly due to lower sentiment readings in Germany and Italy.

He added: "The decline in German sentiment is especially odd in light of solid PMIs and the rise in the IFO, but not unusual. The survey continues to signal strong GDP growth in the Eurozone’s strongest economy. Elsewhere, sentiment rose in Spain, France and Portugal while it slipped in Greece.

"The headline dip will reinforce markets’ increasingly dovish expectations for the coming ECB meeting—at the margin at least—but it doesn’t really move the needle with respect to main story in this survey."

Pound inches higher as investors keep bets on May victory

Sterling rose against the dollar today, with investors shrugging off opinion polls showing British Prime Minister Theresa May's lead over the Labour opposition narrowing less than two weeks before a general election.

The pound has made gains of 4pc since Theresa May called a snap election for next week.

Mihir Kapadia, CEO and Founder of Sun Global Investments, said: "This continued recovery since last week’s lows is an encouraging trend, but with the general election in little over a week, the performance of the currency will be volatile depending on the trends in the polls. The lead between the Conservatives and Labour is narrowing and this could be a worry for markets as it raises the spectre of a hung parliament. However, with the Euro struggling for reasons noted above, the pound may end up being relatively steady against the euro while losing ground against the US dollar.”

Investors remain cautious #GBP pricing a ‘bad' outcome of #UKElection2017. 'EUR/GBP cone' suggests sell on rallies https://t.co/OvosHiV4OLpic.twitter.com/kcN1puxdB8

— Morten Helt (@morten_helt) May 30, 2017

The local currency is currently trading up 0.17pc on the day at $1.2857, having touched an intraday low of £1.2794 earlier this morning.

Euro speculative positions rise in May

Jamie McGeever, of Reuters, points out that the month of May market the second biggest rise in long euro positions since the single currency's launch in 199.

May was quite a month for euro spec positions on the IMM/CFTC - the second biggest rise in long positions since the euro's launch in 1999. pic.twitter.com/dzRJvXosbY

— Jamie McGeever (@ReutersJamie) May 30, 2017

EU May economic sentiment falls after near 10-year high in April

Eurozone economic sentiment fell in May from a near 10-year-high in April against expectations of a rise, as confidence mostly dropped in services, European Union data showed this morning.

The European Commission's monthly survey said the overall index for the 19-country currency bloc fell to 109.2 from an upwardly revised 109.7 in April. Economists polled by Reuters had expected an increase to 110.0 points.

A separate business confidence indicator, which indicates the phase of the business cycle, fell to 0.90 in May from an upwardly revised 1.10 in April, against market expectations of a rise to 1.11.

European Union Economic Sentiment announcement - Actual: 109.2, Expected: 110.0 pic.twitter.com/mNYCbL8Phe

— Spreadex (@spreadexfins) May 30, 2017

The drop in sentiment was mostly driven by less optimism in the services sector, the largest in the euro zone, which dropped to 13.0 in May from 14.2 in April.

Confidence in the retail sector also dropped to 2.0 from 3.1.

But in a sign that the euro zone economy is still in a phase of healthy recovery, the manufacturing sector recorded a boost in confidence to 2.8 points from 2.6.

Inflation expectations among consumers went down to 12.8 from 13.9, in a sign of appetite for future purchases. Expectations of selling prices among manufacturers were stable.

Lower inflation would reduce pressure on the European Central Bank to quickly end its monetary stimulus.

The indicator for overall consumer confidence rose to -3.3 points in May from a downwardly revised -3.6 in April.

Report from Reuters

Pound nudges back above $1.28

After sliding to $1.2794 in early morning trade, the pound has nudged above the $1.28 barrier.

Turning positive on the day, it bounced half a cent higher to $1.2866 against the US dollar.

The local currency is particularly sensitive to next week's general election. After posting its worst falls last Friday since January, the pound regained some ground yesterday after weekend polls showed Prime Minister Theresa May is set to win the election.

London Stock Exchange splashes £535m on US analytics business

Back in London, shares in London Stock Exchange Group have edged up 5p to £33.97 after it snapped up Citi's analytics and index businesses for £535m. Sam Dean reports:

The London Stock Exchange has splashed more than £500m on an analytics business in its first major move since its failed merger with Deutsche Boerse.

LSE has paid $685m (£535m) for US investment bank Citi’s analytics and index businesses two months after EU regulators blocked plans to create Europe’s largest exchanges operator.

The group said the acquisition of Citi’s Yield Book and Citi Fixed Income Indices arms marked a “significant step” as it builds on its presence in the US capital markets business.

It follows the 2014 purchase of the US stock index business Russell, which led to the creation of FTSE Russell.

LSE said the deal, which raises its FTSE Russell assets under management to around $15 trillion, “enhances and complements LSEG's Information Services data and analytics offering, building on FTSE Russell's US market presence and fixed income client base globally”.

Geopolitical risks weigh on European shares

With European bourses on the back foot this morning, Jasper Lawler, of London Capital Group, said European assets need the three pillars of stronger economic data, higher political risk in the US and reduced political risk in Europe to outperform.

Mr Lawler said: "Italy and Greece are holding the sledgehammer that could knock down one of those three pillars. The confluence of risk associated with Italian elections, the Greek bailout and ECB President emphasising global risks are sending the euro lower on Tuesday."

Euro strength clipped by ECB and Italy

Jeremy Cook, of World First, weighs in on the euro weakness:

"We have a very European flavour in markets this morning with the single currency on the back foot as most of the Western world returns to their desks. Comments from ECB President Draghi were enough to start weakening the euro but fears over an Italian election being called earlier than had previously been thought as well as fears over the Greek debt deal and its everlasting ability to throw up something strange in the summer months won’t have helped.

"Draghi’s comments that the European economy needed ‘expansive’ stimulus to restore a level of a stability to the Eurozone despite the recent acceleration in growth is about as obvious as it gets.

"Similarly, news reports over the weekend in Italy that suggested that a proportional electoral law could be passed increases the chances that an early election is called. Italian bonds as well as those of other periphery nations fell against the more secure German and French notes. Finally Germany’s Build newspaper hinted yesterday that Greece is ready to default on its next debt payment should the next package not include some form of debt relief. Their next payment is due in July."

German inflation due as euro weakens - World First Morning Update May 30th - https://t.co/JfEON7YiK1pic.twitter.com/edCH4yvwqX

— World First (@World_First) May 30, 2017

Shares in British Airways owner IAG skid after IT failure chaos

Shares in British Airways owner IAG retreated from one-and-a-half-year highs this morning, falling 3pc, after trading resumed in London following British Airways' massive IT outage. Bradley Gerrard reports:

Investors have taken flight from British Airways' parent company with shares in IAG tumbling on the first day of London trading since an IT meltdown left thousands of passengers stranded.

International Airlines Group saw its shares drop roughly 4pc in early trading to 589p, even greater than the 2.8pc drop it recorded yesterday on the Madrid stockmarket, where the shares are also listed.

The airline has been scrambling to get thousands of passengers stranded at Heathrow and Gatwick Airports onto their flights as well as dealing with passengers overseas.

Chief executive Alex Cruz blamed the IT failure on an “exceptional” power surge, which he said had been so strong it also disabled the company’s back-up system.

The IT system that was hit is responsible for British Airways’ flight, baggage and customer communication systems across 170 airports in 70 different countries.

Greek finance minister dismisses reports Greece may not repay its debt

As the euro skids on fears Greece may forego its next bailout payment following reports in Germany's Bild newspaper overnight, Greek finance minister Euclid Tsakalotos has dismissed such reports.

Speaking to Reuters, he said: "Bild has distorted what I said yesterday. I never said that Greece would not repay debt in July. There is no such issue.

"What I did say is that the disbursement was not an issue, because all sides agreed that we have kept to our commitments. But the Greek government feels that a disbursement without clarity on debt is not enough to turn the Greek economy around."

Ryanair ticket prices set to fall by up to 7pc this year

Shares in low-cost carrier Ryanair have fallen 2pc this morning after it reported record annual profits despite sharp falls in average fares. Sam Dean reports:

Ryanair has said it expects the cost of flights to fall by up to 7pc in the coming year because of the weakness of sterling and excess capacity on its planes.

In its full-year results, the low-cost airline said the average fare would decline by 5 to 7pc.

The company unveiled a 5pc increase in pre-tax profits to €1.47bn (£1.28bn) and a 2pc rise in revenues to €6.6bn in the year to March 31.

Chief executive Michael O’Leary said he was “pleased” with the results, which come “despite difficult trading conditions caused by a series of security events at European cities, a switch of charter capacity from North Africa, Turkey and Egypt to mainland Europe, and a sharp decline in Sterling following the June 2016 Brexit vote”.

Ryanair saw a 13pc increase in customers in the year, from 106m to 120m.

Meanwhile, the company's chief marketing officer told the BBC that it has not subcontracted its IT services to avoid any of the problems that have plagued British Airways.

European shares open lower for fourth consecutive trading session

European shares opened lower for a fourth consecutive trading session as geopolitical fears sapped risk appetite.

Banks were among the biggest fallers following a downgrade by Deutsche Bank. The German lender thinks the sector is among the most sensitive to swings in euro area growth, which it expects will fade.

Here's a snapshot of the current state of play in Europe:

Henry Croft, of Accendo Markets, said: "A negative opening call comes as European and US traders return after their extended weekend to heightened geopolitical tensions in the Eurozone (Greece debt repayment, Italian elections, ECB dovishness), UK (election ‘debate’ & polls), Asia (yet another North Korea missile test) and the US (Trump’s return to Washington). The US dollar opening sharply higher, alongside Crude Oil prices failing to return to May highs following last week’s OPEC deal, has left commodities mixed overnight."

French Q1 growth revised up to 0.4pc

Elsewhere, the French economy grew 0.4pc in the first quarter from the previous three months, the INSEE national statistics agency said this morning, revising the figure up from a preliminary estimate of 0.3pc.

However, despite the upward revision it still marks a marginal slowdown from the fourth quarter of 2016, when the French economy grew by 0.5pc.

French GDP growth revised up to 0.4% in Q1 => Above trend, but labor market needs more quarters like these. My take: https://t.co/28hyMSGV8bpic.twitter.com/1x1QV7NOrG

— Maxime Sbaihi (@MxSba) May 30, 2017

Italian election uncertainties dent euro

It's not just Greece woes weighing on the euro this morning, uncertainties about the Italian election have also pulled the single currency lower this morning.

At the weekend, former Italian prime minister Matteo Renzi suggested that Italy's next election should be held at the same time as Germany's, saying it made sense from "a European perspective".

Germany goes to the polls on September 24, while Italy's election isn't due to take place until May next year.

The comments led to mounting speculation that Italians could head to the polls in autumn, hurting the single currency.

Renzi, leader of the ruling centre-left Democratic Party (PD), said in an interview with the newspaper Il Messaggero that his party "would not ask for early elections, but is not afraid of them either".

Euro skids 0.45pc on Greece uncertainties

The reports suggesting Greece might forgot its next bailout payment if creditors cannot strike a relief deal is weighing heavily on the euro this morning.

The single currency fell by as much as 0.45pc to $1.1114 against the US dollar, marking its fourth session of declines.

It has recovered some ground this morning and is changing hands at $1.1137.

Greece may forego next bailout payment, German press reports

The saga in Greece continued as German paper the Bild reported that the Greek government is preparing to default on its next bailout payment if creditors don't agree on debt relief.

Speaking to Reuters, James Woods, global investment analyst at Rivkin Securities in Sydney, said: "The bailout payments are necessary to meet existing debt repayments due in July, so if Greece were to forgo this bailout payment the probability of a default would spike, reopening the discussion around a Grexit from the eurozone."

However, he cautioned against reading "too much into it" without more details or confirmation, adding it was unlikely Greece would forgo the bailout payment at this stage.

Eurozone finance ministers failed to agree with the International Monetary Fund on Greek debt relief or to release new loans to Athens last week, but did come close enough to aim to do both at their June meeting.

#Greece (3) | May Opt Out of Next Payment Without Debt Deal - Bloomberg (citing Bild) pic.twitter.com/DuKFicoLiY

— Christophe Barraud (@C_Barraud) May 30, 2017

Quotes from Reuters

Greek finance minister calls on IMF and European creditors to end procrastination on debt relief

Greece's finance minister Euclid Tsakalotos he was "confident" that an upcoming eurozone meeting would reach a "good solution" on debt relief, whilst calling on creditors to end their "procrastination".

"We're looking for a good solution. We're not looking for a perfect solution. I'm confident we'll get a good solution," Tsakalotos said in reference to the upcoming meeting on June 15.

"The pressure is on all sides...don't procrastinate at the cost of the Greek economy," Tsakalotos said.

"We are getting close to the time when a decision needs to be taken," he added.

Greece's debt mountain stands at a towering 179 percent of annual output, the legacy of a crisis that brought panic to the markets and nearly forced the country out of the euro.

Agenda: Fears Greece may forego next bailout payment weigh on single currency

Good morning and welcome to our live markets coverage.

Overnight, Asian stocks slipped as European geopolitical fears weighed on risk appetite, while trading was also thin with several markets closed for holidays.

Good morning from Berlin! Asia stocks flat in holiday-thinned trading. Greece, Italy tensions and dovish comments from ECB's Draghi hit euro pic.twitter.com/HQXkoedFRp

— Holger Zschaepitz (@Schuldensuehner) May 30, 2017

Greece's creditors need to reach a deal on debt relief measures at the next meeting of eurozone finance ministers in June to help the country return to bond markets, its finance minister said yesterday.

Lat week, the Eurogroup failed to reach an agreement with the IMF on Greek debt relief as well as failing to release new loans to Athens.

"The Greek government feels it's done its part of what it promised," Finance Minister Euclid Tsakalotos said, referring to parliamentary approval this month on a package of reforms to be implemented in 2019-20, when its existing bailout expires.

However, a report from Germany's Bild last night suggested that Greece may opt out of its next bailout payment if creditors cannot strike a debt relief deal, which hurt the single currency.

Greece threatens to opt out of next payment without a debt deal reports Bild

— LiveSquawk (@LiveSquawk) May 29, 2017

Also on the agenda:

Full-year results: Renold, Horizon Discovery Group, Kainos Group, Ryanair

Interim results: AFI Development

AGM: ValiRx

Economics: Nationwide HPI m/m (UK), Core PCE Price Index m/m (US), Personal Spending m/m (US), personal income m/m (US), CB consumer confidence (US)

Yahoo Finance

Yahoo Finance