Euro’s Gains Proves Fed Hike Anticipated

The Euro has gained on the heels of the interest rate hike via the U.S Federal Reserve. The Euro/ USD forex pair has provided a consistent range since January.

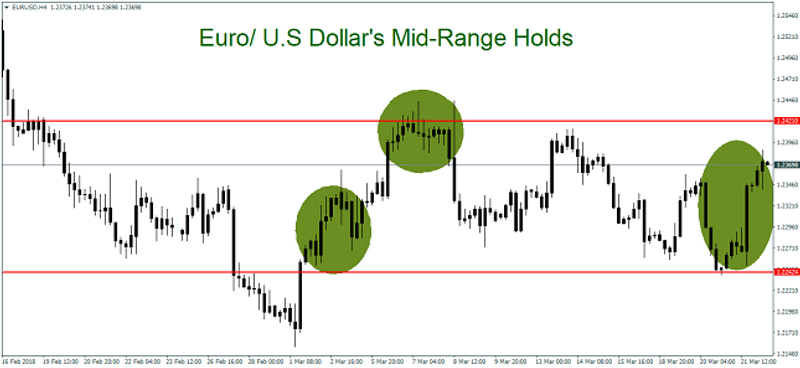

Euro Entrenched Solidly in Range

The Euro has climbed upon the interest rate hike from the U.S Federal Reserve, and the central bank’s pronouncement it intends to maintain a proactive stance while taking economic data into account as it develops.

The Euro is near 1.2360 and is entrenched solidly within its mid-term range, with resistance around the 1.2425 level and support near 1.2240 versus the U.S Dollar.

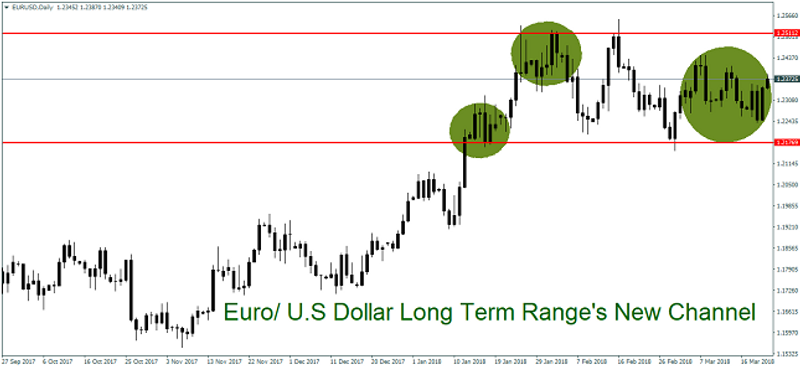

Consistent Channel since January for Euro

The ability of the Euro to gain after an interest rate hike from the States implies the move by the Fed was widely anticipated and already digested within forex.

A look at a long-term chart for the Euro/ U.S Dollar shows a strong channel for the forex pair has existed since early January, and we believe it will continue to prove a relatively consistent range.

In the short term, we believe the Euro could be positive. The mid-term and Long term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire

More From FXEMPIRE:

Stellar’s Lumen Technical Analysis – Lumen Turns Bearish – 22/03/2018

Crypto Update: Cryptocurrencies Negative in Mid-Day Trading, U.S Tax Season Approaching for Traders

E-mini Dow Jones Industrial Average (YM) Futures Analysis – March 22, 2018 Forecast

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – March 22, 2018 Forecast

Yahoo Finance

Yahoo Finance