Euro Forecast was Accurate Last Week, but now what?

DailyFX.com -

NEW: View Real-Time SSI Updates via the FXCM Trading Station Desktop

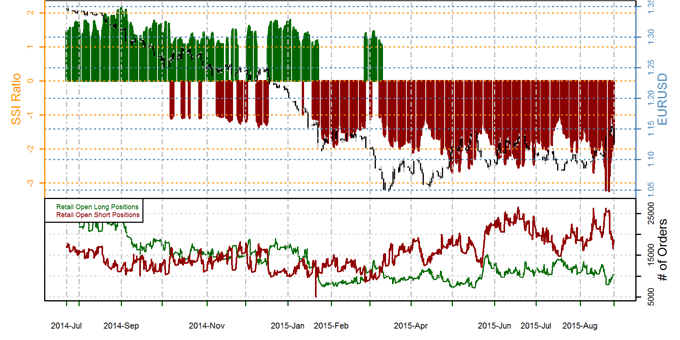

EURUSD – Retail FX traders were recently the most net-short the Euro versus the US Dollar since it traded to $1.40 through May, 2014, and a contrarian view of crowd sentiment kept us steadily bullish the EUR/USD. Yet the past week has seen a substantial pullback in short interest. First we saw many traders forced out of short positions as the pair spiked to $1.17, and since then we have seen many take profits on the substantial Euro pullback. Such a dramatic reversal in both price and positioning creates a great deal of uncertainty.

Crowds remain net-short, and we would typically treat this as a contrarian indication that the EUR/USD could continue higher. Yet clear market indecision since last week leaves us waiting for a more sustained shift in sentiment before taking a strong stance.

See next currency section: GBPUSD - British Pound Likely to Fall Further

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance