EUR/USD Trades Higher off of Trendline Support

Afternoon Technicals (all charts)

FOREX Trading and Technical Analysis Observations

My focus remains on euro crosses, specifically EURUSD, EURAUD, EURCHF

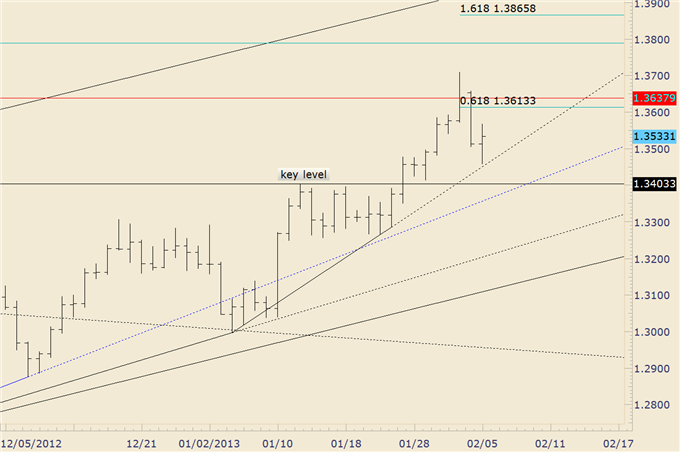

The EURUSDresponded at trendline support beneath 13500 and the aggressive impulsive bullish count is valid above 13403. Look higher. Potential resistance before Friday’s high comes in from the 61.8% retracement of the decline at 13613.

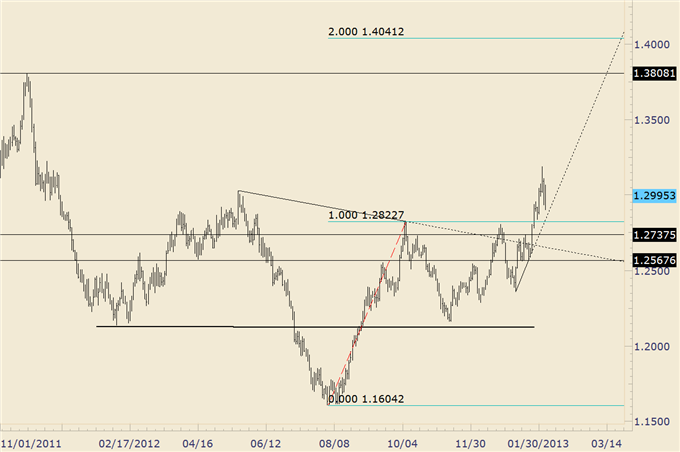

The EURAUD is well off of the lows set last night on the release of the RBA rate decision. Trendline support isn’t until about 12830 today. The line increases about 30 pips per day. The long term bullish breakout is valid against 12568. The target from the inverse head and shoulders isn’t until above 14000.

The EURCHF may be searching for an important low. Price is testing the 50% of the advance from the ‘floor’. I’m bullish as long as price is above the former range high of 12183 (daily closing basis).

No change regarding AUDNZD from yesterday – “the AUDNZD has confirmed a multiyear head and shoulders top. The objective is 10841 and I’m bearish against 12551.”

EURUSD – Daily

Prepared by Jamie Saettele, CMT

EURAUD –Daily

Prepared by Jamie Saettele, CMT

EURCHF –Daily

Prepared by Jamie Saettele, CMT

AUDNZD –Weekly

Prepared by Jamie Saettele, CMT

--- Written by Jamie Saettele, CMT, Senior Technical Strategist for DailyFX.com

To contact Jamie e-mail jsaettele@dailyfx.com. Follow me on Twitter for real time updates @JamieSaettele

Subscribe to Jamie Saettele's distributionlist in order to receive actionable FX trading strategy delivered to your inbox.

Jamie is the author of Sentiment in the ForexMarket.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance