EUR/USD Mid-Session Update for October 16, 2019

The Euro is trading higher against the U.S. Dollar on Wednesday after U.S. retail sales fell for the first time in seven months in September, increasing the chances of a Fed rate cut at its policy meeting on October 29-30.

According to the Commerce Department, retail sales dropped 0.3% last month as households slashed spending on building materials, online purchases and especially automobiles. The decline was the first since February.

Data for August was revised up to show retail sales gaining 0.6% instead of 0.4% as previously reported. Economists polled by Reuters had forecast retail sales would climb 0.3% in September. Compared to September last year, retail sales increased by 4.1%.

After the release of the disappointing report, the chances of a Fed rate cut jumped from 78.4% to 88.2%, according to the CME FedWatch Tool.

Lower rates tend to make the U.S. Dollar a less-attractive investment.

At 14:20 GMT, the EUR/USD is trading 1.1048, up 0.0015 or +0.14%.

Daily Technical Analysis

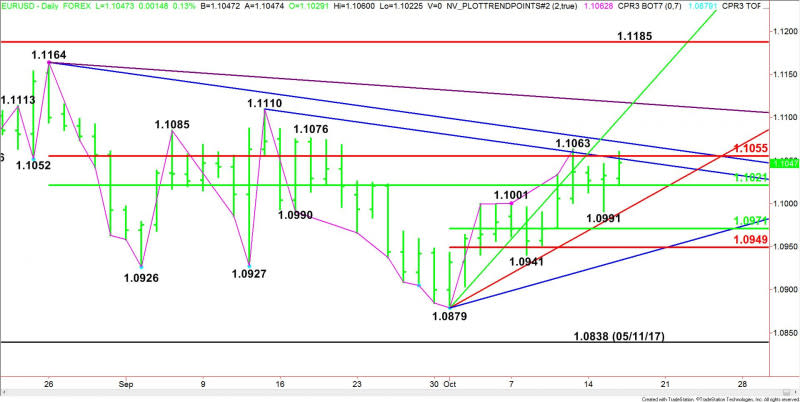

The main trend is down according to the daily swing chart, however, momentum is trending higher. The main trend will change to up on a trade through 1.1110. A move through 1.0879 will signal a resumption of the downtrend.

The minor trend is up. This move confirms the upside momentum. A trade through the minor top at 1.1063 will indicate the buying is getting stronger. The minor trend changes to down on a move through 1.0991.

The main range is 1.1164 to 1.0879. Its retracement zone at 1.1021 to 1.1055 is currently being tested. Trader reaction to this zone will determine the near-term direction of the EUR/USD.

The short-term range is 1.0879 to 1.1063. Its retracement zone at 1.0971 to 1.0949 is support.

Daily Technical Forecast

Based on the early price action, the direction of the EUR/USD the rest of the session on Wednesday is likely to be determined by trader reaction to the downtrending Gann angle at 1.1053 and the Fibonacci level at 1.1055.

Bullish Scenario

A sustained move over 1.1055 will indicate the presence of buyers. If this generates enough upside momentum then look for a move into the minor top at 1.1063, followed by the downtrending Gann angle at 1.1072. Overtaking this angle could drive the EUR/USD into the uptrending Gann angle at 1.1099.

Bearish Scenario

A sustained move under 1.1053 will signal the presence of sellers. This could trigger a retest of the 50% level at 1.1021. This is a potential trigger point for an acceleration to the downside with the next target angle coming in at 1.0989.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance