EUR/USD Increasingly Volatile Amid Preliminary Italian Election Results

THE TAKEAWAY: Centre-Left (pro-austerity, will take up Mario Monti’s reforms) candidate P. Luigi Bersani on pace to win majority in lower house of parliament; however, Centre-Right (anti-austerity, vows to roll back Monti-reforms) candidate and former Italian PM Silvio Berlusconi surging in senate elections. Why does this matter?

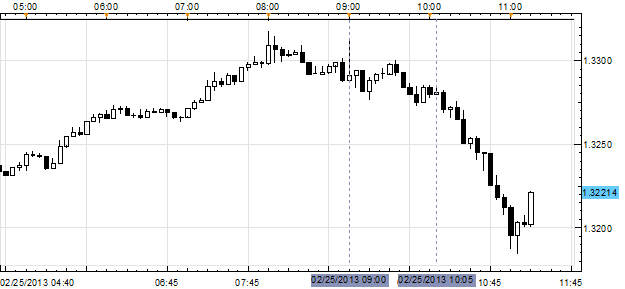

The EURUSD has had quite the volatile start to the week. After starting near 1.3180, the pair rallied up through 1.3300 on news that P. Luigi Bersani, the pro-austerity and Mario Monti-supported candidate, was well-positioned to see his party win a majority in the lower house of parliament.

While this news was continually priced in throughout the morning – really, up through the US cash equity open at 09:30 EST/14:30 GMT – the EURUSD was barely able to hold near 1.3300 as true results – not just exit polling samples – came out.

Thus far, a simple glance at the EURUSD intraday chart below tells all you need to know about further developments in the Italian elections: the anti-austerity candidate is surging at the wrong time. Silvio Berlusconi’s party is winning in the upper house of parliament, meaning that a divided government is very likely. In Italy, the upper and lower houses share power equally; thus, a prime minister from the lower house is essentially dead-weight if the upper house doesn’t comply.

EURUSD 5-minute Chart: February 25, 2013

Charts Created using Marketscope – Prepared by Christopher Vecchio

While the EURUSD has declined from above 1.3300 to test below 1.3200 in a matter of a few hours, the big picture remains the ascending trendline off of the July 24 and November 15 lows, currently holding at 1.3210. A daily close below this level, accompanied by the proper fundamental catalyst – in this case, a hung parliament – could provoke a deeper sell-off. With the US budget sequester just days away, scheduled to hit March 1, volatility is likely to be increasingly high.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance