EUR/USD to Give Back June Advance on Higher U.S. Income, Sticky PCE

DailyFX.com -

- Headline U.S. Consumer Price Index (CPI) to Expand for First Time Since December.

- Core Rate of Inflation to Hold at Annualized 1.8% for Third Consecutive Month.

For more updates, sign up for David's e-mail distribution list.

Trading the News: U.S. Personal Consumption Expenditure (PCE)

Sticky inflation along with a pickup in Personal Income & Spending may heighten demand for the greenback and trigger a near-term decline for EUR/USD as it boosts bets for Fed rate hike in September.

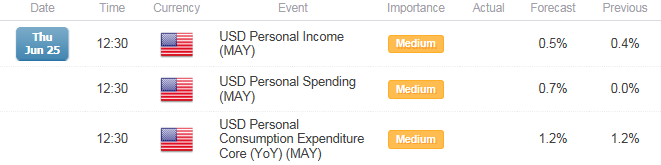

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Positive developments coming out of the world’s largest economy may keep the Federal Open Market Committee (FOMC) on course to normalize monetary policy later this year, and we may see a growing number of central bank officials adopt a more hawkish tone on the back of a stronger recovery.

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

Advance Retail Sales (MoM) (MAY) | 1.2% | 1.2% |

Average Hourly Earnings (YoY) (MAY) | 2.2% | 2.3% |

Non-Farm Payrolls (MAY) | 226K | 280K |

The ongoing improvement in the labor market paired with the pickup in household consumption may generate a slew of better-than-expected data prints, and the dollar may continue to recoup the losses from earlier this month should the developments fuel bets for higher borrowing-costs.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

Consumer Price Index ex Food & Energy (YoY) (MAY) | 1.8% | 1.7% |

Housing Starts (MoM) (MAY) | -4.0% | -11.1% |

Producer Price Index ex Food & Energy (YoY) (MAY) | 0.7% | 0.6% |

However, the persistent lack in the real economy accompanied with the disinflationary environment may become a growing concern for the Fed, and signs of a slower recovery may drag on interest rate expectations as Chair Janet Yellen remains in no rush to remove the zero-interest rate policy (ZIRP).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

How To Trade This Event Risk(Video)

Bullish USD Trade: U.S. Income/PCE Highlight Improved Outlook for Growth & Inflation

Need to see red, five-minute candle following the release to consider a short trade on EUR/USD.

If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: Mixed Batch of Data Warns of Slower Recovery

Need green, five-minute candle to favor a long EUR/USD trade.

Implement same setup as the bullish dollar trade, just in reverse.

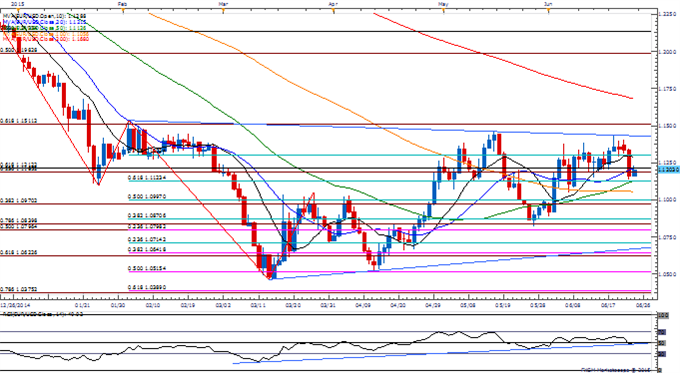

Potential Price Targets For The Release

EURUSD Daily

Chart - Created Using FXCM Marketscope 2.0

Despite the more cautious tone coming out of the Federal Reserve, EUR/USD may continue to face range-bound prices over the near-term as it fails to break out of the monthly opening range.

DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short EUR/USD since March 19, with the ratio approaching extremes as it slips to -2.43.

Interim Resistance: 1.1510 (61.8% expansion) to 1.1532 (February high)

Interim Support: 1.0970 (38.2% expansion) to 1.1000 (50% retracement)

Read More:

NZD/USD at Risk for Further Losses on Growing Bets for RBNZ Rate Cut

GBPJPY Opening Range Setup- Long Scalps Vulnerable Sub 195.50

Impact that US Personal Consumption Expenditure has had on EUR/USD during the last release

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

APR 2015 | 06/01/2015 12:30 GMT | 1.4% | 1.2% | +27 | -18 |

April 2015 U.S. Personal Consumption Expenditure (PCE)

The core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, unexpected slowed to an annualized 1.2% from 1.3% in April, while Personal Spending remained flat following a revised 0.5% advance the month prior. In contrast, Personal Income exceeded market forecasts for a 0.3% print as wage growth increased 0.4% during the same period. Nevertheless, the mixed batch of data prints coming out of the U.S. economy raises the risk for a further delay in the Fed’s normalization cycle as the developments point to a slowing recovery. The greenback struggled to hold its ground following the data prints, but the reserve currency snapped back during the North American trade, with EUR/USD slipping below the 1.0950 region to end the day at 1.0923.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance