EUR/AUD Gaps Into Resistance- Pullback to Offer Opportunity

DailyFX.com -

Talking Points

EUR/NZD pullback off key resistance to be viewed as opportunity

Updated targets & invalidation levels

Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

EURAUD Daily

Technical Outlook:EURAUD gaped into a key resistance confluence on Sunday at 1.4430- this region is defined by the 100% extension of the February advance & the upper median-line parallel. Although our broader outlook remains weighted to the topside, the immediate advance is at risk near-term while below this threshold.

Interim support rests at the 1.43-handle with our broader bullish invalidation down at 1.4167. A breach higher from here targets subsequent topside objectives into the sliding parallel extending off the March highs / 1.4595.

See our 2Q Euro projections and more in the DailyFX Trading Forecasts.

EURAUD 240min

Notes:A closer look at price action highlights near-term confluence resistance at 1.4430. Look for a reaction here with the immediate long-side vulnerable below this mark. Interim support now the figure backed closely by the ML. Both 1.4218 & 1.4173 represent areas of interest for exhaustion / long-entries. A breach higher eyes subsequent resistance objectives at 1.4485, the sliding parallel (currently 1.4550s) & 1.4595.

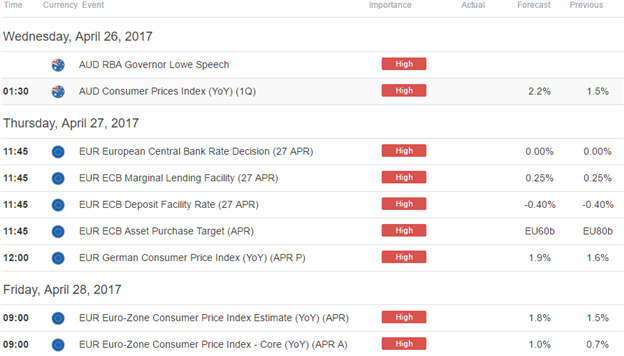

From a trading standpoint I would be looking for another stretch higher to give way to a new low into structural support, where we ultimately want to get positioned for the long-side. Bottom line: the 1.44-handle represents the yearly high-day close and a breach / close above this region would put the broader topside bias back in play. A quarter of the daily average true range (ATR) yields profit targets of 28-32 pips per scalp. Added caution is warranted heading into the Australia CPI & the European Central Bank (ECB) interest rate decision later this week with the releases likely to fuel increased volatility in the Aussie & Kiwi crosses.

---

Relevant Data Releases

Other Setups in Play:

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance