EUR/AUD Approaching Decision Zone Ahead of Aussie GDP, ECB

DailyFX.com -

Talking Points

EUR/AUD eyeing near-term support ahead of Aussie GDP, ECB

Updated targets & invalidation levels

Live Weekly Trading Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

EUR/AUD Daily

Technical Outlook: We’ve been tracking EURAUD for some time now and IF yesterday’s reversal through the upper median-line parallel (blue) is in face a near-term breakout, this immediate pullback should hold above the 2016 low-day close at 1.4303. Interim resistance stands at 1.4478 with critical resistance / bearish invalidation eyed at 1.4550/73- this region is defined by the 100-day moving average, the 61.8% retracement of the November range and former trendline support extending off the 2015 December low. Note this is also an area of interest for near-term exhaustion / short-entries

EUR/AUD 240min

Notes: From a trading standpoint, I’ll be looking to fade weakness while above the 1.43-handle with a breach of the highs targeting the previously noted key resistance zone at 1.4550/73. Look for a reaction there with the broader focus weighted to the downside while below this region. A break below the figure still has to contend with confluence support into 1.4163/83 where a pair of trendlines converge on the October / November swing lows.

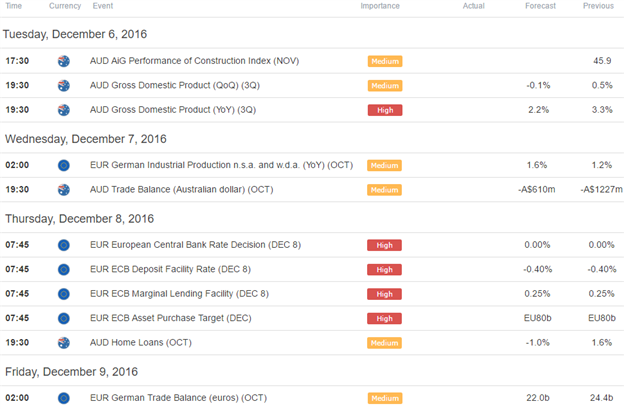

Note that the pair marked clear bearish divergence into the weekly highs and highlights the immediate risk for a deeper push towards confluence structural support before rebounding. A quarter of the daily average true range (ATR) yields profit targets of 42-46pips per scalp. Keep in mind we have Australia GDP tonight followed by the European Central Bank (ECB) rate decision on Thursday. That said, event risk over the next 48 hours should be considered and may fuel additional intraday volatility on the Aussie & Euro crosses.

Relevant Data Releases

Other Setups in Play:

AUD/USD Recovery Hinges on RBA, 3Q GDP; Rally at Risk Sub-7600

Webinar: USD Pullback Fueling Setups Across the Majors- Levels to Know

USD/JPY Rally Eyeing Key Resistance Confluence Ahead of U.S. NFP

3Q GDP, OPEC to Drive USD/CAD Volatility- Shorts at Risk into 1.3370

Looking for more trade ideas? Review DailyFX’s 2016 4Q Projections

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance