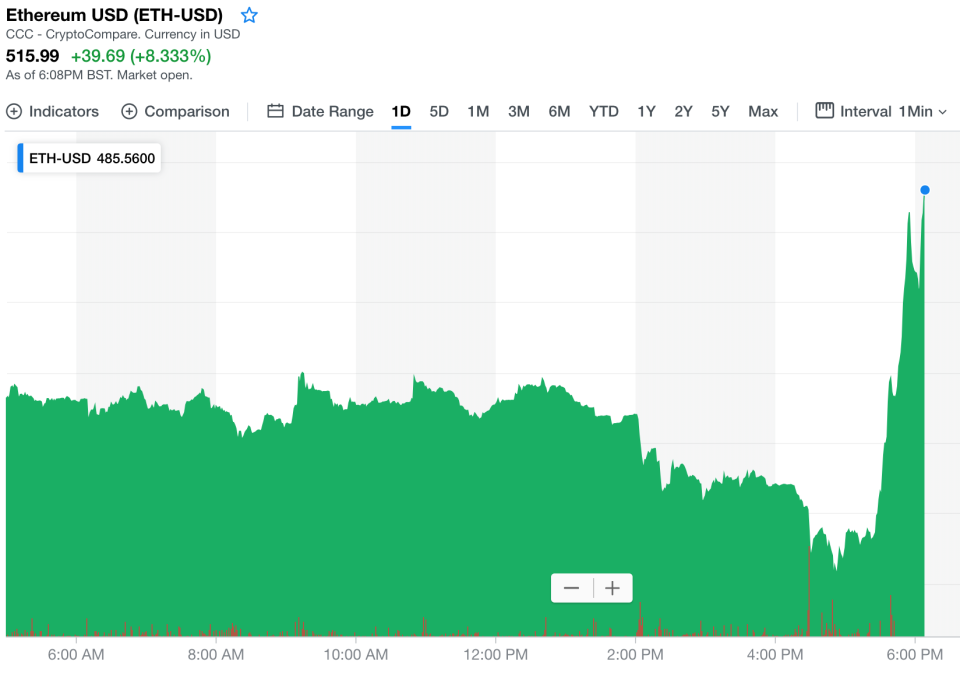

Ether explodes higher after SEC news

Cryptocurrency ether (ETH-USD) fell around 5% earlier on Thursday, but roared back over 6% after an announcement by the SEC’s Director of Corporate Finance William Hinman at Yahoo Finance’s All Market Summit: Crypto.

Hinman announced the SEC’s official position that ether was not a security, something that was in doubt given that its origins were based in a company. Hinman clarified that the important thing the SEC needs to consider is how a security is issued, sold, marketed, and used, rather than any sort of label like “coin” or “token.”

Hear that? That was the entire crypto industry breathing a collective sigh of relief

— Barry Silbert (@barrysilbert) June 14, 2018

The SEC classifying ether as “not a security” caused the cryptocurrency community to breathe a sigh of relief. Had ether been classified as such, it would have marked more aggressive regulation.

Decentralization, Hinman said, played a big role in how the SEC considered ether.

“Can a digital asset originally sold in a securities offering eventually be sold in something other than a security?” he asked. “How about cases when there’s no longer a company [involved]? I believe in those cases answer is a qualified yes.”

If a cryptocurrency network is sufficiently decentralized and purchasers no longer have expectation of managerial stewardship from a third party, a coin is not a security, Hinman added.

Officials at the Commodity and Futures Trading Commission (CFTC) had long urged the SEC to clarify its position on ether, and the two agencies had been discussing how the currencies were first offered. The CFTC allowed bitcoin futures to be traded last year on three exchanges.

Yahoo Finance

Yahoo Finance