ETFs Offer Magic For The Holidays: Freedom From Pass-Through Capital Gains Taxes

[Editor’s Note: The following originally appeared on FactSet.com. Elisabeth Kashner is director of ETF research and analytics for FactSet.]

Year end is the perfect time to consider the advantages of the ETF structure over traditional mutual funds. The creation/redemption mechanism that differentiates ETFs from mutual funds and hedge funds allows ETF managers to wash out realized gains. When it works well—when two-way flows are frequent and when portfolio turnover is low—ETFs often pass through zero capital gains to their holders. That’s a fantastic holiday gift.

ETF: A Better Mousetrap

The contrast between actively managed mutual funds and ETFs is stark.

Even at Vanguard, where keeping investor costs low is a primary mission, seven actively managed mutual funds will pay over 5% of their net assets in capital gains. The Vanguard Explorer fund is estimated to distribute 11.47% of NAV to shareholders, even those who sold no shares during 2017. There are more extreme cases. Principal Financial expects to distribute 31.07% of NAV in its Large Cap Growth Fund this year. For high-income shareholders, the federal tax bill could come to 7.18% of their entire investment.

Yet ETFs largely avoid passing on these gains, using two methods. First, most ETFs create and redeem shares in kind. This allows portfolio managers to pass low-basis positions out of the portfolio without selling them. No sale, no realized gain, no tax. Second, many ETFs track low-turnover indexes, so ETF portfolio managers seldom need to realize gains in a rebalance.

Are there exceptions? Absolutely. We’ll take a look at those in a minute, but first, let’s examine the tax efficiency of ETFs.

Nearly every large asset manager offers a fund tracking the S&P 500. Many track their indexes well, and compete on cost. Yet the ETFs far outperform the mutual funds when it comes to issuer-provided estimated 2017 capital gains distributions, as shown in the table below. It’s hard to beat 0.00% capital gains distributions, which is exactly what the ETFs deliver. The mutual funds are less efficient.

Here’s where the magic of in-kind redemption comes into play. ETFs generally use an in-kind redemption process, in which the agent transacting with the issuer receives a basket of securities in exchange for the ETF shares tendered. ETF portfolio managers are able to select their lowest-cost-basis positions for exchange. No gains are realized in this swap.

Mutual fund portfolio managers must sell portfolio securities to raise cash to meet redemption requests. Profits realized must be distributed amongst all shareholders, and realized gains must be distributed to shareholders within the calendar year. That’s how the low-turnover Principal Large Cap S&P 500 Index fund ended up generating 5.87% of capital gains distributions for its shareholders. At the highest capital gains rate, that translates into a tax bill of 1.40% for 2017.

When it comes to tax efficiency, in-kind redemptions make ETFs shine.

Exceptions: When The Magic Fails

Some ETFs do distribute capital gains. Low-redemption activity and high portfolio turnover make ETF capital gains distributions likely. Timing matters, because portfolio managers need redemptions to coincide with their rebalance dates if they are to replicate their indexes and maintain tax efficiency.

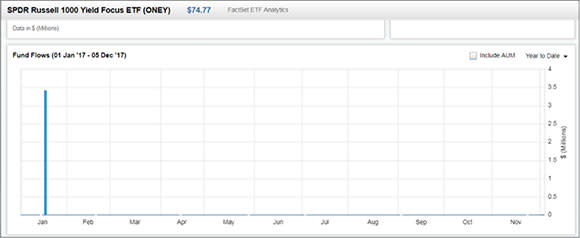

The SPDR Russell 1000 Yield Focus (ONEY) rebalances once per year. This year’s rebalance happened on June 26. It was a big one too, with turnover of 22.5% of the portfolio value. The portfolio manager sold 68 positions and put on 75 new ones.

June 26 would have been a great day for an in-kind redemption, as the portfolio manager could have put the lowest-basis of the 68 positions to the AP (market maker). But ONEY has been in a redemption drought all year, so all positions needed to be traded, and gains realized.

For a larger view, please click on the image above.

According to SSGA, ONEY will distribute 7.23% of its NAV to shareholders this December, 60.76% of these are estimated to be short-term gains, taxable as ordinary income. At a 39.6% marginal tax rate, the short-term portion alone will cost shareholders 1.74% in 2017.

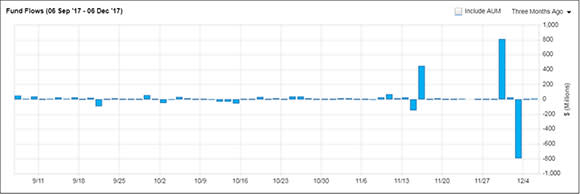

The iShares Edge MSCI Min Vol USA ETF (USMV) offers a counter-example. USMV’s underlying index rebalances twice a year, at the end of May and November. USMV’s portfolio must follow suit, if it is to continue tracking its index properly. On December 1, USMV changed about 6% of its portfolio by weight, positions worth approximately $950 million. That same day, USMV had an outflow of $794 million. Interestingly, $808 million had flowed in only a few days previously, on November 29.

For a larger view, please click on the image above.

It is entirely possible that USMV’s portfolio manager was able to wash out capital gains—and avoid selling any positions—by filling the redemption basket with appreciated securities that needed their weights reduced. That’s the magic of ETFs at work, thanks to an $800 million round trip of inflows and outflows. Rebalance done, capital gains removed.

Rebalances are common for index-tracking funds. It’s not just the complex strategic-beta equity funds like ONEY. Any fund that has specific portfolio limitations is subject to a rebalance, as are actively managed portfolios.

Portfolio Trading Triggers

Rebalances aren’t the only drivers of security sales in ETF portfolios. Forced selling, active management and expiring derivative contracts can push capital gains to ETF shareholders.

In fixed income, portfolio turnover can come under normal conditions in even the most vanilla portfolios, when bonds cross a maturity threshold, undergo a credit downgrade, or when convertible bonds get redeemed as equity, forcing portfolio managers to sell. Vanguard’s only ETF capital gains distributions for 2017 are estimated to be in term-specific bond funds: Vanguard Extended Duration Treasury (EDV), Vanguard Intermediate-Term Bond ETF (BIV) and Vanguard Total Bond Market ETF (BND). In case you were wondering, BND is not allowed to hold bonds with less than 12 months to maturity.

The PowerShares S&P 500 BuyWrite Portfolio (PBP) writes covered calls on the S&P 500 using both at-the-money and out-of-the-money contracts. In a year like 2017, with the S&P 500 up 20.49% through November 30, out-of-the-money calls become in-the-money regularly, calling away stock positions at expiration. That’s a sale forced by the portfolio strategy and terms of the options contracts, and it triggers a capital gain. Add in the premium collected from the call-writing, and you’ve got a formula for generating a capital gains distribution. Indeed, PowerShares anticipates distributing between $1.20 and $1.45/share from PBP this year. At November 30, 2017 NAV levels, that represents 6.40% of assets.

Actively managed ETFs make capital gains distributions as well. SSGA estimates that SPDR MFS Systematic Value Equity ETF (SYV) will distribute 2% of its NAV to shareholders this year.

Futures-based commodity and currency funds have plenty of turnover too, because contracts mature monthly. Most commodity ETFs are actually organized under the 1933 act, which provides for a variety of tax treatments. Exchange-traded notes, another popular structure for commodity products, do not own portfolios and cannot realize capital gains. Grantor trusts hold physical metal, such as bars of gold or silver. Commodity pools must mark portfolios to market and issue K-1s. While many investors dislike K-1s because of the additional complexity at tax time, commodity pools offer favorable tax treatment in that 60% of the profits are treated as long-term capital gains, while only 40% are taxed as ordinary income.

There’s a new type of commodity ETF organized under the 1940 act. These “No K-1” funds offer convenience, but at a cost: All income from collateral and short-term capital gains are taxed as ordinary income. Invesco PowerShares estimated that the PowerShares Optimum Yield Diversified Commodity Strategy No K-1 Portfolio (PDBC) will pay out $0.65 to $0.75 in ordinary income this year. As of November 30, 2017, that represents up to 4.26% of NAV. Worse, all creations and redemptions occur in cash, meaning that outflows can trigger capital gains.

In recent years, currency-hedged equity funds passed large gains through to clients. According to its 2016 estimates, the Xtrackers MSCI United Kingdom Hedged Equity ETF (DBUK) distributed 18.9% of AUM as capital gains, while its competitors WisdomTree United Kingdom Hedged Equity Fund (DXPS) distributed 12.92% and iShares Currency Hedged MSCI United Kingdom ETF (HEWU) distributed 14.17%.

In many cases, portfolio turnover can mitigate capital gain realization if the portfolio manager is lucky enough to receive redemption orders on the days when trades are required. But because the timing of these trades is often highly proscribed, redemptions are sporadic and investor-driven. When the timing doesn’t work out, tax liabilities grow. In that context, it’s quite amazing that the magic of ETF tax efficiency works as well as it does, most of the time.

As the holiday season approaches, it might be time to think about giving your loved ones some tax-efficient ETFs. Look for funds with low portfolio turnover and plenty of two-way flows, avoid derivatives and forced trades, and you should be set for low-cost ownership for years to come.

At the time of writing, the author held a legacy position in IVV. Elisabeth Kashner is director of ETF research and analytics for FactSet.

Research All ETFs Related to This Story

Yahoo Finance

Yahoo Finance