Essex Property (ESS) Beats on Q3 FFO, Raises 2021 Guidance

Essex Property Trust Inc. ESS reported third-quarter 2021 core funds from operations (FFO) per share of $3.12, beating the Zacks Consensus Estimate of $3.10. The figure also surpassed the higher end of the company’s guided range.

Results reflect improving net effective rent growth in the quarter. The residential REIT also raised the full-year 2021 guidance.

Total revenues of $362.9 million exceeded the Zacks Consensus Estimate of $359.9 million.

Michael J. Schall, president and CEO, Essex Property noted, “The economic recovery on the West Coast has led to a significant increase in demand for housing and September net effective rents are 6.4% above pre-COVID levels for our portfolio. The strong recovery in fundamentals and rents has led us to increase our guidance for the third time this year.”

However, the core FFO per share shows a decline of 1% from the year-ago quarter’s $3.15. Also, total revenues slipped 2.1% year over year, reflecting the adverse impact of the pandemic on the company’s business.

Quarter in Detail

During the July-September period, Essex Property’s same-property revenues increased 2.7% from the prior-year period and operating expenses rose 3.8% year on year. Consequently, same-property net operating income (NOI) increased 2.2% year over year. Results primarily reflect declining concessions as compared to the year-ago quarter.

On a sequential basis, same-property revenues increased 3.2%, while expenses flared up 6.6%, resulting in the NOI inching up 1.8%. Increase in scheduled rents and lower levels of concessions and delinquencies acted as positives.

Financial occupancies of 96.4% in the third quarter contracted 20 basis points (bps) sequentially, but were up 40 bps year on year.

During the reported quarter, the company acquired one apartment community for $53 million. Further, it purchased two operating commercial properties for future apartment development at contract prices aggregating $86 million.

In August 2021, the company sold a non-core multifamily community, comprising 276 apartment homes in Hemet, CA for a total contract price of $54.5 million.

Balance Sheet

Essex Property exited third-quarter 2021 with cash and cash equivalents, including restricted cash, of $60.9 million, down from $84 million recorded at the end of 2020. As of Oct 22, the company had $1.3 billion in liquidity through undrawn capacity on its unsecured credit facilities, and cash and marketable securities.

Outlook

For fourth-quarter 2021, the company projects core FFO per share at $3.15-$3.25. The Zacks Consensus Estimate for the same is $3.19.

For full-year 2021, the company raised the core FFO per share guidance to $12.39-$12.49 from the $12.21-$12.45 guided earlier, reflecting an 11-cent-per-share increase at the mid-point to $12.44. The Zacks Consensus Estimate for the same is currently pinned at $12.44.

Management increased the midpoint of full-year guidance for same-property revenues and NOI by 0.2% and 0.3%, respectively.

Essex Property currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

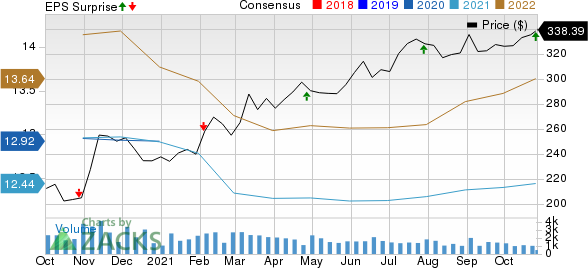

Essex Property Trust, Inc. Price, Consensus and EPS Surprise

Essex Property Trust, Inc. price-consensus-eps-surprise-chart | Essex Property Trust, Inc. Quote

Performance of Another Residential REIT

Equity Residential’s EQR third-quarter 2021 normalized funds from operations (FFO) per share of 77 cents outpaced the Zacks Consensus Estimate of 75 cents. Results reflected robust physical occupancy, sustained pricing power improvement and lower bad debt, net due to higher-than-anticipated resident receipts from governmental rent relief programs. It also marked the first time that Equity Residential achieved positive total same store revenue growth quarter over quarter since the onset of the global health crisis. The residential REIT also raised its full-year guidance for same-store revenues, NOI and normalized FFO per share.

We now look forward to the earnings releases of other residential REITs — AvalonBay Communities, Inc. AVB and Mid-America Apartment Communities, Inc. MAA — scheduled for today after the closing bell.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Equity Residential (EQR) : Free Stock Analysis Report

MidAmerica Apartment Communities, Inc. (MAA) : Free Stock Analysis Report

Essex Property Trust, Inc. (ESS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance