Esperion (ESPR) Q1 Earnings Miss, Lower Drug Price Hits Sales

Esperion Therapeutics, Inc. ESPR incurred loss per share of $3.50 per share in the first quarter of 2021, wider than the Zacks Consensus Estimate of $2.08 per share. The company had incurred loss of $2.26 per share in the year-ago period.

The company generated revenues of $8 million, significantly missing the Zacks Consensus Estimate of $20.4 million. The company had recorded revenues of $1.8 million in the year-ago quarter. However, revenues declined sequentially.

Shares of Esperion declined 20.3% in after-hours market on May 4, following the dismal first-quarter earnings. In fact, Esperion’s stock has lost 18.7% so far this year compared with the industry’s 8.4% decrease.

Quarter in Details

Esperion launched its first commercial drug — Nexletol — in March last year followed by Nexlizet in June in the United States. Please note that while Nexletol is a bempedoic acid monotherapy tablet, Nexlizet is a combination of bempedoic acid and Merck’s MRK Zetia (ezetimibe) that are approved for treating elevated LDL-C (bad cholesterol).

Both these drugs received approval in Europe in April. In Europe, Nexletol is available as Nilemdo and Nexlizet as Nustendi. Daiichi Sankyo, Esperion’s collaboration partner for Europe, launched the drugs in Germany in November.

Product revenues, solely from the United States, were $6.4 million in the first quarter compared with $0.9 million in the year-ago quarter and $8.2 million in the previous quarter. The company stated that prescriptions for its drugs were up 46% year over year. However, higher demand for drugs were partially offset by lower net price of the drugs in the United States.

The company recorded Collaboration revenues of $1.6 million in the first quarter compared with approximately $1 million in the year-ago quarter. It included royalty revenues of $0.6 million from Daiichi Sankyo on sales of Esperion’s drugs in Europe.

Research and development (R&D) expenses decreased 19.3% from the year-ago period to $28 million.

Selling, general and administrative expenses (SG&A) were up 46.9% year over year to $61.1 million. The significant increase was primarily due to costs to support commercialization activities for Nexletol and Nexlizet and a one-time legal settlement cost.

As of Mar 31, 2021, Esperion had cash, cash equivalents and investment securities of $217.9 million compared with $305 million as of Dec 31, 2020.

Key Developments

In April, Esperion expanded its licensing agreement with Daiichi Sankyo granting the latter commercialization rights to its drugs in additional countries namely South Korea, Taiwan, Hong Kong, Thailand, Vietnam, Brazil, Macao, Cambodia and Myanmar. Daiichi Sankyo may get commercialization rights of the drugs in several other countries going forward, per the agreement. The expanded agreement resulted in $30 million in upfront cash from Esperion. The company is also eligible to receive up to $175 million in sales milestone payments as well as royalties on sales.

Last month, the company also received the third and final tranche of funding worth $50 million under its revenue-based funding agreement with Oberland Capital.

These two transactions boosted Esperion’s cash resource subsequent to the quarter. The company reported proforma cash balance of $297.9 million as of Mar 31, 2021 that included the above payments.

2021 Guidance

Esperion maintained its guidance for R&D and SG&A costs in 2021. The company anticipates R&D expense for 2021 to be in the range of $120-$130 million. SG&A expense is expected to be between $200 million and $210 million.

Our Take

Esperion missed expectations for both earnings and sales during the first quarter. The company stated on its earnings call that it continues to face challenges due to COVID-19 related restrictions. Particularly, lower patient visits to physicians as well as lower net price hampered product sales growth. However, the company expects growth to accelerate in the second half of 2021. The company also expects net price for its drugs to normalize and improve going forward as medicare coverages get fully implemented.

Meanwhile, the drugs were off to a strong launch in Germany where 14,000 patients were prescribed the drugs since its launch in November 2020. Strong uptake in Germany and potential launch in additional European countries should boost royalty revenues going forward.

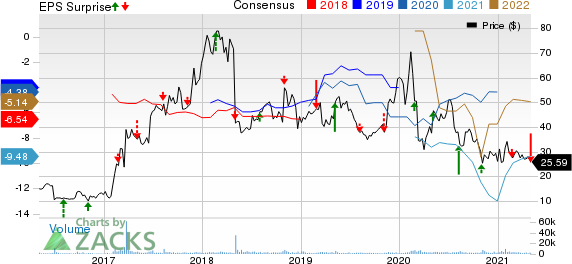

Esperion Therapeutics, Inc. Price, Consensus and EPS Surprise

Esperion Therapeutics, Inc. price-consensus-eps-surprise-chart | Esperion Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Esperion currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks from the same sector include Pacira BioSciences, Inc. PCRX and Ironwood Pharmaceuticals, Inc. IRWD, both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Pacira’s earnings per share estimates have increased from $3.25 to $3.31 cents for 2021 in the past 30 days. The stock has risen 3.1% so far this year.

Ironwood’s earnings per share estimates have moved north from 87 cents to 89 cents for 2021 in the past 30 days. The company delivered an earnings surprise of 33.5%, on average, in the last four quarters.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ironwood Pharmaceuticals, Inc. (IRWD) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Pacira BioSciences, Inc. (PCRX) : Free Stock Analysis Report

Esperion Therapeutics, Inc. (ESPR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance