ESG Investing: How to Evaluate a CEO Using the 4 Cs of Good Management

The Motley Fool's environmental, social, and governance (ESG) team is in search of ESG compounders, or companies that are growing profitably by doing good for the world. These are very high-quality businesses run by excellent management teams that strive to scale sustainably and leave a positive impact on the world.

As ESG investors, we evaluate potential ESG compounders using a 10-point checklist, and we believe owning a basket of these high-scoring companies will outperform the market in the long run. There's plenty of evidence that companies with strong ESG profiles generate higher returns on invested capital (ROIC) and higher sales growth and beat the market over time. One massive research project concluded that out of 2,200 studies on ESG, 90% showed either a positive relationship to corporate financial performance (CFP) or at least no negative relationship.

Similarly, Harvard Business School professor George Serafeim found:

Firms with good performance on material sustainability issues significantly outperform firms with poor performance on these issues, suggesting that investments in sustainability issues are shareholder-value enhancing. Further, firms with good performance on sustainability issues not classified as material do not underperform firms with poor performance on these same issues, suggesting investments in sustainability issues are at a minimum not value-destroying.

So if ESG is likely positive and at the very least doesn't hurt corporate performance, then why would investors decline to invest in companies aiming to make the world a better place? This is ESG investing, Fools: It feels good to be a good corporate citizen by picking winning stocks.

Image Source: Getty Images.

The foundation of an ESG compounder starts with the company's leadership, because its mission (or purpose) statements, business models, strategic direction, and corporate culture are set by the people at the top.

In a CEO (and her executive team), we seek to find the four Cs: compassion, candidness, capability, and commitment. (Note: We borrowed "the 3 Cs" from old Motley Fool Pro recommendations, but we added one more "C" and tweaked the criteria by adding two of the most important qualities in an executive, which are compassion and commitment.)

1. Compassionate

First and foremost, we want a CEO who is compassionate, meaning they genuinely care for people and the planet. In other words, we're looking for CEOs who take a stakeholder approach to value creation, as opposed to a strict shareholder view of putting short-term profits above all else. Ignoring other stakeholders may work to drive short-term profits, but it will surely destroy long-term value. Try building long-term value by mistreating and showing a blatant lack of compassion for employees, customers, community, or the environment. It can't be done!

This stakeholder-centric approach has recently been endorsed by legendary value investor Seth Klarman, by activist investor Jeffrey Ubben, by Larry Fink (CEO of BlackRock, the world's largest asset manager), and most recently by the Business Roundtable.

If you want to read about two investors who have developed a framework that takes ESG to the next level, check out NZS - Non-zero Outcomes in the Information Age by Brinton Johns and Brad Slingerlend. I recently spoke to Johns on the phone, and his insights blew my mind. My hair is still standing up days later. Here are some quotes from their white paper:

"A zero-sum outcome is one where every time one person wins, another person loses equally. A negative non-zero-sum (NZS) outcome implies all parties net out to being worse off. We are focused on positive NZS outcomes wherein a decision made by one party improves, on the whole, all parties involved."

"The players of the game are no longer just a board of directors and a set of equity shareholders. The players of the game in the 21st century include our planet, the environment, society at large, and every human, animal, and plant on earth."

"A simple question can help in the decision process to maximize NZS for the long term: 'Are we creating more value for our constituents than for ourselves?' Here constituents includes employees, customers, shareholders, suppliers, the environment, and the broader social context. If a decision significantly makes one of these players worse off in order to grow corporate free cash flow in the short term, it's probably not the best decision."

"If a company neglects needed investment, perhaps even endangering lives or harming the environment, in order to maintain high dividends and share repurchases, such a company will likely find themselves without customers and perhaps even bankrupt long term."

"That means aligning portfolio construction with the goal of long-term positive outcomes. It also means investing in companies that understand the rapidly evolving and highly complex world we operate in -- companies that are accounting for all possible players in the game for optimal win-win outcomes."

2. Candid

We also want a CEO who is candid and clear, meaning they focus on the metrics that matter most to long-term (sustainable) business value growth, as well as a CEO who is just as candid (and transparent) about mistakes and failures as they are about successes. Finding managers who operate with honesty, integrity, and transparency is a must. We love seeing managers who provide 5 to 10 years of historical financials of the metrics that matter most to a particular industry or business model (and preferably include some return-based number such as ROIC) and who provide long-term financial guidance (or targets). Sadly, management-issued guidance beyond one year is extremely rare, so when a CEO offers this kind of long-range target, ESG investors should take notice.

3. Capable

We also are looking for CEOs who are capable (or competent), meaning they are capable of systems-based thinking and understanding the linkages between ESG, growth, and profitability. We want to invest in CEOs who can juggle many balls at the same time because they know how to operate the business efficiently, allocate capital intelligently, and nurture and grow a positive ESG culture.

4. Committed

We want CEOs to be committed, meaning they have high inside ownership of the company they run, are committed to genuinely supporting the company's mission or purpose, are entrenched in nurturing a unique corporate culture, and are dedicated to investing in long-term initiatives to drive shared-value creation. We're looking for CEOs investing to drive (and support) long-term growth, to protect the company's moat or competitive advantage, and most importantly to build new moats and profitable growth streams over time.

In this regard, we seek companies that are agile and can quickly adapt to change, because change is constant, and in the digital age, change seems to be accelerating. We love companies with strong free cash flow and large net cash positions, but we don't want companies to rest on their laurels by assuming they're safe behind a legacy moat.

Rather, we like to see CEOs who are committed to finding new ventures to invest in with the goal of creating optionality and powering the firm's next stage of profitable growth. To read more about a new competitive advantage framework based on a company's ability to adapt and innovate, check out the white paper titled Complexity Investing that's taking the investing world by storm. In the paper, Johns and Slingerlend argue that investors need to rethink the allure of qualities like legacy moats, ultra-fast growth, and even pricing power and rather focus on a company's ability to innovate and adapt in the digital age, all while providing win-win situations for the company, its customers, and other constituents involved.

As ESG investors, we want CEOs who are committed to showing compassion to both people and the planet. We want CEOs who are committed to constantly improving the customer product or service experience. We want CEOs who provide a top workplace culture so the company can attract the top talent necessary to constantly improve the customer value proposition. Over the long term, shareholders will benefit -- but not at the expense of employees, customers, suppliers, the community, or the planet.

Case study: Home Depot

Let's see how Home Depot's (NYSE: HD) management team, led by CEO Craig Menear, stacks up on our 4 Cs of Management Framework. (Spoiler alert: Menear and his team are exceptional ESG leaders who nail all four Cs.) Menear is 61 years old and has worked at the Home Depot since 1997. He has served as Home Depot's CEO since 2014 and has held executive-level positions at Home Depot since 2007.

1. Compassionate

Home Depot's executive team shows true care for people and the planet.

To begin, Home Depot provides jobs for more than 400,000 employees. The housing industry is a fundamental building block of the U.S. economy and the American dream. For many of us, our home is our largest financial asset. Home Depot provides homeowners with a convenient, friendly, and affordable place to shop for home-improvement parts and services. Home Depot's strategy has always been to use its scale and vendor relationships to offer the best-quality goods at everyday low prices (and if a customer comes in with a lower price, Home Depot will match it).

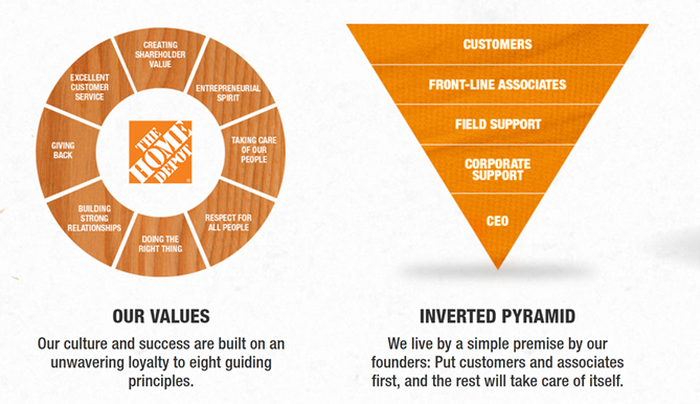

Home Depot's culture is based on the inverted pyramid, which puts customers and store associates at the top and the CEO at the very bottom. According to Home Depot, its "workforce is more ethnically diverse than the U.S. working population." Home Depot paid its hourly associates a combined $222 million as part of its profit-sharing program in 2018 and more than $1 billion in the past five years. To reinforce a shared ownership culture, Home Depot has an Employee Stock Purchase Plan (ESPP) that allows Home Depot employees to buy Home Depot stock at a 15% discount to the market price.

Home Depot scores a perfect 100 for LGBT equality and a perfect rating of 100% on the Human Rights Campaign Corporate Equality Index. Home Depot also demonstrates compassion by having provided $250 million to veterans' causes since 2011 and by committing to reaching $500 million by 2025. Home Depot ranks No. 21 on Fortune's 2019 list of the World's Most Admired Companies and is featured on Barron's 100 Most Sustainable U.S. Companies.

Image Source: Home Depot.

Home Depot is aggressively working to reduce its environmental impact and increase its use of renewable energy sources. It is committed to reducing its carbon emissions by 40% by 2030 and 50% by 2035. For its efforts, Home Depot is one of only 30 U.S. companies to make the 2018 CDP (formerly Carbon Disclosure Project) A list.

Home Depot also sells green products in its stores that help customers save water and reduce carbon dioxide emissions, and it is working with suppliers to reduce suspect chemicals in paint, flooring, cleaning supplies, insulation, and other products. Home Depot was recognized as a retailer of the year for 10 consecutive years (2008-2017) by the U.S. Environmental Protection Agency.

Home Depot is ahead of its goal to help its customers cut greenhouse gas emissions by 20 million metric tons and reduce water use by 250 billion gallons by 2020. In 2018 alone, Home Depot sold 231 million Energy Star products and 18 million WaterSense products. Home Depot's solar program installed solar panels on more than 18,000 homes in 2018. Home Depot's Responsibility Report said, "The solar energy systems from both of our suppliers are able to send excess power from customers' homes back to the electric grid. That enables the whole community to benefit from clean power from the sun."

2. Candid

Home Depot provides five years of historical financials in its annual report, including key retailing metrics such as number of stores, number of employees, comparable sales growth (also called same-store sales growth), customer transactions, average ticket, sales per square foot, and inventory turnover. Home Depot's historical snapshot also includes ROIC, which is the most important metric of corporate profitability and management performance. Home Depot understands that ROIC is a primary driver of intrinsic value growth and stock prices, so the company (1) reports ROIC every single quarter, (2) partly bases management compensation on ROIC, and (3) includes ROIC in its long-term (three-year) guidance.

Image Source: Home Depot.

Image Source: Home Depot.

3. Capable

Home Depot's management team is one of the best in the world not just in the retail industry but in any industry. We used New Constructs' data platform to create the following table showing Home Depot's growth, ROIC, and FCF profile:

2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|---|---|---|---|

Sales ($ millions) | $66,176 | $67,997 | $70,395 | $74,754 | $78,812 | $83,176 | $88,519 | $94,595 | $100,904 | $108,203 |

Sales growth | (7.2%) | 2.80% | 3.50% | 6.20% | 5.40% | 5.50% | 6.40% | 6.90% | 6.70% | 7.20% |

ROIC | 9.00% | 10.70% | 12.20% | 14.00% | 16.20% | 19.00% | 21.20% | 23.60% | 25.70% | 30.20% |

NOPAT margin | 5.20% | 5.80% | 6.40% | 7.00% | 7.60% | 8.20% | 8.80% | 9.30% | 9.50% | 10.40% |

Invested capital turns | 1.75 | 1.84 | 1.91 | 2.02 | 2.12 | 2.31 | 2.42 | 2.55 | 2.71 | 2.92 |

Free cash flow (FCF; $ millions) | $4,202.79 | $4,654.27 | $4,099.99 | $5,066.11 | $6,965.46 | $7,443.74 | $6,119.44 | $8,569.30 | $9,032.08 | $12,290.92 |

FCF margin | 6.40% | 6.80% | 5.80% | 6.80% | 8.80% | 8.90% | 6.90% | 9.10% | 9.00% | 11.40% |

Data Source: New Constructs.

The table shows that in the 10 years from 2009 to 2019, Home Depot's sales increased at a compound annual growth rate (CAGR) of 5.6% and generated an average FCF margin of 8%. Most impressively, Home Depot's ROIC increased every single year from 2009 to 2018. Investors can use the DuPont Analysis (see page 14) to see that Home Depot's rising ROIC was driven by consistent increases in both net operating profit after tax (NOPAT) margins and invested capital turns. This is a management team that can do it all, Fools! They understand the drivers of long-term value creation, and they are skilled at delivering against those drivers.

4. Committed

In 2018 Home Depot increased sales by 7.2%, grew earnings per share (EPS) by 33.5%, and generated ROIC of 44.8% (based on Home Depot's calculation). Home Depot's e-commerce sales grew 24% in 2018, and Home Depot was the fifth-largest e-commerce company in the U.S. Despite having an amazing year, Menear said that Home Depot "must evolve and we must adapt and we must invest to deliver the best customer experience."

Rather than take a victory lap or get lazy, Menear and his team committed to investing an additional $11 billion into digital and omnichannel (or interconnected) initiatives over the next several years. This commitment to never sitting still but rather to continuing to adapt and to search for profitable, sustainable growth opportunities is exactly the kind of mentality we are looking for.

Thus far, Home Depot has done a superb job of investing in digital initiatives and leveraging its supply chain and large store base to create a seamless omnichannel shopping experience. Menear said online sales are "largely incremental," meaning they're not cannibalizing sales from the stores.

Home Depot's 2,291 stores are a massive source of competitive advantage because they serve as the hub of its interconnected experience and double as fulfillment centers. Stores enable buy online pick up in store (BOPIS), buy online deliver from store (BODFS), and buy online return in store (BORIS). In fact, 90% of the U.S. population lives within a 10-mile radius of a Home Depot store. About 50% of online orders are picked up in-store, and 85% of returns are completed there.

But there is still work to be done.

Over the next three years, Home Depot plans to double its investment spending to protect and grow its business in this changing retail environment. It plans to invest $11 billion in its stores, employees, digital platform, product offering, service offering for professional customers, and supply chain. It plans to build 150 additional facilities to convert its supply chain from two-day delivery to next-day or same-day delivery for 90% of the U.S. population.

All of these investment areas require heavy investment into information technology (IT), so Home Depot hired roughly 1,000 technology professionals in 2018 alone. All of its technology investments are led by Chief Information Officer Matt Carey, whom salesforce.com co-CEO Marc Benioff described to Jim Cramer (host of CNBC's Mad Money) as "a legend in information technology."

These investments are crucial to its One Home Depot strategy, which allows customers to shop "whenever, wherever, and however they want," solidifying Home Depot as a leader in a digital retail world.

Home Depot is an underappreciated digital powerhouse -- and an underappreciated ESG powerhouse too.

But there is always room for improvement. We think Home Depot should include some ESG targets in its executive compensation plan and that Home Depot should commit to 100% renewable energy (and sign onto the RE100).

Finally, Home Depot should increase its minimum wage to $15, up from what we estimate is its current level of roughly $11. This is critical. Amazon (NASDAQ: AMZN) and Costco (NASDAQ: COST) already pay a $15 minimum wage, and Target (NYSE: TGT) has plans to increase its minimum wage to $15 by the end of next year. But Home Depot generates truckloads more FCF than either Costco or Target.

There you have it, Fools: our four Cs for analyzing corporate management through an ESG lens. In this article describing The Motley Fool's ESG Investing Framework, we said that as part of our 10-point checklist, each question “contains multiple sub-questions (and even other frameworks embedded within).” We wanted to share what we believe is the most important subframework embedded within our larger checklist. We strongly believe that finding CEOs and executive teams that are (1) compassionate, (2) candid, (3) capable, and (4) committed increases our chances of partnering with leaders who drive purpose and profits while making the world a better place.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. John Rotonti owns shares of Costco Wholesale and Home Depot. The Motley Fool owns shares of and recommends Amazon and Salesforce.com. The Motley Fool has the following options: short January 2020 $180 calls on Costco Wholesale, long January 2020 $115 calls on Costco Wholesale, long January 2021 $100 calls on Salesforce.com, and long January 2021 $120 calls on Home Depot. The Motley Fool recommends Costco Wholesale and Home Depot. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance