Equinix (EQIX) Ups Renewable Power Game With Spain Solar Farms

Equinix, Inc. EQIX recently announced the addition of five new long-term Power Purchase Agreements (PPAs) in Spain, aggregating 225 megawatts (MW). The move considerably increased the company’s backing of renewable power projects.

Reflecting positive sentiments, shares of EQIX gained 1.77% on Mar 2 normal trading session on the NYSE.

Once operations of the projects begin in 2025, it is likely to produce enough power to match consumption at Equinix's International Business Exchange™ (IBX®) data centers in Madrid, Barcelona and Seville.

Equinix’s contracted PPA capacity is expected to touch 595 MW globally with the addition of these five new projects to its existing projects. This is estimated to generate almost 2 million MWh annually, making EQIX’s latest move a strategic fit.

Given that the locations of the new projects have an average solar radiation value above other geographical zones within Spain, EQIX’s goal of supporting renewable power generation globally is likely to be met.

The projects are set to be managed by IGNIS, a Madrid-based integrated renewable energy group involved in the entire value chain, from development to operation and energy solutions. IGNIS presently manages an operational portfolio of more than 4 GW of different generation technologies.

In a similar move, in late 2021 and early 2022, Equinix signed three PPAs in Finland for 144 MW of new-build wind capacity from the Bjorkliden, Lumivaara and Storbotet projects with renewable providers Neoen and Prokon.

Moreover, in tandem with its environmental, social, and governance (ESG) goals, Equinix became the first colocation data center operator to introduce a program by which it can reduce its overall power use by increasing operating temperature ranges within its data centers in December 2022.

Over time, this initiative will help thousands of Equinix customers to reduce the Scope 3 carbon emissions associated with their data center operations.

The growing reliance on technology and acceleration in digital transformation strategies by enterprises have led to a rise in demand for data centers, benefiting data center REITs like Equinix.

Additionally, growth in artificial intelligence, as well as autonomous vehicle and virtual/augmented reality markets, is expected to be robust over the next five-six years, providing excellent growth opportunities for this data center REIT.

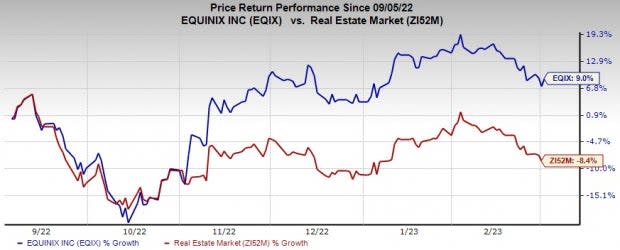

EQIX currently carries a Zacks Rank #3 (Hold). Its shares have gained 9% in the past six months against the real estate market’s fall of 8.4%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the REIT sector are VICI Properties VICI, Alexandria Real Estate Equities ARE and Stag Industrial STAG, each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for VICI Properties’ current-year FFO per share is pegged at $2.10.

The Zacks Consensus Estimate for Alexandria Real Estate’s 2023 FFO per share stands at $8.94.

The Zacks Consensus Estimate for Stag Industrial’s 2023 FFO per share is pegged at $2.25.

Note: Anything related to earnings presented in this write-up represents FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

Stag Industrial, Inc. (STAG) : Free Stock Analysis Report

VICI Properties Inc. (VICI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance