Ensign Group (ENSG) Shares Down 2% Since Q4 Earnings Release

Shares of The Ensign Group, Inc. ENSG have lost 1.7% since it reported fourth-quarter 2022 results on Feb 2. Despite suffering from an escalating expense level, the quarterly results received an impetus from strong segmental contributions and consistent improvement in occupancies. An optimistic 2023 outlook for revenue and earnings per share (EPS) also remains noteworthy.

Q4 Update

Ensign Group reported fourth-quarter 2022 adjusted operating earnings of $1.10 per share, which matched the Zacks Consensus Estimate and came higher than our estimate of $1.09. The bottom line advanced 13.4% year over year.

Operating revenues improved 16.9% year over year to $810 million in the quarter under review. The growth resulted from higher skilled services and rental revenues. The top line outpaced the consensus mark by 1.2% and our estimate of $796.6 million.

Adjusted net income came in at $62.7 million, which grew 14.1% year over year.

Same-store occupancy rose 2.9% year over year while transitioning occupancy increased 4.3% year over year.

Total expenses escalated 17% year over year to $734.3 million in the fourth quarter due to increased cost of services, rent-cost of services, general and administrative expenses, and depreciation and amortization. The metric was higher than our estimate of $712.4 million.

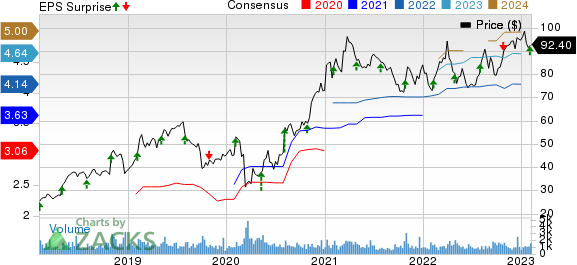

The Ensign Group, Inc. Price, Consensus and EPS Surprise

The Ensign Group, Inc. price-consensus-eps-surprise-chart | The Ensign Group, Inc. Quote

Segmental Update

Skilled Services: The segment’s revenues climbed 16.5% year over year to $777.6 million, higher than our estimate of $770.9 million. Segmental income of $106.5 million advanced 6.2% year over year.

Skilled nursing and campus operations of the segment totaled 234 and 26, respectively, at the fourth-quarter end.

Standard Bearer: Revenues of $19.4 million rose 26% year over year in the quarter under review but fell short of our estimate of $20.4 million. Segmental income fell 13.5% year over year to $7.2 million.

Funds from Operations (FFO) came in at $13 million, which dipped 0.6% year over year.

Financial Update (as of Dec 31, 2022)

Ensign Group exited the fourth quarter with cash and cash equivalents of $316.3 million, which increased 20.6% from the figure in 2021 end. ENSG had an available capacity of $593.3 million under its credit facility at the end of the quarter.

Total assets of $3,452 million rose 21.1% from the 2021-end level.

Long-term debt less current maturities amounted to $149.3 million, which declined 2.4% from the figure as of Dec 31, 2021.

During 2022, net cash provided by operating activities totaled $272.5 million, down 1.2% from the 2021-end level.

Capital-Deployment Update

Ensign Group did not buy back shares in the fourth quarter as part of the share repurchase program authorized by management in July 2022.

In December 2022, management approved a quarterly dividend hike and the increased dividend stood at 5.75 cents per share.

2023 Guidance

Revenues are projected to lie between $3.55 billion and $3.62 billion this year, the midpoint of which suggests 18.3% growth from the 2022 figure of $3.03 billion.

EPS is anticipated within $4.60-$4.74 in 2023, the midpoint of the guidance indicates an improvement of 12.8% from the 2022 figure of $4.14.

The weighted average common shares outstanding is estimated at roughly 57.7 million.

Zacks Rank

Ensign Group currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported fourth-quarter results so far, the bottom lines of Abbott Laboratories ABT, Cigna Corporation CI and Humana Inc. HUM beat the Zacks Consensus Estimate.

Abbott Laboratories reported fourth-quarter 2022 adjusted earnings of $1.03 per share, which exceeded the Zacks Consensus Estimate by 14.4%. The adjusted figure however declined from the prior-year quarter’s levels by 22%. Fourth-quarter worldwide sales of $10.09 billion were down 12% year over year on a reported basis. The top line however exceeded the Zacks Consensus Estimate by 6.4%. ABT reported an adjusted operating profit of $1.80 billion for the quarter under review, down 37.8% year over year. The adjusted operating margin, too, contracted 738 bps to 17.8%.

Cigna’s fourth-quarter 2022 adjusted earnings of $4.96 per share outpaced the Zacks Consensus Estimate by 2.5%. The bottom line advanced 4% year over year. Adjusted revenues inched up 0.1% year over year to $45,743 million. The top line beat the consensus mark by a whisker. CI’s medical customer base came in at 18 million, which grew 5.4% year over year as of Dec 31, 2022.

Humana reported fourth-quarter 2022 adjusted earnings per share of $1.62, beating the Zacks Consensus Estimate by 11%. The bottom line climbed 30.6% year over year. Revenues of HUM amounted to $22,439 million, which rose 6.6% year over year in the quarter under review. Yet, the top line fell short of the consensus mark by a whisker. Total premiums of HUM grew 7.3% year over year to $21,275 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Humana Inc. (HUM) : Free Stock Analysis Report

Cigna Corporation (CI) : Free Stock Analysis Report

The Ensign Group, Inc. (ENSG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance