Eni (E) Signs Deal to Develop Offshore Wind Projects in Italy

Eni SPA E signed an agreement with and Copenhagen Infrastructure Partners (“CIP”) to develop three floating offshore wind projects in Latium and Sardinia, located 30 kilometers off the coast with an overall capacity of 2 gigawatts (GW).

The agreement comprises the development of a project in Latium, offshore Civitavecchia, with a total capacity of up to 540 megawatts (MW). The two other wind farms will be located offshore Sardinia, with a capacity of 500 MW and 1,000 MW.

Combined, the three projects will produce about 5 terawatt-hours of energy per year (TWh/year). The companies expect commercial activities to start between 2028-2031 once the authorization process and subsequent construction phase completes.

The three offshore projects will utilize floating foundations and innovative technical solutions intended to minimize environmental and visual impact. With the latest agreement, Eni and CIP’s offshore wind portfolio in Italy will reach almost 3 GW, with a renewable energy production capacity of 7 TWh per year. This is sufficient to meet the electricity consumption of 2.5 million households.

The wind farms will be developed in collaboration with Copenhagen Offshore Partners, the exclusive offshore wind development partner of CIP, and NiceTechnology and 7 Seas Wind Power, which have partnered with Eni and CIP on the deployment of two other wind farms in Sicily and Sardinia.

The latest agreement represents a further step toward strengthening the floating offshore wind industry in Italy. The agreement will provide a major role in achieving a low-carbon future, while encouraging the development of the local supply chain.

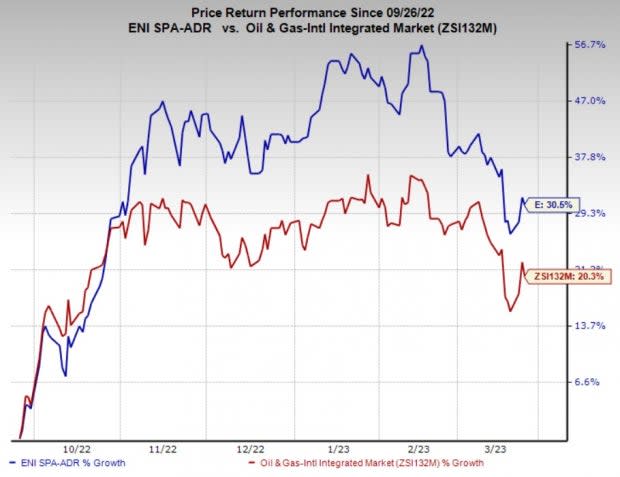

Price Performance

Shares of Eni have outperformed the industry in the past six months. The stock has gained 30.5% compared with the industry’s 20.3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Eni currently carries a Zack Rank #5 (Strong Sell).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Antero Midstream Corporation AM reported fourth-quarter 2022 adjusted earnings per share of 20 cents, beating the Zacks Consensus Estimate of 17 cents. The strong quarterly results were primarily driven by higher freshwater delivery volumes and increased average freshwater distribution fees.

For 2023, Antero Midstream expects a net income of $340-$380 million, indicating an increase from the $326.2 million reported in 2022.

Liberty Energy Inc. LBRT announced fourth-quarter 2022 earnings per share of 82 cents, which handily beat the Zacks Consensus Estimate of 71 cents. The outperformance reflects the impact of strong execution and increased service pricing.

As part of its shareholder return policy, LBRT repurchased $125 million of its stock at an average price of $15.29 a piece since July and reinstated a quarterly cash dividend of 5 cents in the fourth quarter.

Oceaneering International, Inc.’s OII fourth-quarter 2022 adjusted profit of 6 cents per share missed the Zacks Consensus Estimate of a profit of 17 cents. The underperformance was due to weaker results in certain segments.

For 2023, Oceaneering projects consolidated EBITDA of $260-$310 million and free cash flow generation of $75-$125 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eni SpA (E) : Free Stock Analysis Report

Antero Midstream Corporation (AM) : Free Stock Analysis Report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance