Eni (E) Signs Deal to Develop Fusion Energy Plant With CFS

Eni SPA E signed an agreement with Commonwealth Fusion System (“CFS”) to accelerate the industrialization of nuclear fusion energy.

The companies will collaborate on a pipeline of projects to launch a nuclear fusion power facility. The facility will be capable of feeding power into the grid at the beginning of the 2030s.

Nuclear fusion energy will generate electricity from nuclear fusion reactions and significantly contribute to the energy transition. The contract will help Eni reach its net-zero emission goal by 2050.

In 2021, CFS examined its high-temperature superconducting magnet technology that ensures plasma confinement in the magnetic fusion process. The technology will create opportunities to achieve net energy from fusion in a future demonstration plant.

The world’s first facility to produce fusion energy, dubbed SPARC, is being developed. The facility is expected to be up and running in 2025. SPARC will create opportunities for ARC, the first commercial power plant, expected to be operational at the beginning of the next decade.

Eni, which invested in CFS in 2018, has a majority ownership in the company. Eni was the first energy company to invest in fusion, which can significantly contribute to energy transition once it is developed on an industrial level.

The agreement will leverage Eni’s global engineering and project management expertise to support CFS, and the development and deployment of fusion energy on an industrial scale. The agreement strengthens the existing partnership between the companies, with the aim of facilitating the industrialization path of fusion.

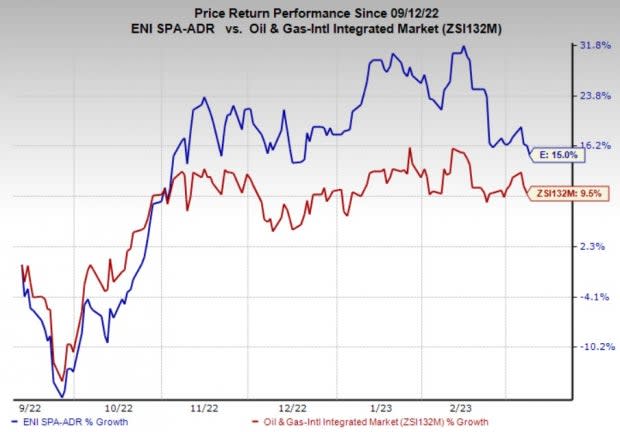

Price Performance

Shares of Eni have outperformed the industry in the past six months. The stock has gained 15% compared with the industry’s 9.5% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Eni currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Sunoco LP’s SUN fourth-quarter 2022 earnings of 42 cents per unit missed the Zacks Consensus Estimate of 77 cents. Weak quarterly earnings resulted from the higher total cost of sales and operating expenses.

Sunoco has witnessed upward estimate revisions for 2023 earnings in the past 30 days. For 2023, Sunoco expects adjusted EBITDA of $850-$900 million.

RPC Inc.’s RES adjusted earnings of 41 cents per share in the fourth quarter beat the Zacks Consensus Estimate of 30 cents. The strong quarterly results were backed by higher activity levels in all the service lines and rising equipment utilization.

As of Dec 31, RPC had cash and cash equivalents of $126.4 million, up sequentially from $73.2 million. Nonetheless, the company managed to maintain a debt-free balance sheet.

Valero Energy Corporation’s VLO fourth-quarter 2022 adjusted earnings of $8.45 per share beat the Zacks Consensus Estimate of $7.45 per share. The strong quarterly results were driven by increased refinery throughput volumes and a higher refining margin.

Valero can benefit from the Gulf Coast export volumes as fuel demand recovery gets support from Asia economies. The Gulf Coast contributed 59.4% to the total throughput volume in the fourth quarter of 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eni SpA (E) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance